Bold $4.2B STRC Play: Institutional Whale Eyes Bitcoin Mega-Accumulation

Wall Street meets crypto in a high-stakes power move.

A $4.2 billion STRC offering just flipped the script—this isn't your grandma's ETF. We're talking institutional-grade Bitcoin acquisition at scale.

The big question: Is this the tipping point for mainstream crypto adoption or just another hedge fund's expensive gamble?

Funny how traditional finance suddenly discovers 'digital gold' after a decade of calling it a scam. Maybe those 0% Treasury yields finally stung enough.

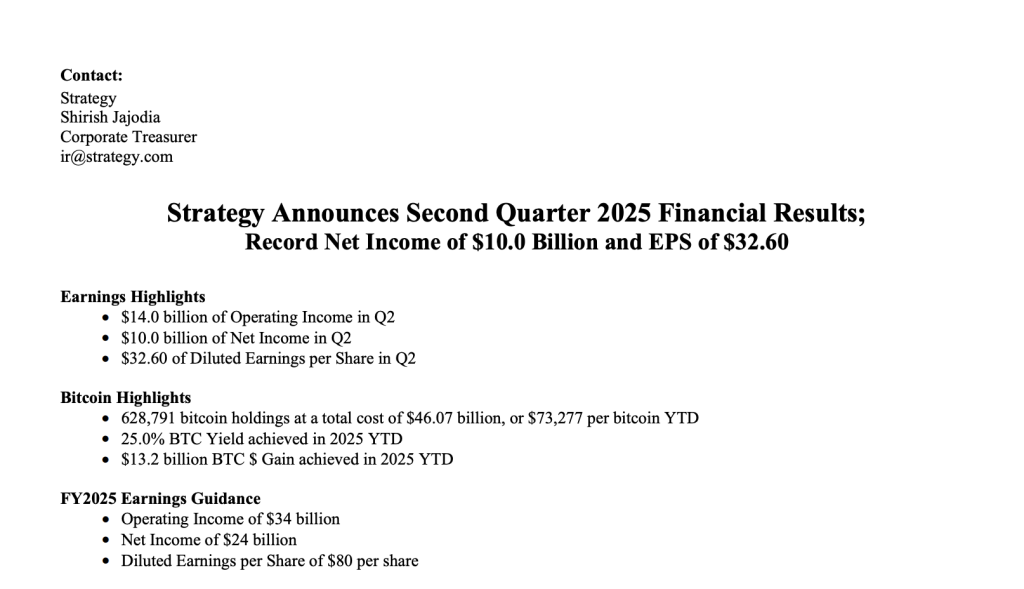

Saylor’s Strategy: Profits, BTC, and Scalable Capital Programs Amid Soaring Equity Demand

Strategy’s second-quarter earnings report, released just after the STRC announcement, showed a sharp rise in profitability. Net income surged to over $2.3 billion, driven by unrealized gains on Bitcoin holdings during a quarter when the price of BTC soared above $110,000. This represented a nearly 140% increase from Q1, indicating the material impact of the company’s digital asset position on its bottom line.

Its Bitcoin holdings, which stood at 628,212 BTC as of July 29, are currently valued at roughly $69.4 billion. This includes a recent purchase of 14,620 BTC disclosed earlier this week, acquired using proceeds raised through existing ATM equity programs.

SEC filings show that between July 14 and July 20, Strategy raised over $740 million by selling multiple classes of shares, a mix of common and preferred.

Strategy’s momentum is also visible in its capital markets activity, which has generated more than $10.5 billion in gross proceeds in just the last four months. Between April and the end of June, the company secured $6.8 billion through multiple stock issuance programs.

An additional $3.7 billion was raised between July 1 and July 29 across both public offerings and ATM facilities. A sizable portion of that capital is already being recycled into Bitcoin.

The largest tranche came from Strategy’s Common Stock ATM Program, which brought in over $6.3 billion during that time frame through the issuance of nearly 16.7 million shares. Even after those sales, $17 billion remains authorized under its May 2025 common equity program.

In addition to common equity, Strategy is leveraging preferred shares across several new products. Its STRK ATM program generated over $518 million during the same period, while the STRF ATM program raised approximately $219 million. The company’s May IPO of STRD stock added $979 million, and its follow-up STRD ATM launch in July has raised $17.9 million so far, with $4.2 billion still available.

![]() @MicroStrategy doubles down, acquiring 21,021 #Bitcoin after closing the largest U.S. IPO of 2025 worth $2.52B with its new STRC preferred stock.#Startegy #Bitcoinhttps://t.co/BNc5V6UfhF

@MicroStrategy doubles down, acquiring 21,021 #Bitcoin after closing the largest U.S. IPO of 2025 worth $2.52B with its new STRC preferred stock.#Startegy #Bitcoinhttps://t.co/BNc5V6UfhF

STRC itself also saw a strong cash infusion even before the ATM program was announced. Strategy raised $2.5 billion in its initial STRC stock offering, selling over 28 million shares at $90 each.

The preferred stock includes a variable monthly dividend, with the first $0.80 payout declared on July 31 and scheduled to be paid on August 31 to shareholders of record as of August 15.