Pi Network (PI) Hits Rock Bottom: Can This Crypto Stage a Comeback?

Pi Network’s token just nosedived to its worst price ever—but true believers aren’t hitting the panic button yet.

What’s next for the mobile-mined crypto?

Subheader: The Freefall

No sugarcoating it: PI’s chart looks like a skydiver without a parachute. The ‘people’s crypto’ now trades lower than your average vending machine snack.

Subheader: Miner Morale

Thousands still tap that mining button daily, betting their digital sweat equity will pay off. Meanwhile, Wall Street snickers into its overpriced coffee.

Subheader: Roadmap or Roadkill?

The team promises mainnet magic is coming. Skeptics counter that ‘any day now’ stopped being convincing in 2021. Place your bets—this is either the bargain of the decade or a masterclass in sunk cost fallacy.

The Free Fall Continues

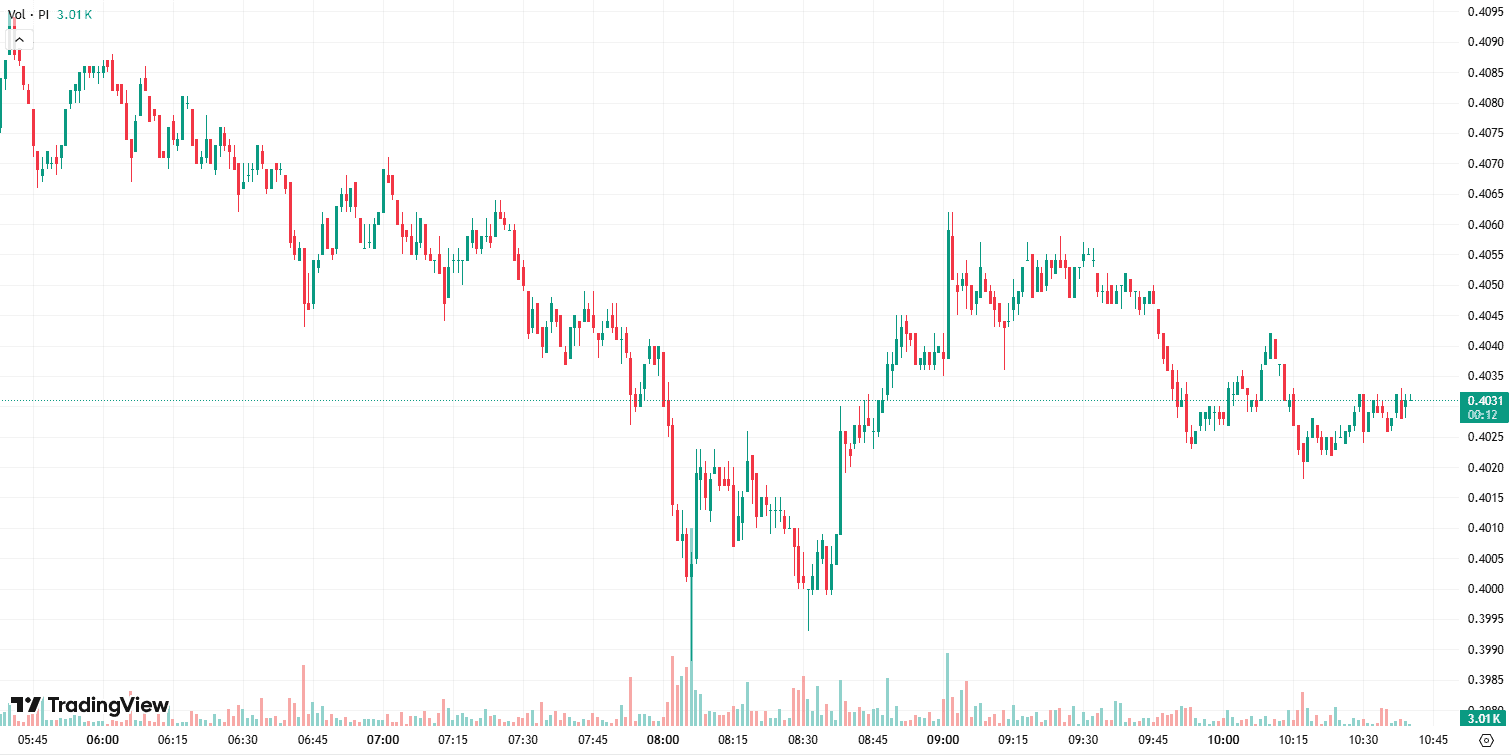

Just a few hours ago, the price of Pi Network’s PI plunged to a new record low below $0.40. Its market capitalization dived to approximately $3.13 billion, making the asset the 44th-largest in the crypto sector.

The main reason for the latest downtrend appears to be the correction of the broader digital asset market, where Bitcoin (BTC) temporarily dropped below $114,500 and Ripple (XRP) lost the psychological level of $3.

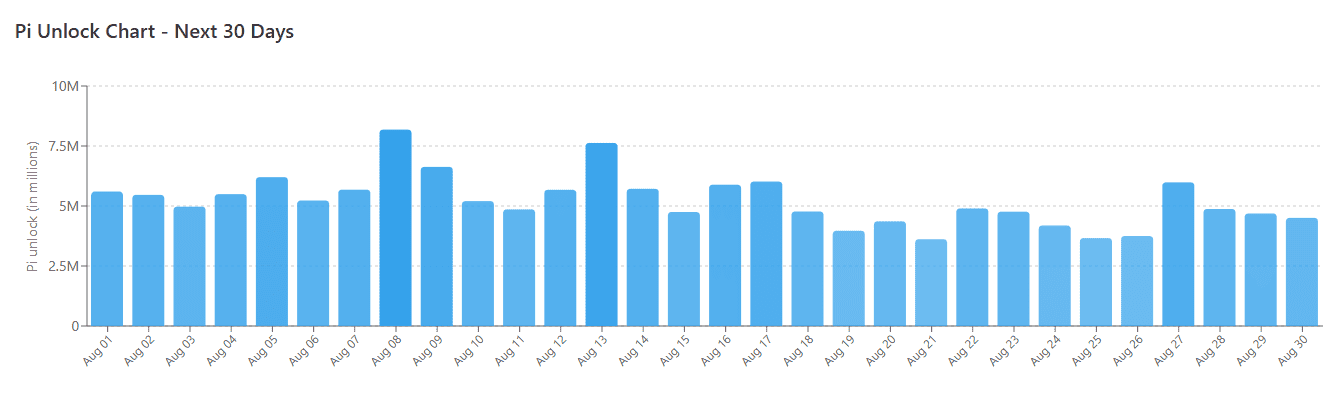

Other factors that may add to PI’s negative performance include the unlocks scheduled for the next 30 days, the rising amount of assets stored on crypto exchanges, and the uncertainty surrounding the coin’s potential listing on Binance.

Data shows that almost 160 million Pi will be freed up in the following month, which will allow some investors to sell tokens they’ve been waiting for a long time.

A few weeks ago, the total number of PI situated on cryptocurrency exchanges surpassed 400 million. The figure has been steadily growing and currently stands at an all-time high of approximately 405.5 million, resulting in increased selling pressure.

Proponents of the asset rely on groundbreaking news, such as PI’s listing on major platforms, to stop the free fall. Recently, there has been renewed speculation that Binance might embrace the token, with the community eyeing August 15 as a potential date. However, there’s nothing official, and this might turn out to be just the next rumor.

It is worth mentioning that the exchange has already asked its users if they want to see PI available for trading, and over 85% of the voters clicked “yes.”

Something for the Bulls

It’s not all doom and gloom for PI as its Relative Strength Index (RSI) has moved to oversold territory with a ratio around 30. This means that the asset’s price has declined too rapidly in a short period and could be poised for a rally.

The technical analysis tool helps traders identify oversold or overbought conditions, ranging from 0 to 100. Typically, readings above 70 suggest a pullback might be just around the corner, while those below 30 are seen as buying opportunities.