Why Ethereum (ETH) Is the No-Brainer Trade of 2025

Ethereum isn't just leading the pack—it's rewriting the rules. As DeFi 3.0 and institutional adoption hit overdrive, ETH's dominance looks less like a trend and more like a foregone conclusion. Forget "if"—the question is how high.

The Smart Money's Open Secret

While TradFi analysts still debate proof-of-stake, ETH's ecosystem quietly ate 68% of all dApp TVL last quarter. The merge? Old news. The real story? Layer-2 networks now settle transactions faster than Visa—at 1/1000th the cost.

Regulators Hate This One Trick

SEC lawsuits can't dent ETH's momentum. Every institutional custody solution added this year supports it by default (take notes, Bitcoin maximalists). Even Wall Street's latecomers are forced to admit: you can't index crypto without 30%+ ETH exposure.

The Cynic's Corner

Sure, some hedge funds will still lose millions overcomplicating this trade. Because why buy the obvious winner when you can chase obscure altcoins and pretend it's "alpha"?

Is ETH the Right Horse?

Ethereum (ETH) has rebounded from the multi-year low of under $1,400 in April and currently trades at well above $2,500.

Its resurgence brought back Optimism among industry participants, with many viewing it as an attractive investment opportunity. The X user Crypto Rover (who has over 1.2 million followers) recently argued that ETH “is the most obvious trade in 2025.”

$ETH is the most obvious trade in 2025! pic.twitter.com/NhywHpRnzT

— crypto Rover (@rovercrc) June 19, 2025

He claimed the asset’s latest rally resembles the one from 2020, which continued until the end of 2021 when the price reached an all-time high of just south of $5,000.

Crypto Caesar touched upon ETH’s positive performance in the past hour, summarizing that “it’s looking good for now.” The analyst urged investors to remain patient, claiming that only the potential outbreak of World War III could derail the bullish momentum.

Crypto Fella believes ETH’s next rally is a matter of when not if. The X user envisions new peak levels ahead, though the price may dip before heading higher.

Those willing to explore additional recent forecasts involving ethereum can refer to our dedicated article here.

What Are the Indicators Signaling?

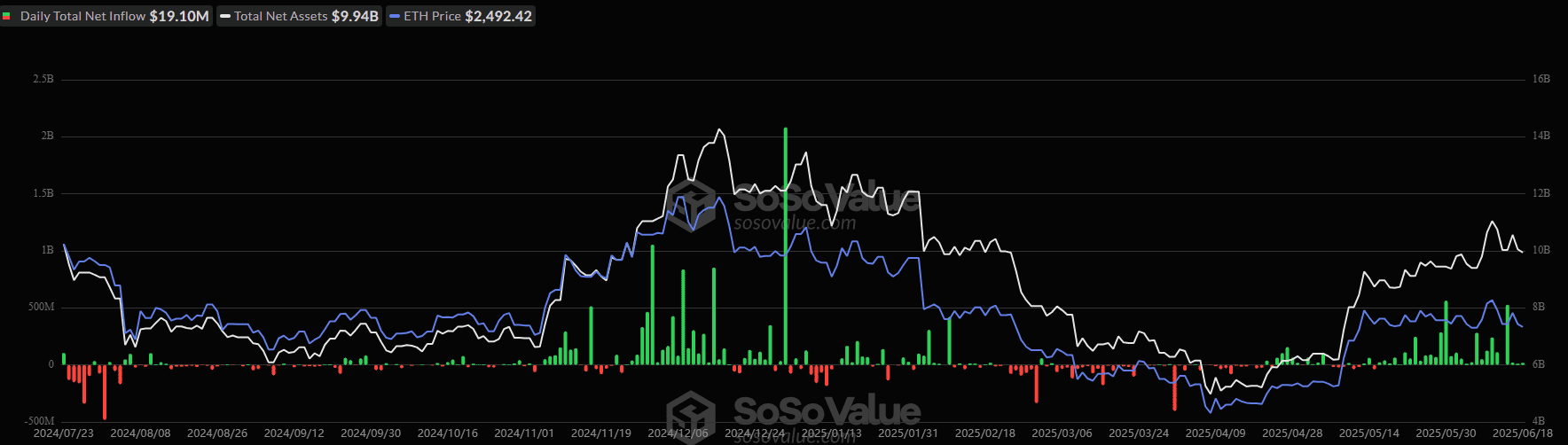

Over the past several weeks, there has been an evident influx of capital toward spot ETH ETFs. Data compiled by SoSoValue shows that the last day when the netflow was negative (outflows exceeding inflows) was on May 15.

The development generally indicates that a rising number of investors have been buying shares of these funds, showcasing their confidence in the asset. Spot ETFs hold actual ETH, so these purchases can benefit the bulls.

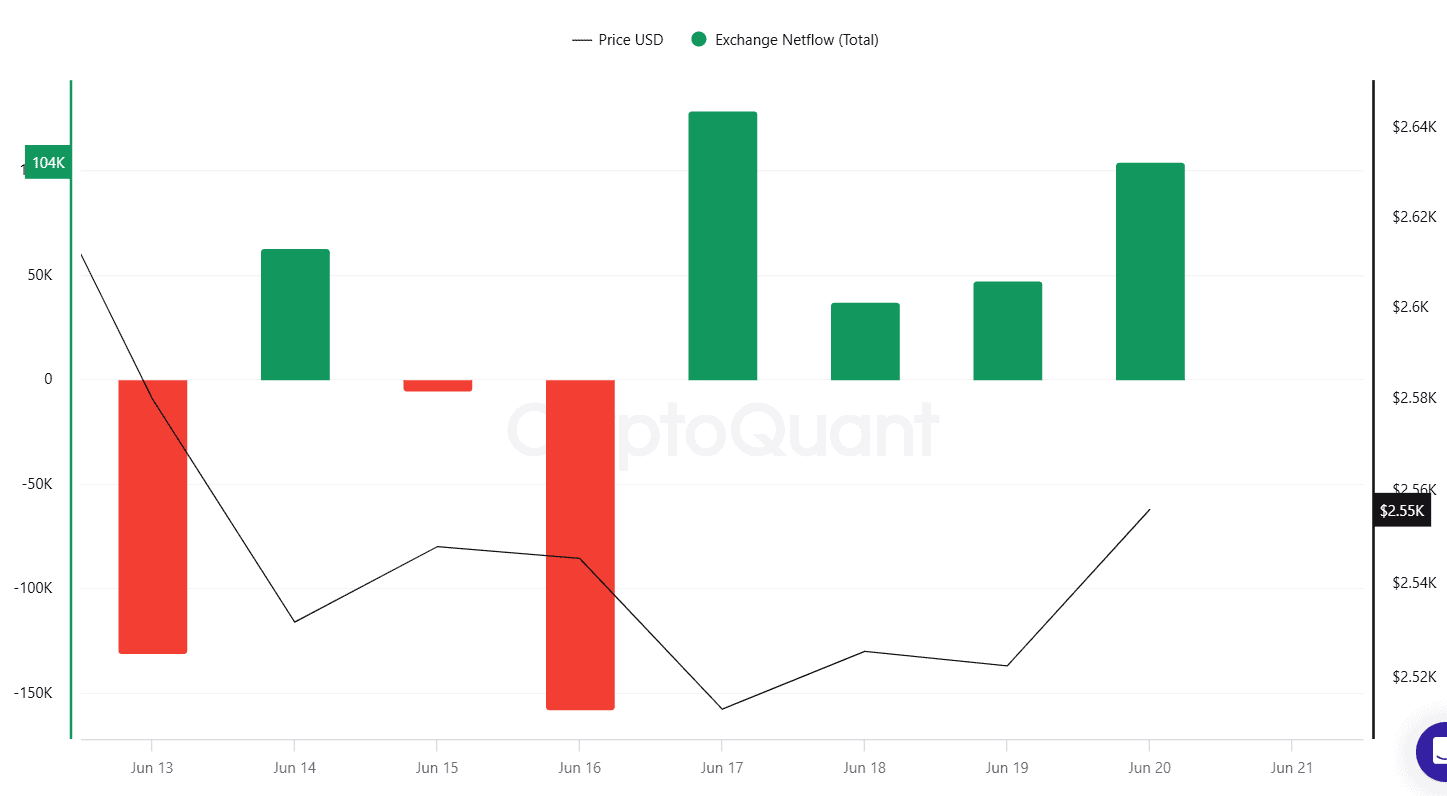

Nonetheless, it’s not all sunshine and roses. The Ethereum exchange netflow has been predominantly positive in the last few days, suggesting that some investors have moved their holdings to centralized platforms. This is typically considered a pre-sale step and might have a negative influence on the valuation.