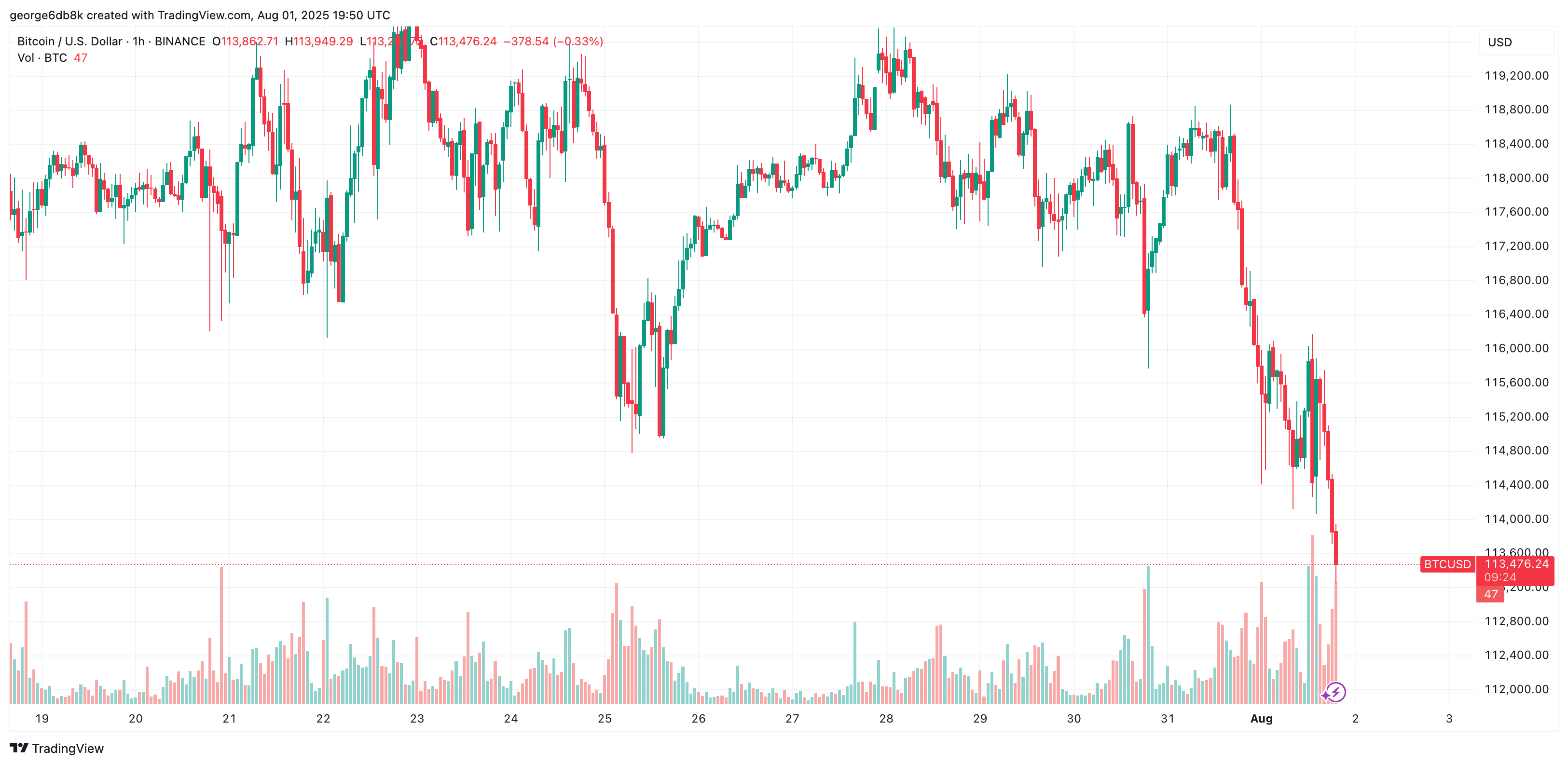

Bitcoin Nosedives Toward $113K—$1 Billion in Liquidations Rocks Crypto Markets

Crypto carnage as Bitcoin's freefall triggers mass liquidation bloodbath.

The king of crypto just got dethroned—at least temporarily—as BTC price action turns into a full-blown demolition derby. With $1 billion in positions getting wiped faster than a meme coin's roadmap, traders are scrambling for cover.

Leverage gets its revenge

All those 100x longs looked genius... until they didn't. The market's brutal reminder that gravity still applies sent over-leveraged degens straight to liquidation city. Somewhere, a VC is writing a 'macro environment' tweet through tears.

Silver lining? This flushout sets the stage for the next leg up—after all, what's a crypto cycle without a few billion in vaporized paper gains? The only thing more predictable than these shakeouts are the 'buy the dip' tweets flooding your timeline.

Source: TradingView

Source: TradingView

Data from Coinglass shows that the total liquidations for the past 24 hours have surpassed $900 million, up more than 300% since yesterday, highlighting the severity of the move.

Naturally, long traders took the bigger hit, accounting for more or less $800 million of the total. Interestingly, ETH is leading the pack in liquidations with around $300 million, at the time of this writing.

As CryptoPotato reported earlier, the downturn comes amid severe turbulence in international geopolitics and macroeconomics as Donald TRUMP continues with his tariffs policy. He imposed an additional 10% tariffs on Canadian goods and slammed 10% on goods imported from every country, aside from the countries that are subjected to higher tariffs.

The drop is not isolated to crypto markets. The S&P 500 is down 1.5% today, the NASDAQ Composite lost 2.16%, while the Dow Jones Industrial Average also lost 1.2%.