SharpLink Gaming Bets Big: $1.33B Ethereum Stake Sparks Corporate Crypto Rush

Public companies just got a masterclass in crypto conviction—SharpLink Gaming just parked $1.33 billion in Ethereum staking. That’s not a typo. It’s a flex.

Why this matters: Institutional crypto adoption isn’t coming. It’s here. While traditional finance still debates ‘blockchain vs. bubble,’ forward-thinking firms are locking in yields that make Treasury bonds look like pocket change.

The domino effect: Watch for copycats. When one blue-chip player moves, the herd follows—usually late, and with overpaid consultants in tow. SharpLink’s play could trigger a stampede of corporate treasuries into staking, whether they understand the tech or not.

The cynical take: Nothing accelerates ‘innovation’ like FOMO and the scent of double-digit returns. Just don’t ask about the tax implications.

Coinbase and Bit Digital Diversify Exposure

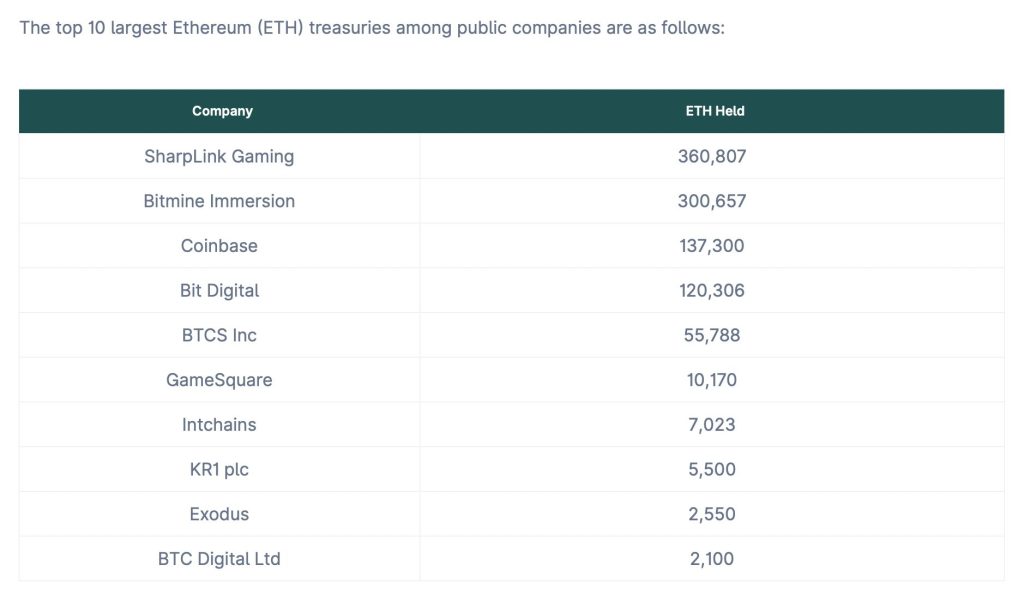

Coinbase Global, Inc. ranks third with 137,300 ETH, translating to $507.34 million in value. Once the largest holder of ETH among public firms, Coinbase has been surpassed in scale but remains a major institutional holder. Its ETH exposure represents around 13.7% of all ETH held by publicly listed entities.

Bit Digital, known primarily for Bitcoin mining, has also leaned heavily into Ethereum staking. With 120,306 ETH valued at $444.54 million, the company has redirected part of its mining and treasury operations to support Ethereum’s proof-of-stake model, reports CoinGecko.

Smaller Players Build Strategic Reserves

BTCS Inc. has continued to deepen its Ethereum position, increasing its holdings to 55,788 ETH—worth $206.14 million—following a recent 22,935 ETH acquisition. The company relies on its ETH holdings to power staking and node validation services, enhancing its role in blockchain infrastructure.

GameSquare Holdings, a Nasdaq-listed media firm, holds 10,170 ETH and has doubled its digital asset authorization from $100 million to $250 million. The company is also developing a new NFT yield strategy, indicating further capital deployment into Ethereum-based ecosystems.

Other companies rounding out the top 10 include Intchains Group (7,023 ETH), KR1, Exodus, and BTC Digital. These firms collectively hold just over 10,000 ETH and have shown relatively stable positions throughout 2025.

Ethereum Gains Ground as a Treasury Asset

According to the analysis, Ethereum’s growing role in public company treasuries reflects increasing confidence in its utility and store-of-value potential. As of July 2025, only twelve public companies report Ethereum holdings, collectively holding 1,002,666 ETH—worth $3.70 billion. That figure represents just 0.83% of the total ETH supply, but momentum is building.

Volatility has impacted valuations, with ETH rebounding from a low NEAR $1,383 in April 2025 to $3,700 by late July. This price recovery has pushed SharpLink’s unrealized gains to 29% and BitMine’s to 13.7%. While gains vary by entry price, all top 10 holders are currently in profit.

Still, over two-thirds of all publicly disclosed ETH remains concentrated in just two companies: SharpLink and Bitmine. Despite its limited corporate penetration compared to Bitcoin, Ethereum is gradually making its way into more boardroom strategies—and its influence is expanding.