HYPE USD Explodes With +40% Weekly Surge: Alt Season Incoming?

HYPE USD just printed a massive weekly candle that's turning heads across crypto markets.

The Numbers Don't Lie

That +40% weekly gain isn't just impressive—it's the kind of move that makes traditional finance folks clutch their pearls. While Wall Street debates fractional percentage points, crypto assets are out here delivering returns that would make your grandfather's retirement portfolio blush.

Market Implications

When altcoins start posting these kinds of numbers, the entire ecosystem takes notice. The question isn't just about HYPE USD's performance—it's about whether this signals broader altcoin strength. Remember when diversification meant holding more than one blue-chip stock? Crypto laughs at your 'safe' bets.

The Big Picture

+40% in a week. Let that sink in while traditional investors celebrate their 7% annual returns. The real question isn't whether alt season is here—it's whether you're positioned to ride the wave or still waiting for 'proper' financial instruments to catch up.

HYPE USD With 40% Weekly Gains: Will Buyers Keep The Momentum?

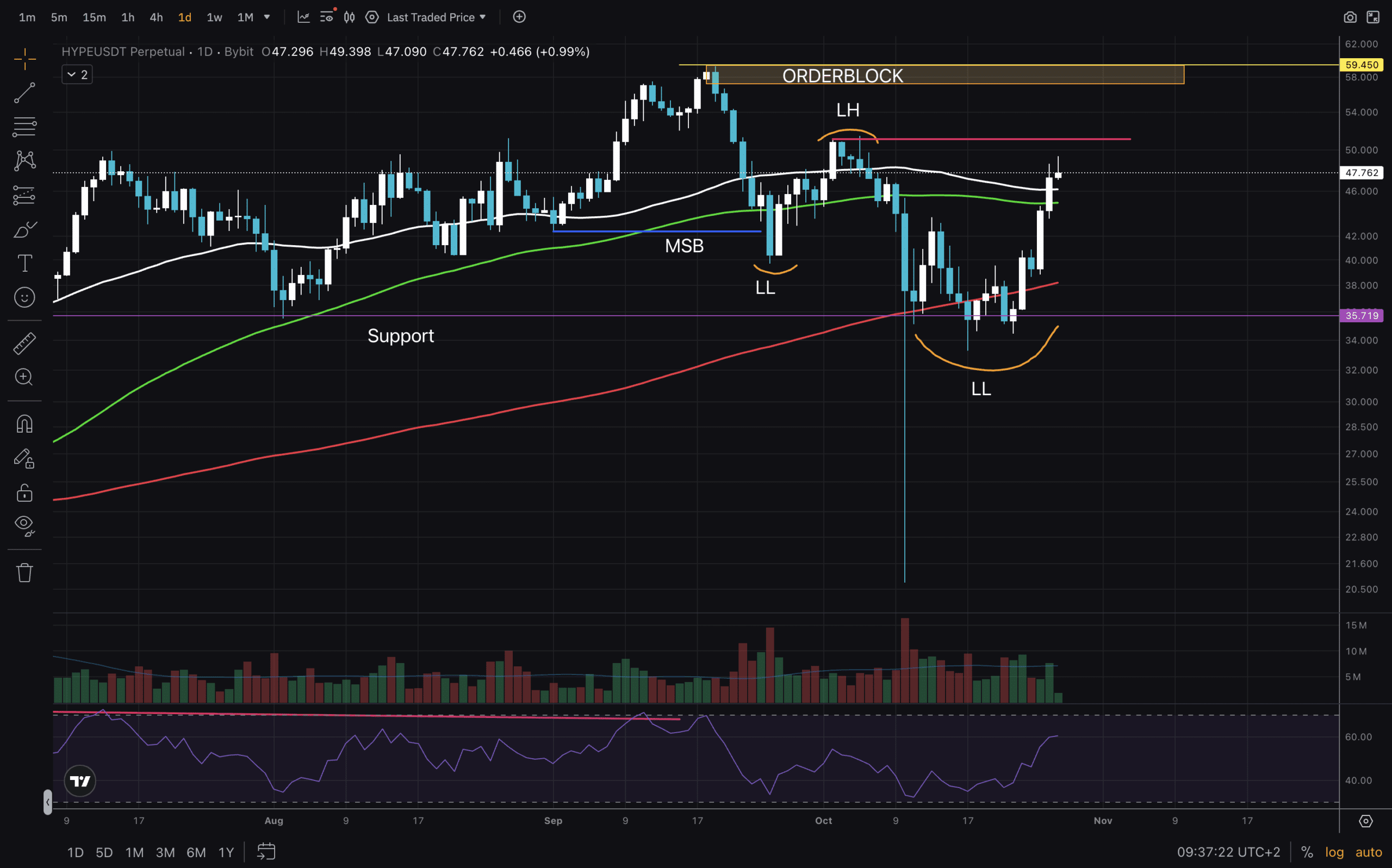

(Source – Tradingview, HYPEUSD)

Let us begin today’s analysis on the Weekly timeframe. We can see this beautiful 2024 High acting as a strong support and that is exactly what investors like to see. This is a young project and we don’t have much price history when it comes to the weekly timeframe. But sometimes this kind of price action becomes a time area in long-term price history fading to the bottom left part of the screen. Will this become reality for HYPE USD?

(Source – Tradingview, HYPEUSD)

On the Daily chart, Hyperliquid looks very decent too. RSI ranged in the bottom half for nearly a month and now it is breaking back into the upper half of its range. Also, price has regained all Moving Averages on this timeframe, while MA200 looks like a support. Now it needs to maintain and stay above for decisive reclaim. Then our next target to reclaim is the LH level.

Hyperliquid Going On a Run Soon? TA Gives The Verdict.

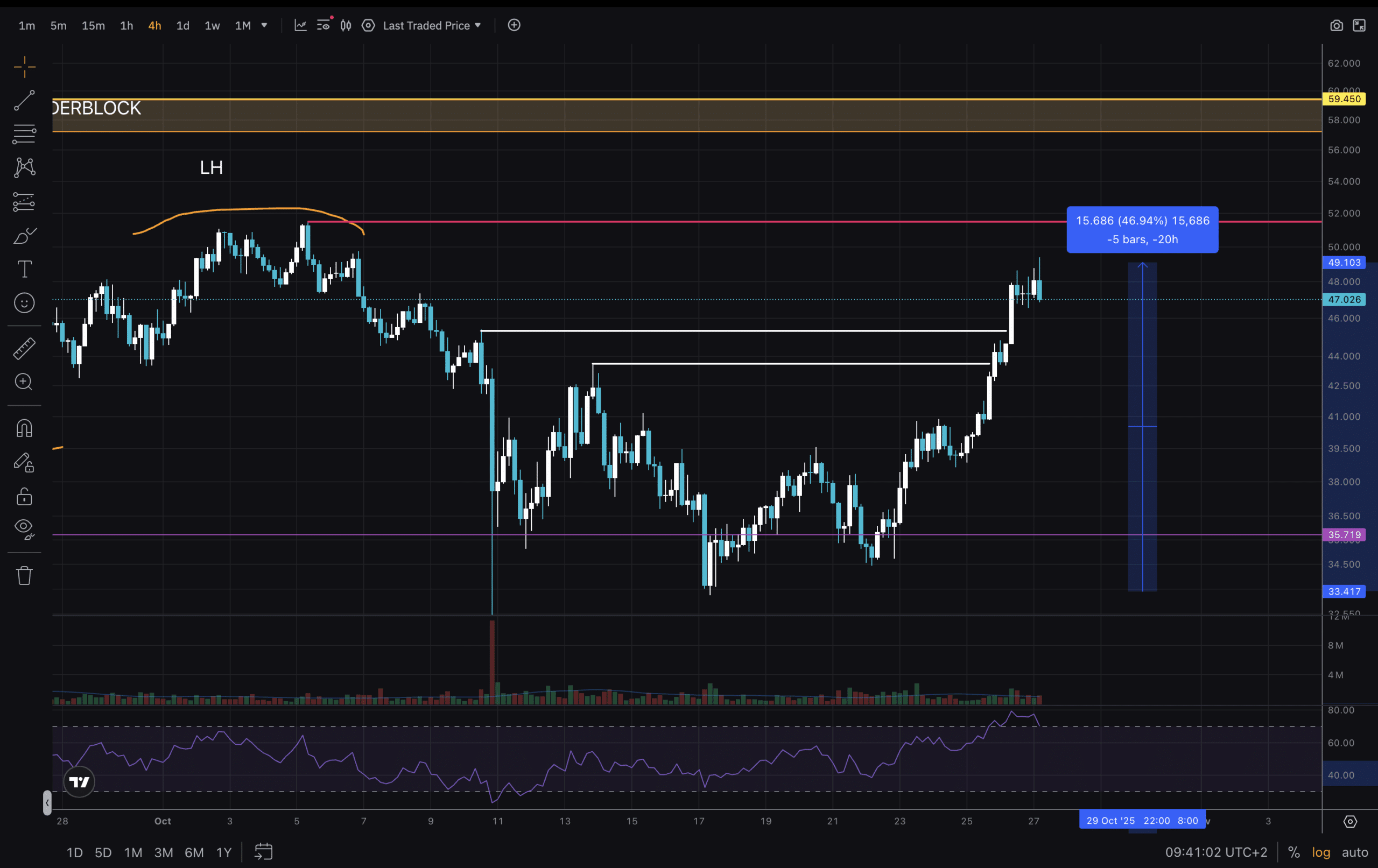

(Source – Tradingview, HYPEUSD)

Final chart for this analysis for us is on the 4H. Here, we have the total price gain from the very bottom on October 17th – a whooping 47%. Next, HYPE USD broke two previous highs, which could be retested before moving onward to break the $50 level. But the retest could go as low as $40 or even wick down to $35 to liquidate overleveraged longs. Either way, price on this low timeframe entered bullish structure, which is a starter hope. Furthermore, if it is sustained throughout this week, we can expect new ATH soon.

Stay SAFE out there and have a profitable week!

Join The 99Bitcoins News Discord Here For The Latest Market Update

HYPE USD Prints a +40% Weekly Candle: Is Alt Season Here?

- HYPE USD had a strong weekend. It needs to price this week.

- RSI on 1D has bottomed and is entering strength zone.

- LH at $50 needs to be reclaimed next

- Pull back expected – watch the $40 level for potential support.