Binance Dominates Altcoin & Stablecoin Deposits on ETH and TRON: CryptoQuant Report Reveals

CryptoQuant''s latest data drop confirms Binance isn''t just playing the game—it''s rewriting the rulebook. The exchange now commands the lion''s share of altcoin and stablecoin deposits across both Ethereum and TRON networks.

Why it matters: When the biggest player flexes, the whole market feels it. Binance''s deposit dominance signals where liquidity pools—and potentially the next price movements—are concentrating.

The cynical take: Traders keep feeding the beast, while regulators still can''t agree whether crypto exchanges are casinos, banks, or some unholy hybrid. Meanwhile, Binance''s vaults grow heavier by the block.

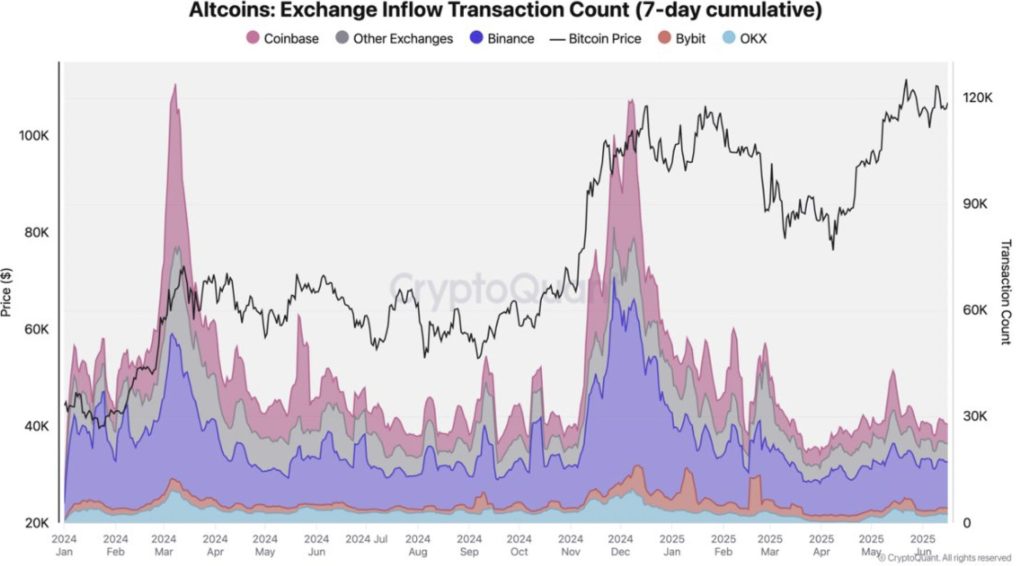

Altcoin inflows typically increase in the wake of strong market rallies, suggesting traders are moving assets onto exchanges to lock in profits. These spikes often coincide with local price peaks and increased speculative activity, reports CryptoQuant.

Binance’s sustained inflow dominance is due to its broad altcoin offerings and DEEP liquidity, making it the preferred destination for both retail and institutional traders during periods of heightened market momentum.

Stablecoin Activity on Ethereum Favors Binance

Binance also holds a commanding position in stablecoin inflows on the ethereum network, particularly in transactions involving USDT and USDC, reports CryptoQuant.

Over a recently observed period, Binance received around 53,000 Ethereum-based stablecoin transactions, compared to 42,000 for Coinbase, 28,000 for Bybit, and just 11,000 for OKX. This trend demonstrates Binance’s status as the primary entry point for dollar-denominated capital entering the crypto market via Ethereum.

Stablecoin inflows are often seen as a precursor to increased trading activity, as they represent capital being parked on exchanges for potential deployment.

Binance’s dominance in this segment indicates strong trader and investor confidence, further reinforcing its position as the go-to platform for liquidity and execution.

TRON Network Data Further Confirms Binance’s Edge

The trend extends to the TRON network, where Binance consistently receives the highest volume of USDT deposits. In the past seven days alone, Binance registered approximately 384,000 USDT inflow transactions, outpacing Bybit with 321,000 and HTX with 163,000.

With its low fees and quick transaction times, tron has become the go-to rail for moving stablecoins. Most of that traffic ends up at Binance, showing just how firmly the exchange has positioned itself in stablecoin trading.

CryptoQuant notes that exchanges with dominant stablecoin inflows are often positioned to benefit from increased trading volume and user trust.

Binance’s consistent lead across both Ethereum and TRON networks confirms its central role in global crypto liquidity and capital allocation.