ETH Buy Zone Alert: 4% Price Dip Creates Prime Entry Opportunity

Ethereum plunges 4% - traders scramble for strategic positioning.

Critical Support Levels Emerge

The dip puts ETH at crucial technical thresholds that historically triggered major rebounds. Market watchers eye these zones as potential springboards for the next leg up.

Timing the Bottom

With volatility spiking, seasoned investors are mapping entry points while weak hands panic-sell. The 4% decline represents either danger or opportunity - depending on your timeframe and conviction.

Smart Money Moves

Institutional flows continue accumulating despite short-term turbulence. Meanwhile, retail traders obsess over daily charts while missing the bigger picture - classic market psychology at play.

Whether this dip becomes a blip or the start of something bigger remains unclear. But one thing's certain: in crypto, the perfect buy zone often feels the most uncomfortable to enter. Just ask anyone who bought during last year's 'certain collapse' that never materialized.

ETH/BTC Pullback May Offer Opportunity

Michaël van de Poppe shared a weekly ETH/BTC chart showing a strong rally earlier this year. The pair moved up more than 140% from its low, topping out NEAR 0.038. It is now trading close to 0.0365 and approaching a support area.

Van de Poppe marked the 0.0325 to 0.03 BTC range as a possible entry point. This zone was acting as a resistance in the past, and now sits near the 10-week moving average. He also pointed to lower support levels at 0.026, 0.0232, and 0.0194. The current pullback has happened on lower volume, which could suggest less selling pressure.

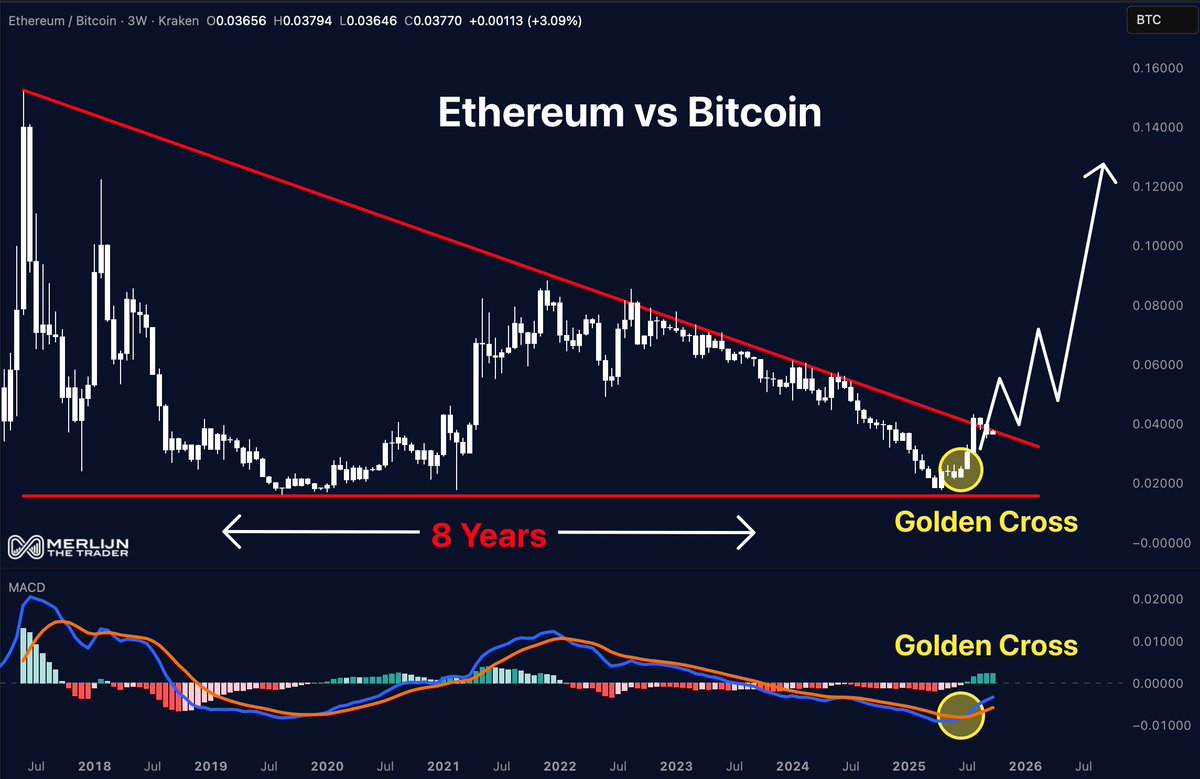

In addition, Merlijn The Trader posted a separate ETH/BTC chart showing a MOVE above a trendline that held for eight years. The breakout came after ETH bounced off long-term support near 0.020. This change in structure may suggest a shift in momentum.

The chart also includes a golden cross on both price and MACD. This is the first time in years that momentum has flipped in favor of ETH on this chart.

“Ethereum doesn’t crawl out of patterns like this. It erupts,” Merlijn said.

His chart shows a path that could take ETH/BTC toward 0.10–0.12.

Daily Chart Shows Repeat Setup

On the daily chart, Trader Tardigrade posted a pattern that has repeated multiple times in recent months. In each case, ETH traded sideways, broke slightly below its support level, and then moved higher. These earlier setups resulted in rapid gains.

The latest move shows ETH pulling back below $4,600 before bouncing again. The pattern now suggests a possible move toward $5,800–$6,200. “Ethereum pump is ongoing,” he said, hinting that the structure may still be in play.

Key Zone Remains a Challenge

Ali Martinez has called the $4,000–$4,800 range Ethereum’s “danger zone” since 2021. His chart shows that ETH has failed at this level several times, often followed by sharp pullbacks. The past six rejections led to declines ranging from 31% to over 80%.

ETH is now back in that same zone, trading near $4,500. The chart marks this area as one to watch. “Every touch led to a correction,” Ali noted, suggesting caution as ETH tests this resistance once again.