Fed Freezes Rates, Trump Unleashes Tariffs—Watch Bitcoin & Altcoins Roar: The Week That Shook Crypto

Markets hold their breath as Powell plays chicken with inflation.

Trump’s trade war 2.0 sends shockwaves—and crypto’s loving the chaos.

Bitcoin flexes its ‘digital gold’ muscles while alts ride the volatility wave. Traders scramble as the Fed’s hesitation becomes crypto’s adrenaline shot.

Another day, another dollar devalued—thank goodness for hard-capped assets.

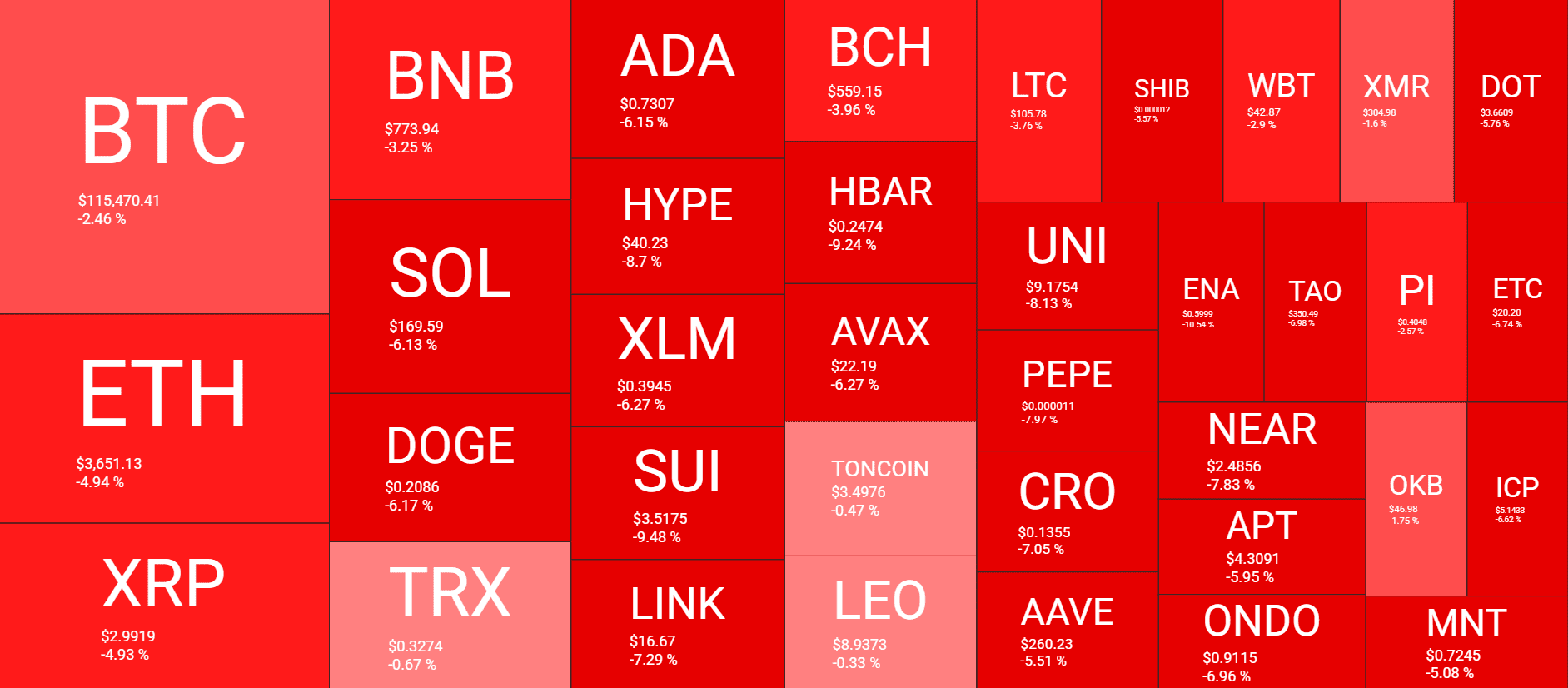

Market Data

Market Cap: $3.83T | 24H Vol: $180B | BTC Dominance: 60%

BTC: $115,350 (-2.5%) | ETH: $3,646 (-4.8%) | XRP: $2.98 (-4.8%)

This Week’s Crypto Headlines You Can’t Miss

. Another major news that came out earlier this week was the long-anticipated Digital Asset report from the US White House. Interestingly, it mentioned different industry initiatives like stablecoins and DeFi, but failed to provide any details about the country’s strategic bitcoin reserve.

It’s a week for anniversaries in the cryptocurrency space, with Shiba Inu and Ethereum standing out for their fifth and tenth birthdays, respectively. Here are some of Ethereum’s massive achievements since 2015 and what might lie ahead.

. Speaking of Ethereum, its underlying asset has been on fire for the past few months, driven to a large extent by the substantial inflows into the spot ETH ETFs. In fact, July saw more net inflows into those financial vehicles than the previous 11 months combined.

. Although it didn’t announce a bitcoin purchase on Monday, as usual, the Saylor-spearheaded company held an IPO for 28 million shares for STRC and raised over $2.5 billion. Naturally, it used a large portion of this stash to accumulate 21,021 BTC.

. Reports emerged after BTC’s latest correction that retail investors had begun offloading sizeable portions of the asset. At the same time, though, whales have been on a buying spree and now hold 68% of the cryptocurrency’s supply.

. Whether or not this cycle will go through an altseason continues to be a heated discussion within the community. According to CryptoQuant, this relatively short period has already begun as the analytics company outlined several factors proving its point.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Solana, and HYPE – click here for the complete price analysis.