Shiba Inu’s Key Metric Hits 3-Month Low—What’s Next for SHIB?

Shiba Inu’s critical indicator just nosedived to its lowest level in three months. Traders are scrambling to decode the signal—is this a buying opportunity or a warning sign?

Dog-themed coins have always been volatile, but SHIB’s latest move has even seasoned crypto vets raising eyebrows. The ’important indicator’ referenced in the original data (now at a 90-day low) typically precedes major price action—though whether that’s up or down remains the million-SHIB question.

Remember: in crypto, ’fundamentals’ often just means ’which way the hype wind blows.’ As Wall Street would say: past performance is no guarantee of future results—unless you’re talking about memecoins, where past irrationality is the only reliable indicator.

Brace for Impact?

The number of daily transactions processed on Shiba Inu’s layer-2 blockchain solution, Shibarium, has been in decline over the past few weeks.

On June 1, the figure shrank to just 65,411, marking the lowest point observed in nearly three months. Additionally, the number of active accounts and new contracts has also headed south.

The aforementioned data indicate stalled activity on the network, suggesting reduced user engagement, which may have a negative influence on the price.

Some members of the shiba inu team, as well as other industry participants, believe the future development of Shibarium is vital for the meme coin’s price performance. One of those is the Bitcoin advocate Jeremie Davinci, who recently said:

“I like Shiba Inu, as you know, and I think it will do relatively well in this cycle, but it may not go as high as you expect. I think Shiba Inu has a lot of utility now that they have Shibarium, and basically, it’s a chain that you can actually run all kinds of applications.

However, nobody is using it, and there are no applications for using your tokens on Shibarium yet. If they get that solved, Shiba Inu will go to the moon.”

Another factor signaling bad news for SHIB’s valuation is the project’s burning mechanism. Over the past seven days, the team and community have destroyed approximately 111 million tokens, representing a 15% decline compared to the rate witnessed the week before. Furthermore, only 1.57 million SHIB were burned in the past 24 hours, meaning a nearly 90% decrease on a daily scale.

The program’s ultimate goal is to reduce the overall supply of the meme coin and potentially increase its value through scarcity. According to Shibburn, the amount of tokens burned from the initial supply since adopting the program is over 410.7 trillion, leaving 584.4 trillion in circulation.

Some Bullish Signs

Although the aforementioned signs imply a bearish future for Shiba Inu, other factors paint a more positive picture.

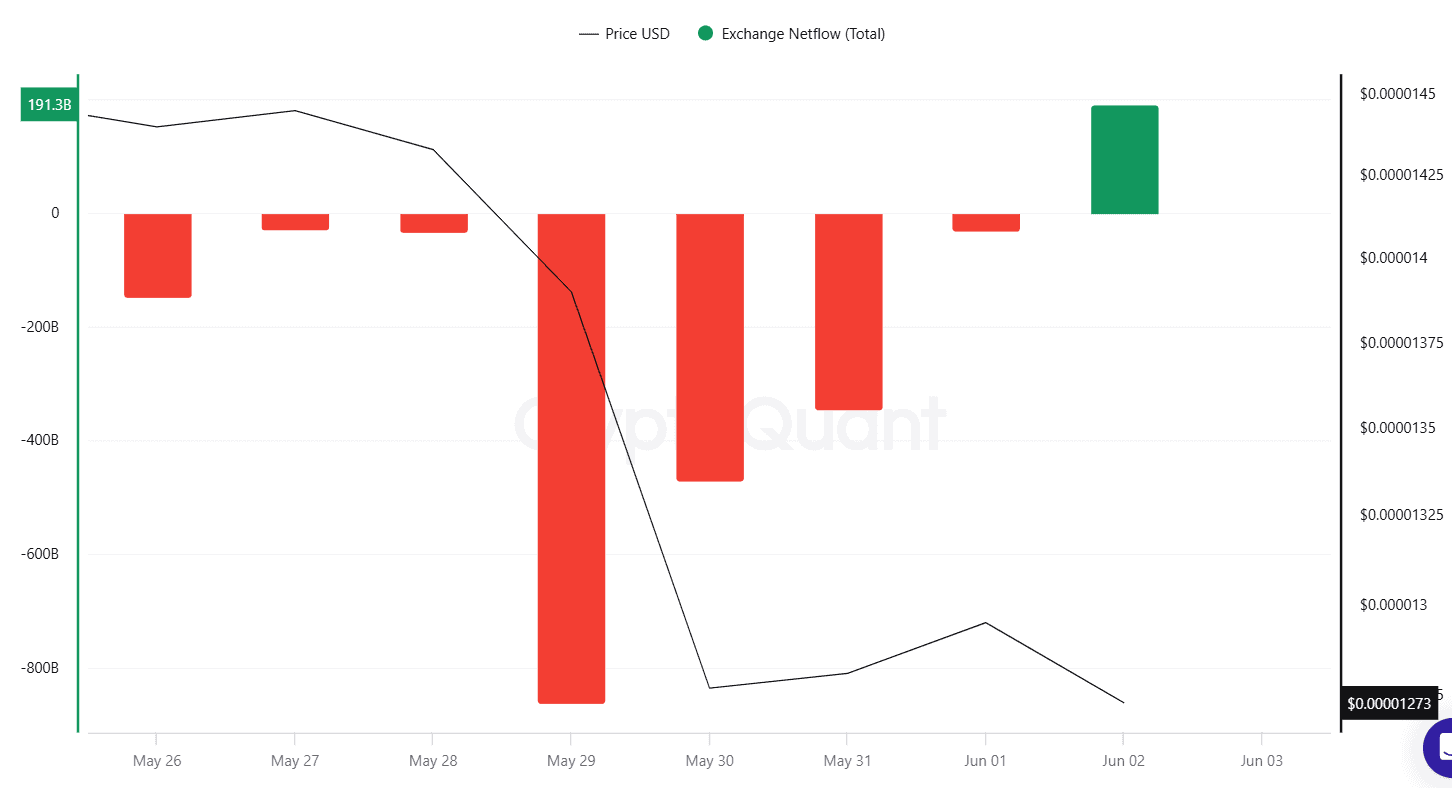

For instance, SHIB’s exchange netflow has been predominantly negative over the past week, indicating that the coin’s supply on centralized platforms is decreasing. This suggests that investors may have shifted toward self-custody methods, a MOVE that reduces immediate selling pressure.

Shiba Inu’s Relative Strength Index (RSI) is also worth mentioning. The momentum oscillator is currently hovering slightly above the bullish zone of 30. Ratios below that level typically indicate that the meme coin may be oversold and poised for a rally. On the contrary, anything above 70 may be taken as a warning signal.