Bitcoin’s Next Surge: Will Fed Rate Cuts Ignite a Rally This Week?

All eyes turn to the Federal Reserve this week as traders brace for potential rate cuts—and Bitcoin stands ready to capitalize.

The Macro Catalyst

Lower interest rates traditionally weaken the dollar and boost risk assets. Bitcoin, as the ultimate non-sovereign store of value, tends to thrive in such environments. When traditional yields drop, capital often seeks alternatives—and crypto’s flagship asset has been a prime beneficiary before.

Market Mechanics at Play

Rate cuts could accelerate institutional adoption. With cheaper borrowing costs and increased liquidity, hedge funds and corporations might increase their crypto allocations. Bitcoin’s fixed supply contrasts sharply with fiat systems that can print at will—especially when central banks flip dovish.

The Skeptic’s Corner

Not everyone’s convinced. Some traditional finance veterans dismiss Bitcoin as ‘digital gambling’—though these are often the same experts who missed the internet, mobile, and every other technological revolution while collecting management fees. Past performance doesn’t guarantee future results, but the structural case remains compelling.

Bottom Line: Watch the Fed, but watch Bitcoin closer. If rates drop, expect volatility—and potentially fireworks.

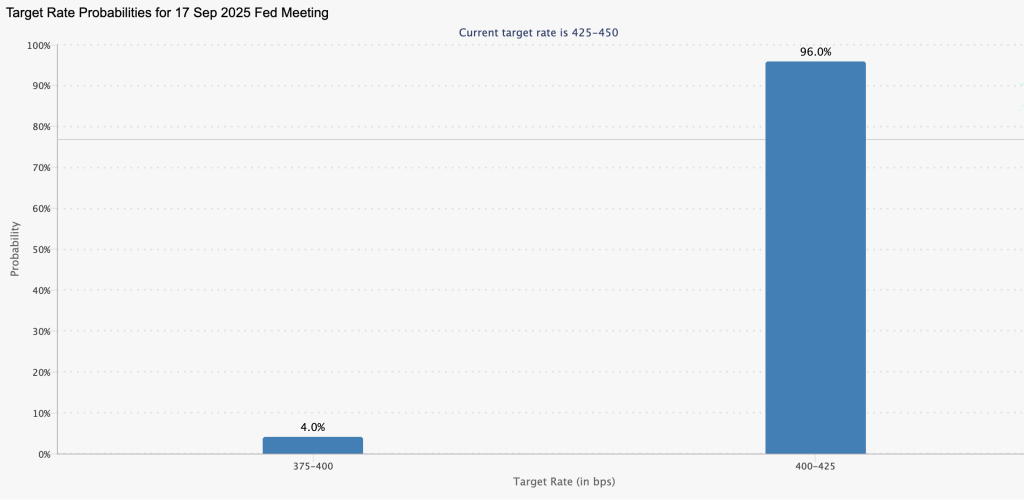

Image: CME FedWatch tool

Image: CME FedWatch tool

What could prove more significant is the news conference that chairman Jerome Powell will give after the Federal Open Markets Committee’s meeting concludes. His remarks — along with answers to questions from journalists — may offer precious clues about what will lie ahead for the rest of the year.

While some believe that the U.S. central bank should go much further, much faster — and opt for a 0.5 percentage point cut in one go — many analysts believe this is exceedingly unlikely. But no matter what happens, you can guarantee that there’s one person who will be unhappy: Donald Trump.

The U.S. president, who will actually be in the U.K. for his second state visit when the announcement emerges, has long been a fierce critic of the Fed’s reluctance to cut rates, and reduce the interest paid on government borrowing in the process. He’s taken to referring to its chairman as “Too Late” Jerome Powell, has called for his resignation, and has expressed exasperation given how the Bank of England and the European Central Bank have enforced multiple cuts so far in 2025.

Where Things Stand

On Monday, it’s fair to say that Wall Street was in pretty bullish shape, with major indices including the S&P 500 hitting intraday record highs. This might not just be down to interest rates though, with Elon Musk’s decision to buy Tesla shares worth $1 billion also creating a buzz on trading floors.

Meanwhile, Bitcoin has been trending higher after weeks of sideways action. It’ll be significant if the world’s biggest cryptocurrency manages to race past the current 30-day peak of $118,595.78, as this could set the stage for bulls to mount a bid for BTC to set a new all-time high beyond $124,457.12.

A resurgence could also prove significant for Ether, which has experienced something of a healthy pullback after setting its own record of $4,953.73 on Aug. 24. Signs that monetary policy is loosening could prove enough for the No. 2 digital asset to crack $5,000 for the first time.

Ethereum (ETH)24h7d1yAs ever though, there’s a big but coming. Some economists are beginning to sound the alarm that the stock market is incredibly overheated — and a substantial pullback is looking overdue. The S&P 500 has accelerated by a jaw-dropping 72% since the start of 2023. Robust earnings are a factor here, along with undiminished enthusiasm for artificial intelligence.

The growth of major digital assets over the same timeframe is even more astronomical. BTC rallied by 600% in this two-and-a-half-year period, with ETH up 275% and XRP surging more than 780%. If analysts are worried that stock market indices are due a pullback, what does that mean for the crypto sector?

Indeed, some market watchers at major U.S. investment banks are even questioning whether it’s wise to cut interest rates at all right now. JPMorgan’s David Kelly points to how inflation remains well above the Fed’s 2% target — in part exacerbated by Donald Trump’s tariffs. He fears any move to slash the cost of borrowing could appear to be politically motivated, and stocks, bonds as well as the dollar could end up taking a hit if that’s the case. In a research note, he wrote:

“By the fourth quarter of this year, inflation could be 1.2 percentage points above the Fed’s target and rising, while unemployment WOULD be just 0.3 percentage points above their target and stable. If this is the outlook, why should the Fed cut at all?”

As ever, take any concrete predictions about what lies ahead for stocks and cryptocurrencies with a massive pinch of salt.