BitMEX Partners with Hoc-trade to Launch AI-Driven VIP Trading Analytics—Because Even Sharks Need Bigger Data

BitMEX just upped the ante for high-rollers—rolling out AI-powered VIP trading reports that promise to turn market noise into actionable alpha. The crypto derivatives giant teamed up with quant-focused Hoc-trade to deliver institutional-grade insights, slicing through volatility with machine-learning precision.

Who needs a crystal ball when you’ve got algorithms? The new reports analyze execution quality, liquidity impact, and hidden slippage costs—finally giving whales metrics to justify those 3am trading binges.

While retail traders stare at candlestick patterns, VIPs now get forensic-level trade diagnostics. A cynical take? Another premium product for the 1% in an industry that still can’t fix Bitcoin’s $50 gas fees for the little guy.

Jonas Schleypen, CEO & Co-founder of Hoc-trade commented, “We’re excited to partner with BitMEX as the first crypto exchange to offer VIP Trading Reports. Given the fast-paced, high-volatility nature of crypto markets, staying focused and minimising behavioural biases is more critical than ever—and that’s exactly where the VIP Trading Report delivers value. This partnership reflects BitMEX dedication to driving innovation and raising the bar in financial crypto services.”

The BitMEX VIP Trading Report is now accessible to BitMEX VIP clients, offering an exclusive advantage in navigating the complexities of the crypto market. Traders can unlock these in-depth analytics, along with a range of other benefits like trading fee discounts, by achieving higher tiers of trading volume on the BitMEX platform or by staking BMEX Tokens, the native token of BitMEX. More details on the VIP tiers can be found here.

BitMEX is the OG crypto derivatives exchange, providing professional crypto traders with a platform that caters to their needs through low latency, DEEP crypto native liquidity and unmatched reliability.

Since its founding, no cryptocurrency has been lost through intrusion or hacking, allowing BitMEX users to trade safely in the knowledge that their funds are secure. So too that they have access to the products and tools they require to be profitable.

BitMEX was also one of the first exchanges to publish their on-chain Proof of Reserves and Proof of Liabilities data. The exchange continues to publish this data twice a week – proving assurance that they safely store and segregate the funds they are entrusted with.

For more information on BitMEX, please visit the BitMEX Blog or www.bitmex.com, and follow Telegram, Twitter, Discord, and its online communities. For further inquiries, users can contact [email protected].

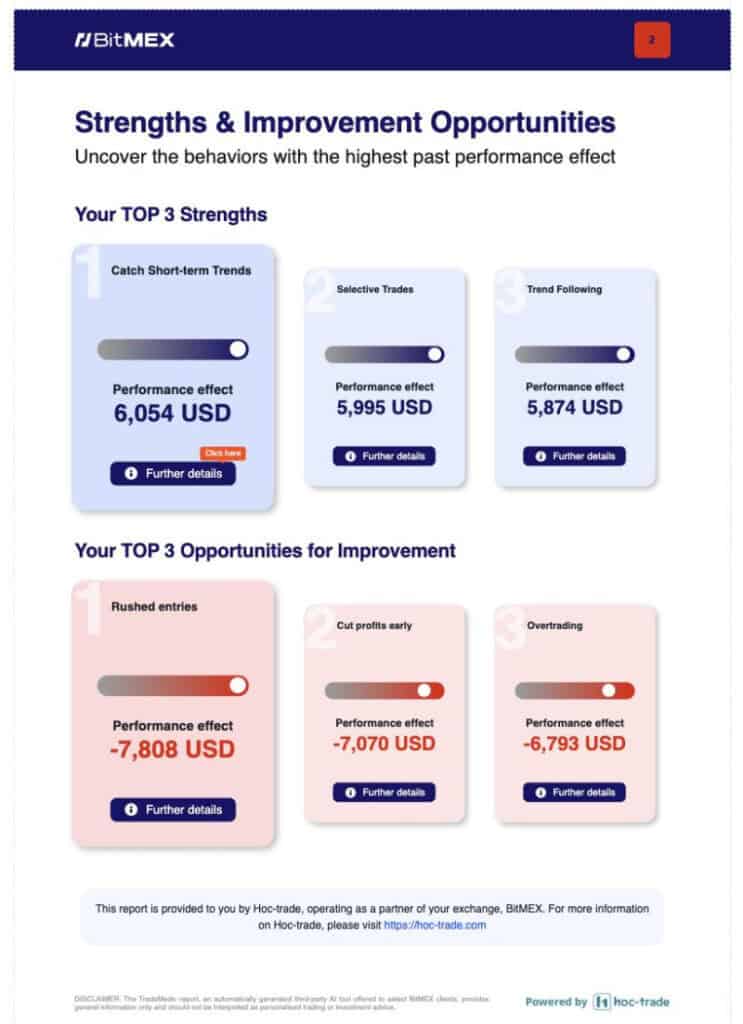

Hoc-trade is a behavioral analytics platform powered by AI, designed to help traders and institutions optimize performance by detecting and correcting emotional and cognitive biases in real time. Pioneering behavioral AI for trading, Hoc-Trade combines advanced machine learning with behavioral finance to deliver hyper-personalized insights that reveal the psychological drivers behind each trading decision — from overtrading and revenge trading to loss aversion and premature profit-taking. By transforming trading history data into actionable behavioral intelligence, Hoc-trade enables users to gain a sustainable edge through deeper self-awareness and smarter decision-making.

Through our flagship product, TradeMedic, Hoc-trade provides hyper-personalized performance reports that help traders understand the psychological factors influencing their trading habits. TradeMedic AI identifies key behavioral biases but also trading strengths, offering actionable insights that drive better decision-making and support long-term trading success. For more information on Hoc-Trade and TradeMedic, users can visit www.hoc-trade.com, and follow them on Twitter, LinkedIn, and Instagram. For further inquiries, users can contact [email protected].