Chainlink Dips: Is a Massive Rally to New All-Time Highs Imminent?

Chainlink stumbles—but smart money sees a setup for explosive gains.

Technical Breakdown

The oracle network's recent pullback looks more like a coiled spring than a breakdown. Key support levels held while institutional accumulation patterns suggest whales are positioning for the next leg up.

Market Psychology

Traders chasing quick pumps got shaken out—leaving determined holders who understand Chainlink's fundamental role in the DeFi ecosystem. This divergence between weak and strong hands typically precedes major moves.

Catalysts Ahead

With real-world asset tokenization accelerating and cross-chain interoperability becoming critical infrastructure, Chainlink's oracle solutions face unprecedented demand. The network effect compounds faster than traditional finance models can comprehend.

Watch for a decisive break above resistance levels—that's when sidelined capital floods back in. Sometimes the market needs a dip to remind everyone that building actual utility beats spreadsheet speculation every time.

Price Pulls Back to Key Level After Recent Highs

Chainlink (LINK) was trading NEAR $21 at press time after falling 4% over the last 24 hours. Over the past week, the token has dropped by 14%. The current move represents a pullback of around 20% from the recent high of $26.

The asset is approaching a short-term support between $19 and $20. This area acted as a resistance in previous months. Maintaining this zone might keep the existing trend structure intact. Should the price break below it, then lower levels may be considered, depending on other market conditions.

A broader support zone, ranging from approximately $11 to $14, has been active since mid-2023. LINK has built higher lows from that level, indicating a larger upward structure in place over the past several months.

Michaël van de Poppe, a market analyst, described the current moment as a time to consider building positions. He said, “LINK is getting into a higher timeframe support zone,” and believes there is a “very high chance that will hold.” He also mentioned the next MOVE could lead to a “new all-time high.” While some traders watch this zone closely, others are waiting for price confirmation.

Absolutely legendary moment to be scooping up some of your favourite #Altcoins.$LINK is getting into a higher timeframe support zone.

Very high chance that will hold, and the next rally is likely the rally towards a new ATH. pic.twitter.com/q4WpmsO1e1

— Michaël van de Poppe (@CryptoMichNL) September 25, 2025

Indicators Show Pressure, But Stabilization Possible

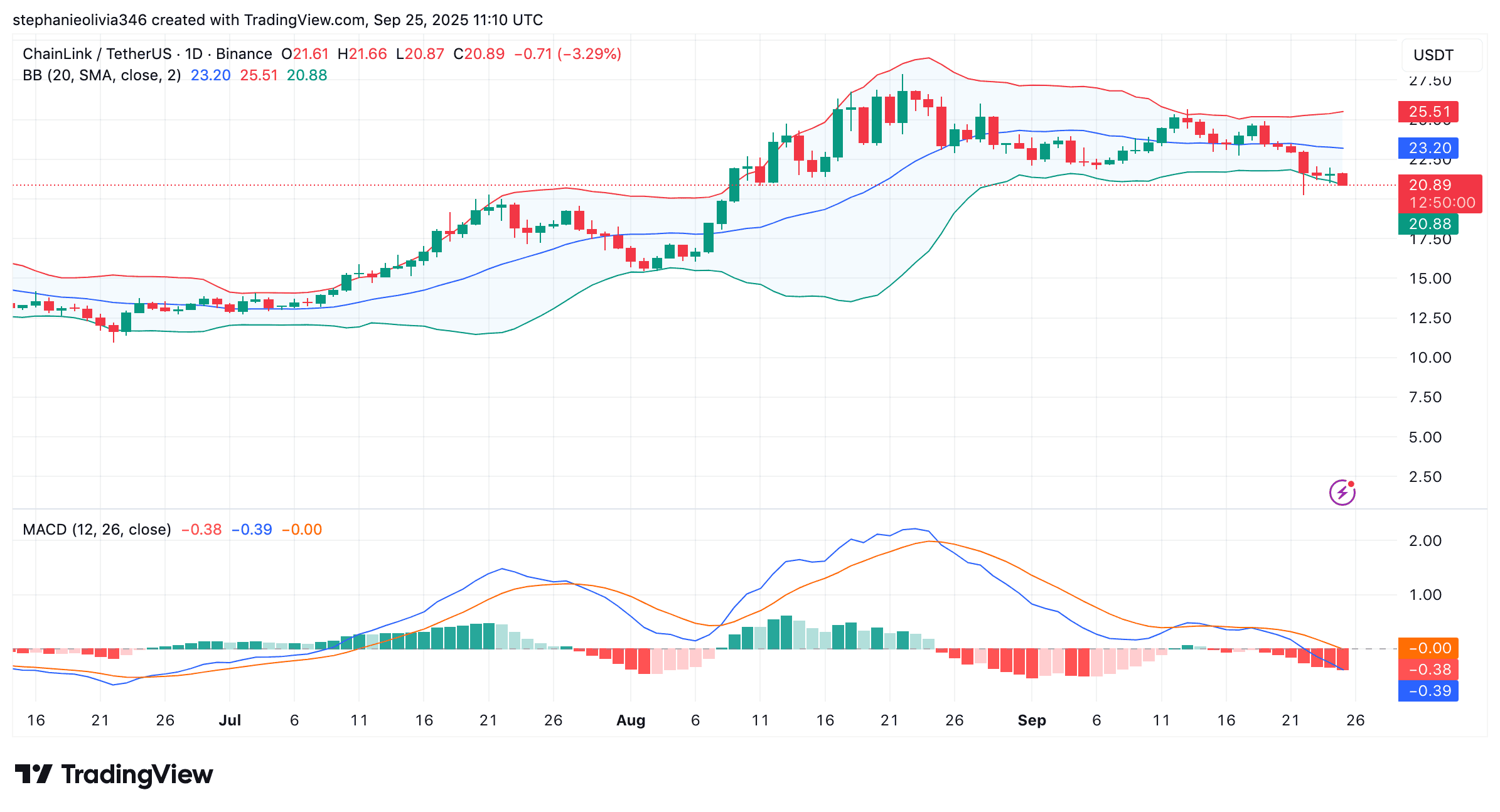

Technical data on the daily chart shows LINK trading below the 20-day simple moving average of the Bollinger Bands. That midline currently sits near $23. The price is now near the lower band, around $20. This may suggest the asset is short-term oversold, but the direction remains uncertain unless the midline is reclaimed.

Momentum indicators such as the MACD show a recent bearish crossover. Both lines remain negative, and the histogram is flat. While no strong shift is visible, the current state shows slowing downside strength rather than full reversal.

Exchange Outflows Increase as New Partnership Forms

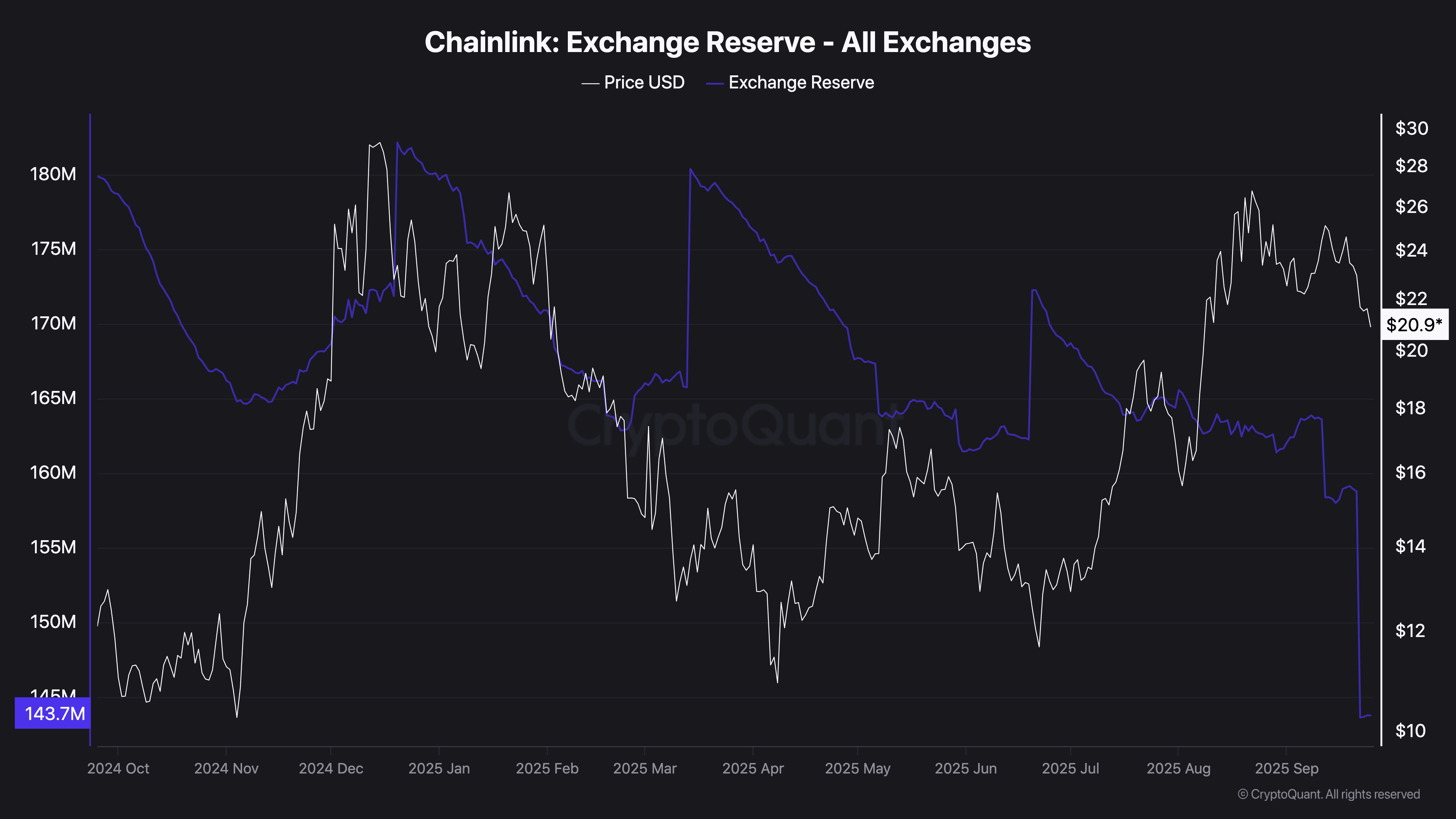

Data from on-chain platforms shows LINK exchange reserves have dropped to 143.7 million, the lowest point in more than a year. A steady decline in reserves suggests tokens are moving off exchanges, often to self-custody or long-term holding setups.

Notably, the drop continued even as the price corrected from $26 to around $21. This movement may show that traders are holding their positions despite recent losses. Fewer tokens on exchanges can also reduce short-term selling pressure.

Chainlink recently partnered with the Canton Network, a blockchain project backed by financial and technology firms. Through the integration, Chainlink’s data services and cross-chain messaging protocol (CCIP) will operate within the network. Canton has also joined Chainlink’s Scale initiative, which helps cover operating costs for oracles used in smart contracts.