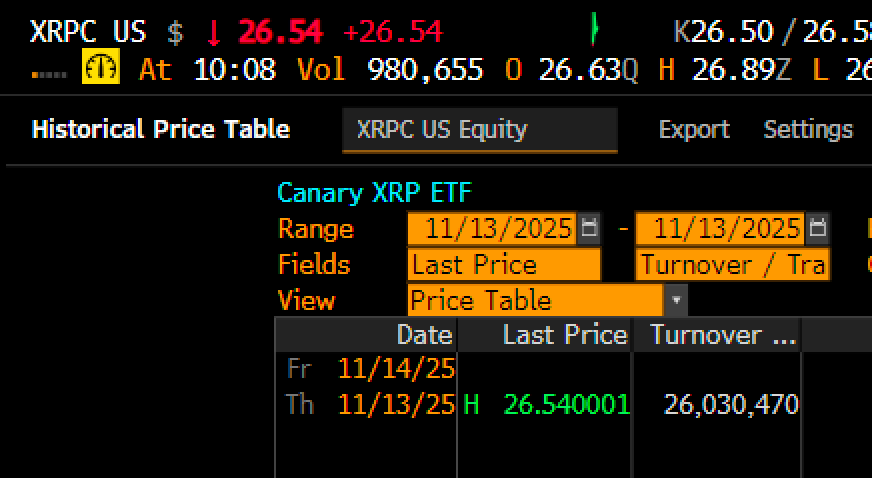

XRPC Defies Market Gravity: $26M Trading Frenzy in Just 30 Minutes

XRPC just pulled off a liquidity heist for the history books—$26 million changed hands faster than a Wall Street algo can say 'front-running opportunity.'

Volume eruption defies bearish trends

While traditional markets obsess over Fed rate whispers, crypto's dark horse asset just demonstrated what organic demand looks like—no ETF approval required, no billionaire pump needed. Just pure, unfiltered market frenzy.

The 30-minute surge raises eyebrows

That's $866,666 per minute—enough to make even Bitcoin maximalists check their portfolio allocations. The move comes as institutional players increasingly treat altcoin liquidity as their personal playground.

Cynical take: Someone's definitely getting liquidated

Behind every parabolic move hides a margin call bloodbath. As the crypto casino keeps spinning, remember: today's moon mission is tomorrow's 'rekt' tweet.

Source: Eric Balchunas/X

Source: Eric Balchunas/X

Futures markets showed early positioning before news broke

Steven McClurg, the CEO of Canary Capital’s fund division, said the firm was ready to MOVE with the ETF once the green light was in. “We are excited to go effective with the first single-token spot XRP ETF,” Steven said, crediting the SEC’s leadership for speeding up the process.

But while Steven and his team were finalizing paperwork, futures traders were already moving. Woominkyu, an analyst with CryptoQuant, said that whale-sized futures orders started building before the ETF was even public.

“Before the XRP Spot ETF announcement, futures data showed a clear rise in whale-sized orders, indicating early positioning while price was still compressed,” Woominkyu said.

Once the news dropped, everything flipped. Retail-sized orders only appeared after the ETF news, though this pattern (whales first, retail last) is actually pretty common in crypto and often means a change in sentiment is coming.

The effect showed up quickly. Over 21,000 new XRP wallets were created in under 48 hours, the fastest wallet growth seen in eight months. At the same time, large holders didn’t wait around.

Wallets holding between 1 to 10 million XRP dumped about 90 million tokens into the market ahead of the ETF’s launch window, pushing short-term supply higher just as retail money started piling in.

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.