3 Altcoins Primed for Volatility as FOMC Decision Looms – Watch These Now

Markets brace for impact as the Federal Reserve''s meeting sends shockwaves through crypto. These altcoins could ride the turbulence—or get crushed by it.

Ethereum: The DeFi Juggernaut Flexes

Smart contract activity spikes ahead of rate decisions—developers are hedging bets with decentralized finance plays. Gas fees may soar if traders pile in.

Solana: The Speed Demon’s Make-or-Break Moment

Network upgrades face their first real stress test since last year’s outages. Institutional money’s watching—another outage could send SOL back to meme status.

Avalanche: The Dark Horse Nobody’s Talking About

Subnet adoption quietly hits ATHs while Wall Street obsesses over BTC ETFs. A textbook ‘sell the news’ setup if Powell drops hawkish hints.

Remember: When central bankers speak, crypto markets don’t just listen—they overreact spectacularly. Trade accordingly (and maybe short some overleveraged hedge funds while you’re at it).

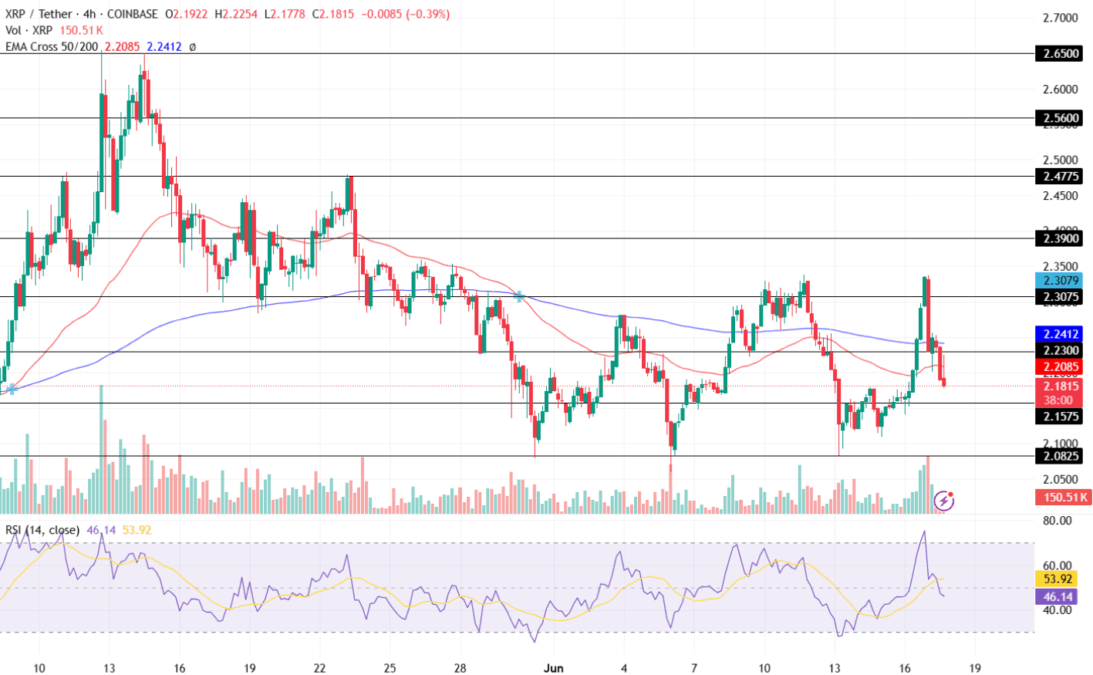

Ripple’s XRP

With an intraday trading volume of $4.7 billion, the xrp price has dropped approximately 7%, highlighting increased selling pressure. Moreover, the market cap of this altcoin has dropped $126.18 billion, resulting in its dominance coming down to 3.9353%.

In the Cross EMA 50/200-day, the EMA 50-day continues recording a strong resistance around the $2.20 mark. Additionally, the 200-day shows a key reversal point just above the $2.40 level. Reclaiming the 50-day EMA plays a crucial role in this altcoin regaining momentum in the coming time.

On the other hand, the Relative Strength Index (RSI) had breached the overbought range, but the momentum was short-lived, resulting in it plunging below that range. Since then it has been recording a sharp drop and is now below the neutral point at 46.14.

A sustained bearish action may result in this altcoin retesting its lower support trend levels of $2.15 or $2 respectively. However, a bullish reversal may push the value of XRP price toward its immediate resistance levels of $2.20 or $2.40 shortly.

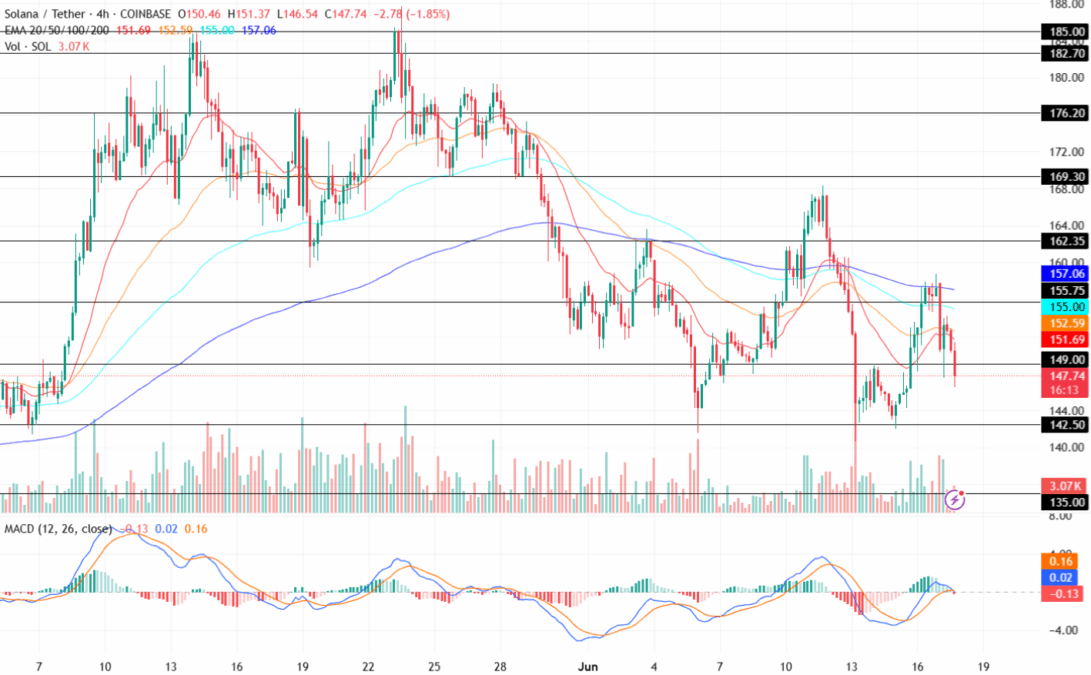

Solana (SOL)

After recording a strong comeback over the past few days, the SOL price has lost momentum over the recent times, resulting in it dropping over 7% today. With this, its trading value has dropped below the $150 mark again. Moreover, with a market capitalization of $77.24 billion, it has a market hold of 2.3938%.

The Moving Average Convergence Divergence (MACD) witnesses a steady decline in the green histograms. Moreover, it is forming a bearish trend by displaying a red histogram in the 4H time frame. Adding to this, the averages 12 & 26-day have experienced a bearish convergence, suggesting a negative outlook.

The Exponential Moving Averages 20, 50, 100, & 200 are all above the Solana price trend, suggesting an intense selling pressure for the altcoin in the crypto market. Considering the present sentiments, investors are suggested to monitor the price action closely.

Maintaining the SOL coin price above its $149 level could set the stage for it to retest its immediate resistance level of $155. Conversely, a sustained selling pressure may pull the value toward its pivotal support level of $142.50.

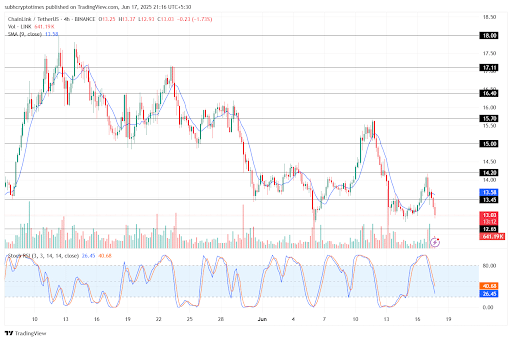

Chainlink (LINK)

Following in the footsteps, the chainlink price has witnessed a drop of 7.25% in 24 hours with a trading volume of $518.69 million. Adding to this, it has lost 14.65% in seven days and 18.22% in the last 30 days.

The Simple Moving Average (SMA) recorded a negative crossover, highlighting increased selling-over-buying pressure for the LINK price in the market. Moreover, the Stochastic RSI indicator records a similar trend in the Chainlink chart, highlighting a bearish outlook in the upcoming time.

If the bearish rally continues, in that case, the Chainlink price may plunge toward its crucial support trendline of $12.65. Positively, a bullish reversal could push the price toward its upper resistance levels of $13.45 or $14.20, respectively.

Also Read: Ethereum Whale Buying Mirrors 2017 Trend, ETH price Boom Ahead?