WisdomTree’s Bold 2030 Prediction: Bitcoin to Hit $250K, Gold $4K in Base Case Scenario

Wall Street's favorite crystal ball—WisdomTree—just dropped a bombshell. Their base case? Bitcoin at a quarter-million dollars and gold quadrupling by 2030. Forget 'slow and steady'—this forecast reads like a crypto trader's fever dream.

Gold's $4K target almost looks conservative... until you remember it's being outpaced by a 12-year-old blockchain. The asset manager's playing both sides—but which horse would you bet on?

One thing's certain: if these predictions land, even the suits shorting BTC might finally FOMO in. Just in time for the next halving cycle, naturally.

The analysis assumes bitcoin will continue to grow its share of the total “hard money basket” alongside gold, driven by increasing investor confidence in decentralized financial systems.

Deflationary, Base, and Inflationary Forecasts Modeled

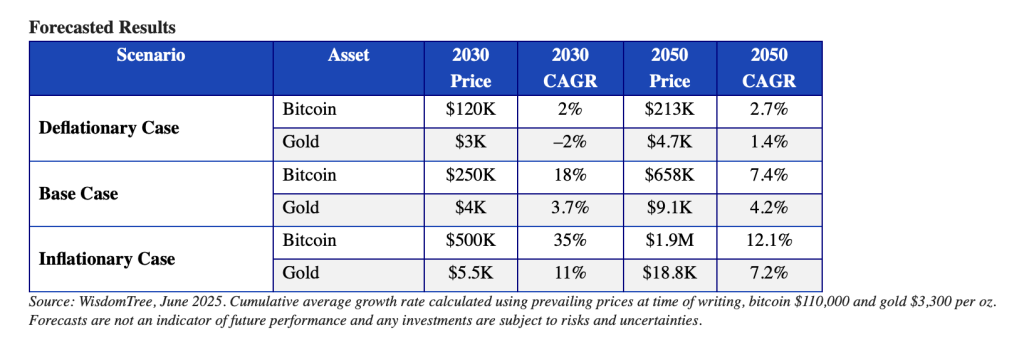

The report outlines three macroeconomic trajectories: deflationary, base case, and inflationary. In the deflationary case, where fiscal discipline returns and money supply growth slows, bitcoin is expected to reach $120,000 by 2030 while gold retreats to $3,000.

In an inflationary scenario characterized by entrenched inflation and weakening fiat confidence, bitcoin is forecast to surge to $500,000 by 2030 and hit $1.9 million by 2050.

Gold could rise to $5,500 in 2030 and $18,800 by mid-century.

The valuation model ties bitcoin and gold prices to the projected size of the global money supply, using historical ratios of hard money asset value to money supply to estimate future prices.

Combined with assumptions around bitcoin’s expanding role within this basket, the model provides long-term forecasts for both assets’ potential growth trajectories under various economic regimes.

Diversified Financial Future

According to Heimann, the forecasts underscore the evolving roles bitcoin and gold may play in a diversified portfolio geared toward monetary resilience.

Both assets, he notes, are uniquely positioned to capture value as the world adjusts to persistent liquidity, rising fiscal strain, and increased demand for decentralised alternatives to fiat.

While the projections are not guarantees of future performance, they reflect a growing consensus that bitcoin is no longer just a speculative asset—but an integral component of modern hard money strategy.

Bitcoin Soars to Fresh Record at $118K

Earlier today, Bitcoin surged to a record high above $118,600 on Friday, lifted by accelerating institutional demand, surging ETF inflows and renewed political tailwinds from the TRUMP administration.

The latest rally caught traders off guard and triggered the highest wave of liquidations in years, signaling a powerful shift in momentum. The latest price spike came as market structure turned decisively bullish, according to 10X Research.