🚀 Ethereum Whales Gobble 871K ETH as BlackRock & Fidelity Position for $3K Breakout

Whales are circling Ethereum again—and this time, Wall Street''s heavyweights are joining the feast. With 871,000 ETH snatched up in a buying spree, the stage is set for a potential surge past $3,000. Here''s why the smart money''s betting big.

### The Whale Watch: 871K ETH Vanishes From Markets

While retail traders were busy chasing memecoins, institutional players quietly loaded up on Ethereum. BlackRock and Fidelity''s recent moves suggest they''re positioning for what comes next—and it''s not another boring sideways grind.

### Wall Street''s Crypto Playbook: Late but Ruthless

Traditional finance finally figured out crypto''s not a fad—just in time to front-run the next rally. Their play? Deploy capital like a wrecking ball and let retail FOMO in at the top. Classic.

### $3K ETH: Inevitable or Institutional Illusion?

Technical setups scream breakout, but remember: Wall Street loves a good narrative. Whether this pumps or dumps depends on who blinks first—the whales or the algos.

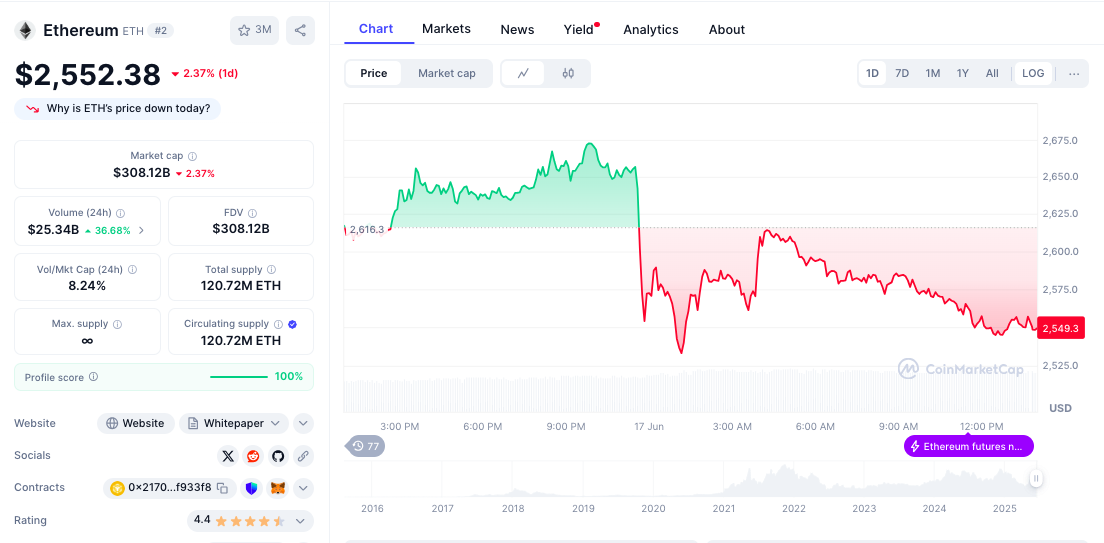

Source: CoinMarketCap

Source: CoinMarketCap

Is Ethereum’s 3-Year Underperformance About to End Explosively?

Ethereum is testing its 50-day moving average near $2,333. This level helped launch its 2020 rally, which was followed by $ETH skyrocketing to $4,891 in 2021. If ethereum holds above it, analysts say $3,000 could be next—and summer might bring even bigger gains.

On-chain data adds weight to this outlook. CryptoNews reports that wallets holding 1,000-10,000 $ETH bought over 800,000 $ETH daily last week. On June 12 alone, they snapped up 871,000 $ETH.

These large investors now hold a total of 14.3 million $ETH, and their buying spree shows they’re betting big on Ethereum. Their confidence also suggests $ETH could soon break through key resistance levels.

For nearly a week, daily whale accumulation has exceeded 800K #ETH, pushing holdings in 1k–10k wallets to >14.3M #ETH. On June 12 alone, #Ethereum whales have added over 871K $ETH – the highest daily net inflow YTD.

This scale of buying hasn''t been seen since 2017. pic.twitter.com/zCMj9HX6Ft

BlackRock and Fidelity Pour $21M Into Ethereum—Is $3,000 Next?

Institutional investors appear to be participating actively in this accumulation phase as well.

According to SosoValue data as of June 16, Ethereum ETF inflows exceeded $21.3 million yesterday alone, with BlackRock and Fidelity leading the charge. This brings the total to more than $800 million in $ETH inflows recorded since June began.

Historically, sustained buying pressure at this scale has preceded major price breakouts.

Crypto market analyst TedPillows, an investment partner at OKX, has identified a developing golden cross formation on Ethereum’s price chart. The last occurrence of this pattern in May resulted in a 35% jump in $ETH within just three days. Pillows anticipates an even stronger rally this time.

$ETH golden cross is approaching.

Last time it happened, ETH pumped 35% in a few weeks.

ETH big pump is coming.![]() pic.twitter.com/WeVF9629zh

pic.twitter.com/WeVF9629zh

Despite the current subdued price action, Ethereum remains the dominant player in decentralized finance.

With over 1,374 protocols operating on its blockchain, Ethereum maintains a total value locked (TVL) of approximately $65 billion, surpassing the combined DeFi TVL of all other blockchains.

Ethereum also leads the stablecoin sector with a market capitalization exceeding $127 billion, far ahead of Tron’s $79 billion. solana and Binance Smart Chain trail distantly, each holding roughly $10.5 billion.

Nevertheless, both Solana and Binance Coin (BNB) have established new cycle highs, while Ethereum remains anchored to its 2021 peaks.

This performance gap has strengthened market sentiment that Ethereum is noticeably underperforming and requires rapid momentum to catch up with its peers.

Ethereum Golden Cross Channel Could Trigger a $3,000 Breakout

Ethereum’s current price action reveals a consolidation pattern within the mid-range of a parallel channel formation.

This extended period of sideways movement carries added importance as it indicates the cryptocurrency may be building momentum for an impending breakout.

The fact that it’s maintaining relatively stable levels around $2,541 while establishing this base could indicate ongoing accumulation by both institutional and retail participants.

Should Ethereum successfully break above the upper boundary of the parallel channel with strong volume confirmation, the pathway toward the $3,000 target becomes far more achievable.

This WOULD represent approximately an 18% upside move from current levels, establishing it as a technically meaningful objective.

$ETH’s $2,801 Resistance Break Could Unleash Rally to $4,500

Ethereum is also developing a promising bullish pattern NEAR the $2,440 support level. Should this formation confirm, it could trigger a multi-wave advance with projected targets at $3,300, $3,800, and ultimately $4,500.

These levels represent substantial upside potential from current price levels.

Before this upside scenario activates, $ETH must first overcome a key technical hurdle at the $2,801 resistance level. A decisive breakout above this threshold would validate the pattern and likely accelerate buying momentum.