BTC Holds Steady Post-FOMC as Geopolitical Tensions Loom: Your Crypto Week Unpacked

Bitcoin finds its footing after Fed drama—now all eyes turn to Middle East chaos and political chess moves.

Markets exhale as volatility cools...for now.

Here's what's moving crypto this week—no fluff, just alpha.

Geopolitical risk meets monetary policy: The ultimate cocktail for crypto traders.

Remember when 'uncorrelated asset' was the sales pitch? *laughs in risk-on asset*

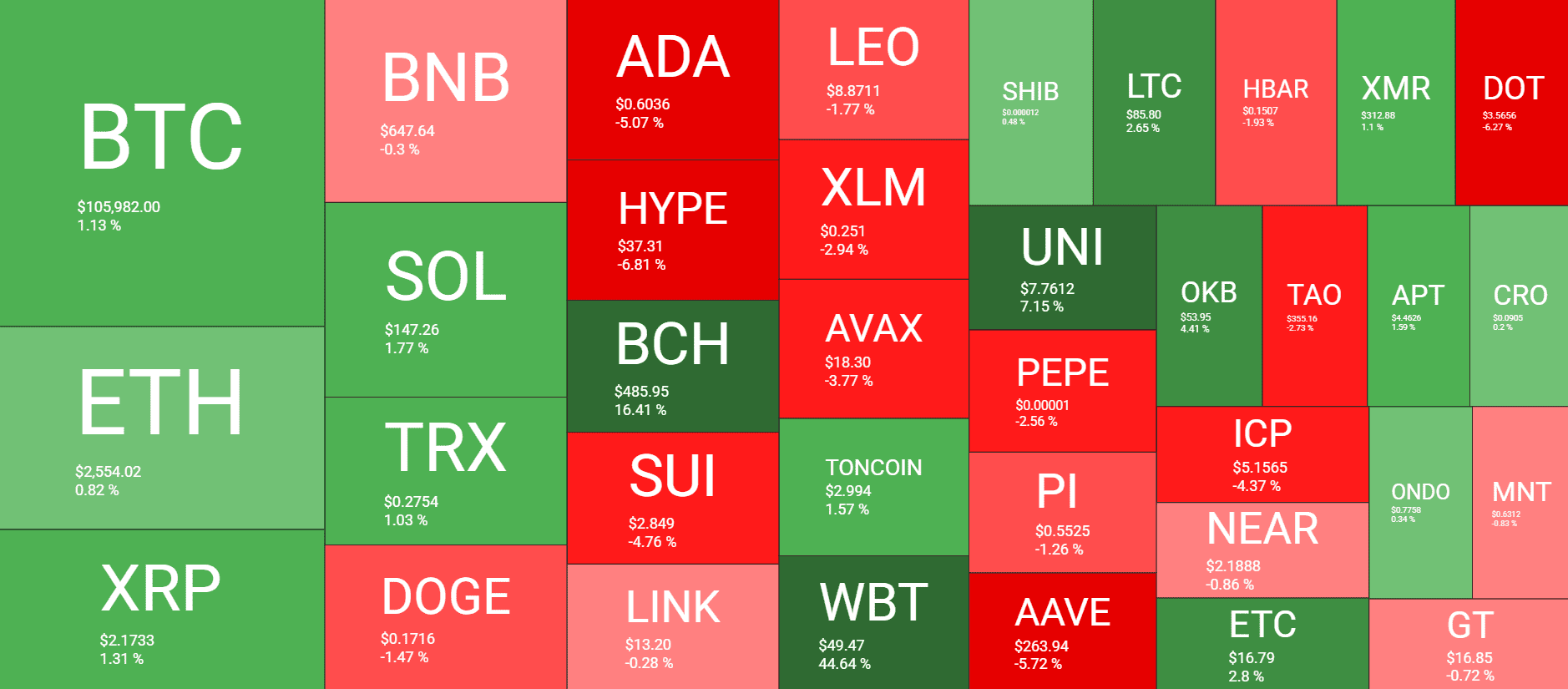

Market Data

Market Cap: $3.406T | 24H Vol: $103B | BTC Dominance: 61.8%

BTC: $106,100 (+1.2%) | ETH: $2,560 (+0.8%) | XRP: $2.17 (+1.5%)

This Week’s Crypto Headlines You Can’t Miss

. The warm relationship between Tron’s Justin SUN and the current US presidential administration seems to be paying off. According to a recent report, the blockchain project is planning to go public in the US through a reverse merger with SRM Entertainment.

. The Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act passed the US Senate with an overwhelming 68 to 30 vote on June 17. The bill now needs to be approved by the House, which is controlled by the Republicans.

. Although ether’s price has stagnated recently, the token is continuously being staked and transferred to long-term holders, who are less inclined to sell.

The available supply of bitcoin seems to be drying up. According to a recent report by Fidelity, an average of 566 BTC per day is falling into a long-term “ancient supply” bucket, while the daily issuance rate of BTC is just 450.

. On-chain data reveals that retail investors are still missing, as the smaller transactions are lacking. This means that bitcoin’s price is being supported above $100,000 mostly by institutional players, as the network activity shows primarily large transactions.

. It wasn’t really a surprise on Monday when Michael Saylor announced the latest BTC acquisition by Strategy, which is back in the billions of dollars. Before the NASDAQ-listed company, Metaplanet also outlined its latest bitcoin purchase, while Genius Group expanded its BTC holdings by 52% despite some regulatory issues.

Charts

This week, we have a chart analysis of Binance Coin, Ripple, Cardano, Hype, and solana – click here for the complete price analysis.