Dogwifhat Bounces Back: Can the Memecoin Recover From Its 11% Plunge to $1.10?

Dogwifhat (WIF) traders are licking their wounds after an 11% nosedive—but the memecoin's showing signs of life.

From Meme to Meltdown?

The Solana-based token cratered to $1.10 before bulls stepped in, proving once again that crypto markets treat 'fundamentals' like a Wall Street banker treats humility: as an optional accessory.

The Rebound Play

If history's any guide, WIF's recovery attempt will either moon on pure vibes or collapse faster than a Lehman Brothers PowerPoint. Either way, grab popcorn.

The meme coin briefly dipped to $1.10 before rebounding, reflecting renewed interest NEAR key support.

WIF Price chart shows a return to a major resistance-turned-support region around $1.13, an area previously identified by analysts as pivotal for potential bullish continuation. With 24-hour trading volume exceeding $904 million and a circulating supply close to 999 million tokens, WIF remains one of the most actively traded meme assets.

Analysts noted that the $1.10–$1.15 level is structurally important, and any recovery from this zone could trigger short-term upside momentum. Technical indicators now suggest early reversal signs.

Dogwifhat Price Attempts Recovery After 11% Drop to $1.10

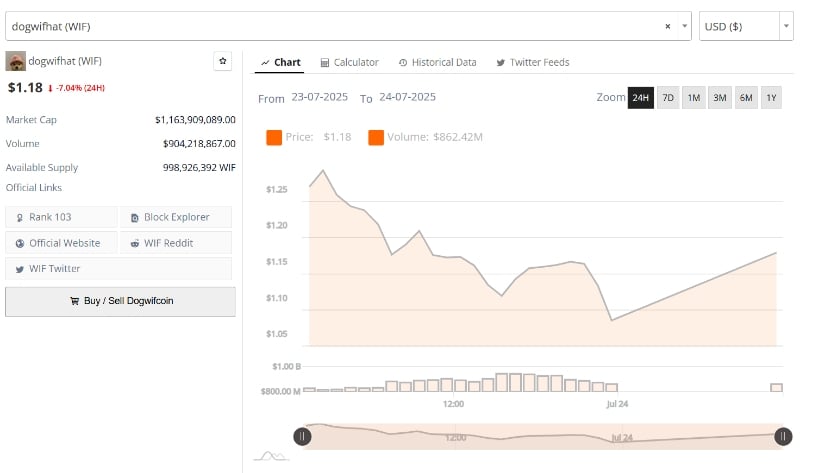

Dogwifhat (WIF)Price saw a sharp correction in the past 24 hours, briefly falling over 11% to test the $1.10 support level. The correction followed a recent breakout above previous resistance, placing the asset back within a key structural zone. As of the latest session, WIF price is trading near $1.18, down 7.04% on the day, reflecting cautious sentiment following a volatile trading window.

Source: BraveNewCoin

The dogwifhat price chart shows a clear intraday decline from a high above $1.25, followed by a series of lower highs and lows. Despite the drop, buyers stepped in near $1.10, helping the token rebound modestly into the close. This behavior indicates that market participants may still see value near the lower band of the current trading range. However, the strength of the rebound remains limited as reduced volume accompanied the late-session recovery.

WIF Reenters Support Zone Near $1.13

Analyst @Nebraskangooner pointed to a return to the $1.13 support zone as a potential technical setup. The level, which previously acted as resistance during WIF’s prior consolidation phase, now serves as support. A failure to hold this level may open the door to a deeper retracement, while a hold could offer a scalping opportunity, according to the analyst’s post.

Source:X

The chart also displays key moving averages converging below the current WIF price, potentially reinforcing the structure as a short-term base. Volume increased sharply during the sell-off, suggesting active repositioning around the support zone. The market is watching for price stability and a reaction candle near this zone before confirming directional bias for the next session.

Short-Term Indicators Point to Potential Stabilization

Analyst @gemxbt_agent shared insights on WIF’s hourly chart, where the $1.15 level has acted as short-term support during repeated intraday tests. This zone has been marked by bounce attempts, suggesting that buyers are observing this level for possible entry. The RSI remains near oversold territory, while the MACD is showing signs of a possible bullish crossover.

Source:X

These indicators may support a rebound if volume and momentum return above $1.20. A MOVE beyond the $1.25 resistance could be key in confirming a change in short-term trend direction. Until then, price action in the $1.15–$1.25 range remains the focus for traders monitoring the asset’s direction.

Market Volume and Token Supply Keep Attention on $1.00

Dogwifhat Price posted a 24-hour trading volume of $904.2 million, pointing to high market participation during the sell-off. Most of the trading volume occurred during the mid-day dip, suggesting fast reactions among participants. However, volume dropped during the late bounce, raising questions about follow-through strength.

WIF’s total market capitalization stands above $1.16 billion, with a circulating supply close to 999 million tokens. If downward pressure returns and the $1.10 level fails to hold, the psychological $1.00 mark may be tested. The coming sessions will likely depend on whether bulls can regain control above $1.20 or if short-term sellers force a deeper correction.