Bitcoin Plummets to 2-Week Low After Galaxy Digital Dumps $1.5B BTC—Buying Opportunity or Bear Trap?

Bitcoin just got sucker-punched. The king of crypto nosedived to its lowest level in 14 days after Galaxy Digital—Michael Novogratz’s crypto merchant bank—unloaded a staggering $1.5 billion BTC position. Was this a strategic exit or panic selling? Let’s break it down.

### The Whale Move That Rocked the Market

When institutional players dump nine figures worth of BTC, the market notices. Galaxy’s sell-off triggered cascading liquidations, slicing through key support levels like a hot knife through butter. Retail traders got caught holding the bag—again.

### Why This Isn’t 2022 All Over Again

Unlike the Terra/Luna collapse, this dip comes amid strong on-chain fundamentals. Miner reserves are stable, and the Bitcoin ETFs are still sucking up supply. Galaxy might’ve needed fiat for another ‘strategic investment’ (read: covering losses elsewhere).

### The Silver Lining Playbook

History shows these institutional fire sales often mark local bottoms. With the halving supply squeeze still in play, smart money’s already eyeing the dip. As Wall Street would say: ‘It’s not a loss until you sell’… unless you’re Galaxy Digital, apparently.

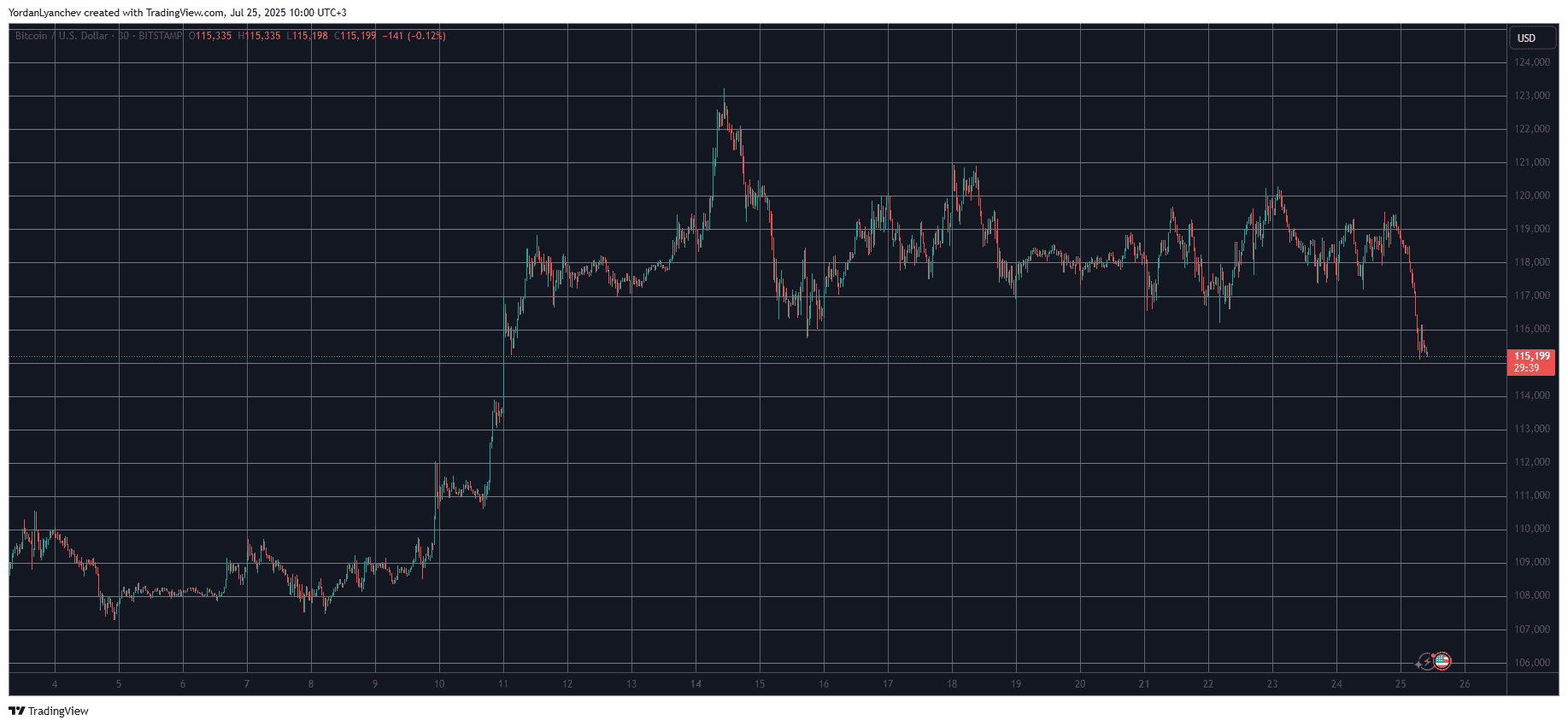

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

The primary cryptocurrency remained in a relatively tight range between $117,000 and $120,000 for the past week, ever since it was pushed south from its latest all-time high of over $123,000.

It challenged the upper boundary on a couple of occasions on Wednesday and Thursday, but to no avail. The latest rejection, which took place hours ago, was particularly painful as it drove BTC south to its lowest price tag since July 11 at $115,000.

This violent correction appears to be at least partially related to Galaxy Digital’s decision to dump a substantial portion of its BTC stash. As reported by Lookonchain, the Novograz-spearheaded company first deposited 10,000 BTC (valued at $1.18 billion at the time) to exchanges before initiating withdrawals of USDT.

Looks like #GalaxyDigital has already dumped the 10,000 $BTC($1.18B)!

Over the past 3 hours, they’ve withdrawn 370M $USDT from #OKX, #Binance, and #Bybit.

Meanwhile, $BTC has dropped over 3% in the past 8 hours.https://t.co/SAD8JLS3TU pic.twitter.com/t0ETxWlw3s

— Lookonchain (@lookonchain) July 25, 2025

In a follow-up, the analytics company said Galaxy deposited another 2,850 BTC ($330 million) to trading platforms, bringing the total to roughly $1.5 billion in bitcoin.

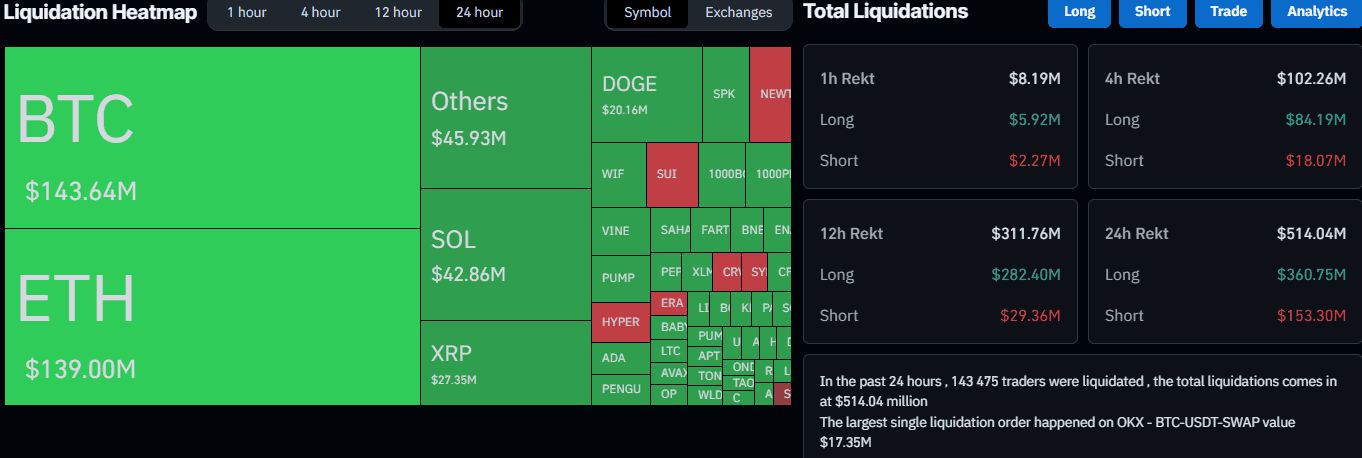

This enhanced volatility has harmed traders using high levels of leverage, as shown by CoinGlass. On a daily scale, the total value of wrecked positions is up to $515 million, with BTC leading the pack ($143 million).

The number of liquidated traders is over 140,000. The single-largest wrecked position took place on OKX and was valued at more than $17 million.