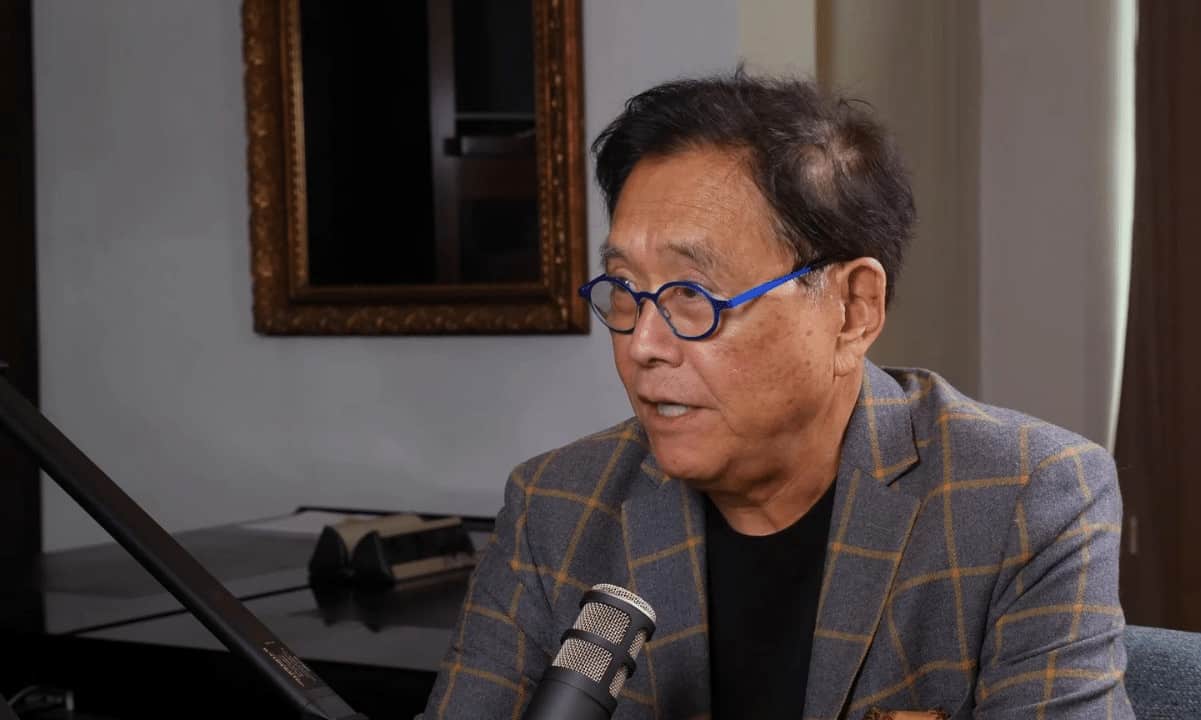

Robert Kiyosaki’s Bitcoin Warning: Skip the Paper ETFs—Go for Real BTC or Get Left Behind

Finance guru Robert Kiyosaki just dropped a truth bomb on crypto investors—fake Bitcoin won’t cut it. Here’s why he’s doubling down on the real thing.

The Paper Trap

ETFs? Derivatives? Kiyosaki calls them ‘financial fast food’—convenient but hollow. His advice? Hold actual Bitcoin or watch from the sidelines as the smart money stacks sats.

Wall Street’s Illusion

Traditional finance keeps pushing paper proxies, but the ‘Rich Dad’ author isn’t buying it. Literally. ‘You wouldn’t collect IOUs for gold,’ he argues—so why settle for Bitcoin receipts?

The Bottom Line

While suits chase ETF fees, Kiyosaki’s betting on cold, hard private keys. One cynical footnote? The same banks selling crypto ETFs still charge $35 for overdrafts—innovation at its finest.

Own Real BTC, Not Paper

In his latest tweet praising Bitcoin, Kiyosaki urged his followers to be wary of ETFs, which he referred to as “paper.” The American entrepreneur stated that he has come to realize that ETFs simplify the investing experience for the average investor. So, he recommends such products, but with caution.

While the average investor can invest their capital in Bitcoin, silver, and Gold ETFs, Kiyosaki advises that they should know when it’s time to go for real assets.

The author of Rich Dad Poor Dad likened owning ETFs to having pictures of guns for personal defense. In essence, such holdings are useless in the face of danger.

“Sometimes it’s best to have real gold, silver, Bitcoin, and a gun. Know the differences when it is best to have real and when it’s best to have paper,” the entrepreneur stated.

According to the businessman, understanding the difference between ETFs and real assets, as well as how to leverage them, makes an investor better than average.

An Easy Way to Get Rich

Over the years, Kiyosaki has become a bitcoin bull and advocate, constantly urging his followers to buy BTC and precious metals. The author believes the United States dollar is doomed and that millions of Americans holding the fiat currency will be financially wiped out when it collapses. However, BTC, gold, and silver holders will remain afloat.

Two months ago, Kiyosaki went as far as stating that bitcoin has made it so easy for anyone to get rich, as the asset obeys the two most important laws of money. He insisted that most people will remain poor for as long as they hold onto assets that violate these laws.

While the U.S. economy faces the risk of collapse in the long term, Kiyosaki sees bitcoin’s value skyrocketing to $1 million. Even when BTC eventually reaches that level, the finance guru says he will continue to buy the digital asset, so as not to regret not accumulating more when the price goes higher.