Ethereum rockets 50% in a month—so where does ETH go from here?

ETH’s bull run leaves traders scrambling: Is this the start of a new paradigm or just another crypto sugar high?

Breaking down the rally: Ethereum’s surge defies skeptics—but can it sustain momentum after such a steep climb?

Key levels to watch: The network’s fundamentals look strong, though Wall Street analysts are already dusting off their ’bubble’ talking points.

One thing’s certain: When ETH moves this fast, even the suits start paying attention—right before they call it a ’speculative asset class’ again.

Technical Analysis

The Daily Chart

On the daily chart, ETH is trading just below the confluence of the 200-day and the $2,800 supply level. Yet, the 100-day moving average is currently below the asset, providing support just below the $2,100 demand zone. With the price being trapped between these two moving averages, a breakout to either side could be the beginning of a new impulsive move.

Meanwhile, the RSI sits around 66, just below overbought conditions but on a downtrend, reflecting slowing upside strength, with a bearish divergence forming, which indicates that a correction is probable in the coming weeks.

The 4-Hour Chart

Dropping lower on the 4-hour timeframe, ethereum is showing signs of weakening momentum. After the explosive move above $2,100, the price has been consolidating within a narrow ascending channel near the $2,500–$2,600 range. Yet, the RSI has been on a slight uptrend, indicating that the momentum is slowly shifting in favor of the buyers on this timeframe.

Yet, for any meaningful rally to begin, the market needs to break out of the channel with force and volume. Otherwise, a drop below the $2,600 level, which is now acting as a short-term support, WOULD likely lead to a breakdown of the channel and a price decline back toward the $2,100 demand zone.

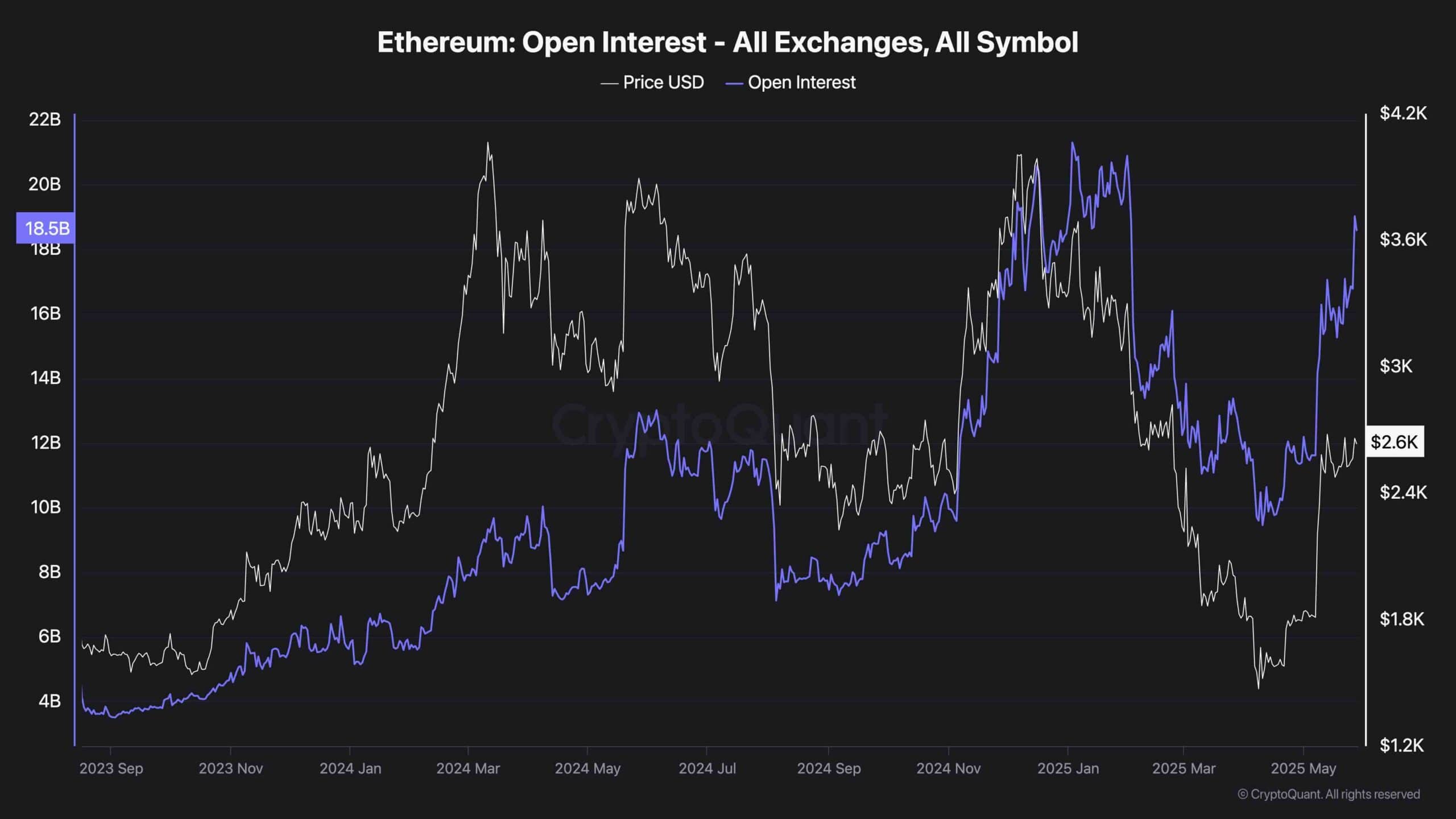

Ethereum’s open interest has surged sharply, now standing at $18.5B, approaching its previous all-time highs seen at the beginning of the year. This significant uptick in open interest alongside rising prices suggests a buildup of Leveraged long positions across the market.

While this often indicates strong bullish sentiment and trader confidence, it also introduces potential risk. When open interest climbs aggressively without a clear breakout, it can signal overcrowding and increase the chances of a liquidation-driven pullback. The current positioning reflects high anticipation of a breakout above $2.8K.

However, if ETH fails to clear that resistance, the market could see a swift correction as overleveraged longs are flushed out.