Arthur Hayes Doubles Down: Bitcoin to $1M—But He’s Shorting the Rally

Bitcoin maximalist and ex-BitMEX CEO Arthur Hayes hasn’t lost his trademark audacity—predicting a $1 million BTC price target while openly shorting the climb. The crypto maverick’s contrarian play reveals hedge-fund-grade irony: betting against the very asset he’s evangelized for years.

Hayes’ strategy hinges on exploiting volatility during Bitcoin’s ascent, a move that’ll either look genius or reek of overleveraged hubris. ’Traders gonna trade,’ he shrugs—ignoring howls from bitcoin purists who see shorting as sacrilege.

Wall Street analysts are already sharpening their knives. ’This is why crypto won’t replace finance,’ quips one JP Morgan strategist, ’you can’t pump an asset while betting against your own investors.’ Game on.

Arthur Hayes says capital controls are coming

Arthur said the US trade imbalance can’t be fixed with tariffs because voters won’t put up with higher prices or empty shelves. He pointed to Trump’s 90-day tariff rollback with China as proof that the hard route won’t work politically. Instead, the solution now favored by the WHITE House is to tax foreign ownership of US financial assets.

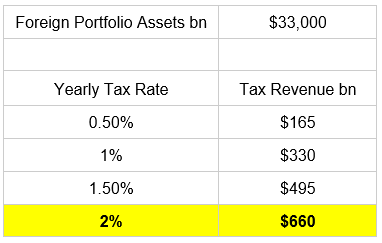

That’s where capital controls come in. Arthur laid it out simply: if foreigners want to buy American stocks, bonds, or real estate, they’ll have to pay for it. He gave a 2% yearly tax as an example.

With $33 trillion in foreign portfolio assets held in the US, that tax could replace income taxes for most Americans. “Trump could eliminate income taxes for the vast majority of voters,” Arthur wrote, and that kind of math wins elections.

Arthur said capital controls are easier to enforce than tariffs and avoid the political fallout. If foreign money stays, it gets taxed. If it leaves, the dollar weakens, and American manufacturing comes back. Either way, voters win. “This is the Boiling Frog Theory,” Arthur wrote, predicting that the market won’t react violently because the change will be gradual.

Arthur warns that financial markets will feel the pain

Arthur said foreign investors won’t stick around forever. When they realize their returns are being taxed, they’ll start dumping stocks, bonds, and real estate.

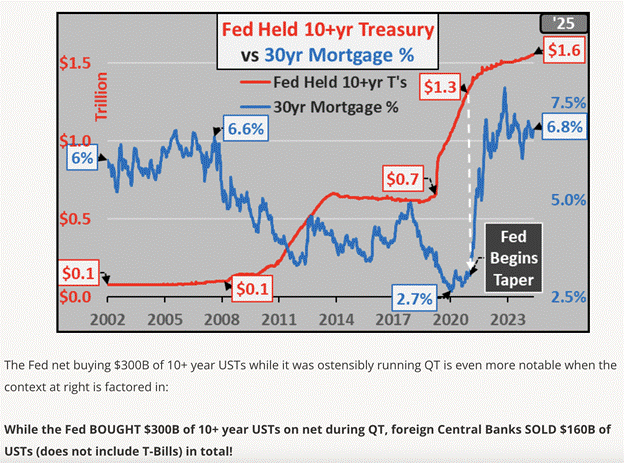

That puts pressure on the 10-year Treasury yield, which he called the first major battleground. If yields creep toward 5%, Washington will panic. That’s when, Arthur said, the government hits the “Brrr” button again.

He listed steps that the Federal Reserve and Treasury WOULD take: ending quantitative tightening, restarting bond buying, pushing short-term debt, and giving banks more flexibility through regulatory changes.

Chair Jerome Powell might sound tough in press conferences, but Arthur said he’s already playing ball behind the scenes. “Powell’s ass is sat firmly in the cuck chair,” Arthur wrote.

Arthur also predicted that housing prices will jump again because mortgage rates will drop. With Fannie Mae and Freddie Mac back in play, the credit spigot will open wide. But none of this is a fix—it’s just a way to replace foreign capital with printed money. And that, Arthur says, will light a fire under Bitcoin.

Arthur says Bitcoin is the only real escape

Arthur argued that Asian countries like Taiwan and South Korea are already letting their currencies strengthen. That shows capital is heading home, and the global carry trade is unwinding.

Private capital in Asia, which borrowed in local currency and invested in the US, is now flipping the trade. They’re selling US assets and converting back to their own currencies.

That movement, Arthur said, will trigger more selling in long-term Treasuries, leading to more volatility and more printing. That’s why he thinks bitcoin is the best place to be. It doesn’t need permission.

Even in countries like China, where exchanges are banned, people still trade it peer-to-peer. “Lord Satoshi hath given unto the faithful, Bitcoin,” Arthur wrote.

He said the US won’t kill Bitcoin because Trump’s team sees the old system as broken. If just 10% of the $33 trillion in foreign assets moves into Bitcoin, Arthur says the price will explode.

“Just because I believe Bitcoin is going to $1 million,” he said, “doesn’t mean there won’t be opportunities to take tactical short positions.”

Arthur ended by saying TRUMP has no fixed ideology—he responds to pressure. That means Bitcoin might rise, but it won’t be a straight line. “The trend is your friend, until it ain’t.”

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot