Cardano at a Crossroads: Can ADA Still Explode 25%?

Cardano faces its defining moment as technical indicators signal potential breakout territory.

Technical Momentum Building

ADA's chart patterns show consolidation near critical resistance levels—traders watch for the 25% surge that could trigger cascading buys across exchanges. The blockchain's recent protocol upgrades deliver measurable improvements in transaction throughput while cutting gas fees by double digits.

Ecosystem Development Accelerates

Developers flood Cardano's testnet with new dApp deployments ahead of the Vasil hard fork. Staking yields outperform traditional savings accounts by multiples—though let's be honest, most bankers still think DeFi stands for 'definitely fraudulent'.

Market Psychology at Play

Whale accumulation patterns suggest institutional money positioning for volatility. Retail FOMO could amplify moves once ADA breaches psychological price barriers. The network's peer-reviewed approach either demonstrates academic rigor or proves committees move slower than crypto markets—take your pick.

All eyes on whether Cardano converts technical promise into tangible gains as altcoin season heats up.

Did ADA Lose Its Chance?

It has been just over a month since Cardano’s ADA surged above $1. Since then, though, it has been on an evident decline which has even worsened in the past few days. As of this writing, the asset trades at around $0.78, representing a 15% plunge on a weekly scale.

According to renowned analyst Ali Martinez, the drop below $0.80 could prove critical, potentially preventing the price from rebounding by roughly 25% to $0.95.

Earlier this month, he revealed that large investors (known as whales) have offloaded 160 million tokens in the span of just 96 hours. This adds more weight to the bearish view, as it signals diminished confidence in the asset from these market participants, which could also reflect on smaller players. In addition, such actions increase ADA’s circulating supply, potentially triggering a price decline if demand does not increase.

The lesser-known market observer, using the X moniker Man of Bitcoin, also outlined a bearish forecast. He believes the dip below $0.782 could be followed by an additional plunge to as low as $0.731.

ATH for Christmas?

The X user Sssebi recently agreed with the assumption that ADA can continue nosediving in the short term. However, the analyst thinks the downtrend will last only until next month and after that will be replaced by a resurgence, which could take the price to a new historical record by Christmas this year:

“Bigger drop until October and then bounce back mid-October-November. Possible new ATH at Christmas time.”

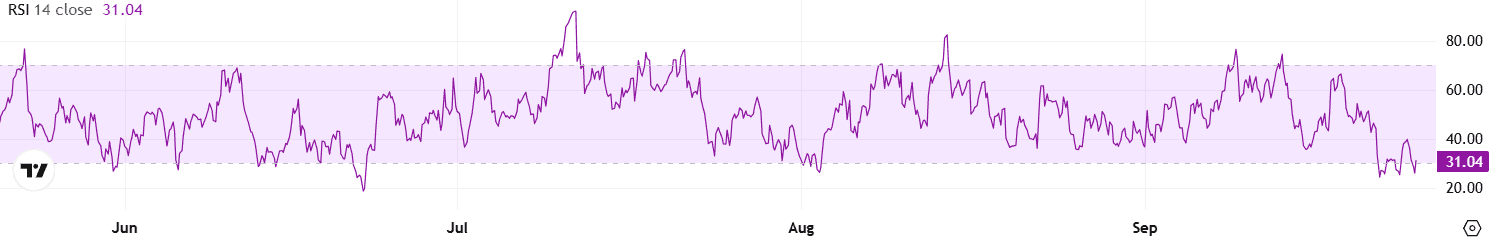

Bulls should also examine ADA’s Relative Strength Index (RSI), which has recently plummeted to approximately 30. Readings around and below that level indicate that the asset’s price has declined too rapidly over a short period, suggesting it may be on the verge of a revival. On the contrary, anything above 70 is considered bearish territory.