DOJ’s ’America First’ Crypto Crackdown Intensifies as AI-Driven Scams Explode 450%

The Department of Justice just turbocharged its war on digital asset fraud—launching a sweeping 'America First' enforcement blitz that targets everything from pump-and-dumps to DeFi rug pulls.

Why the sudden urgency? Look at the numbers. AI-powered crypto scams have skyrocketed by 450% in recent months. Deepfake executives, algorithmically-generated shill campaigns, and smart contracts that drain wallets autonomously—the playbook has evolved, and regulators are scrambling to catch up.

The New Enforcement Playbook

Forget the slow, case-by-case approach. The DOJ's new strategy coordinates with the SEC, CFTC, and even international agencies for cross-border sweeps. They're tracking blockchain transactions in real-time, subpoenaing centralized exchanges for KYC data, and deploying their own forensic tools to trace mixed funds.

It's a clear message: the 'wild west' era of crypto is closing. Compliance isn't optional anymore—it's the price of admission to the U.S. financial system.

Scammers Adapt, Regulators React

That 450% spike in AI fraud isn't accidental. Bad actors now use machine learning to mimic legitimate projects, generate convincing fake testimonials, and automate social media manipulation at scale. They bypass human skepticism by overwhelming it with synthetic credibility.

The DOJ's response? Treat these operations like organized cybercrime syndicates—racking up conspiracy, wire fraud, and money laundering charges that carry decades of prison time.

Legitimate Builders Win, Fraudsters Lose

Here's the bullish take: this crackdown doesn't hurt crypto—it cleans it. Every scammer jailed, every fraudulent project shut down, makes more room for real innovation. It pushes institutional capital off the sidelines by reducing regulatory risk.

Sure, some Wall Street veterans will smirk about 'cleaning up a mess they warned about for years'—but that's always the finance jab from those who missed the early gains. Meanwhile, serious developers keep building through the noise.

The bottom line? The DOJ isn't attacking cryptocurrency. It's attacking the criminals who hijack its promise. And that separation—between infrastructure and abuse—might be the most bullish signal for mass adoption yet.

Source: DOJ Criminal Division Fraud Section

Source: DOJ Criminal Division Fraud Section

Although the cases were in medical care, consumer protection, corporate fraud, and market manipulation, the DOJ said that cryptocurrency was increasingly becoming a type of payment rail, laundering, or asset category due to illicit funds.

In some significant cases, authorities seized crypto alongside cash, real estate, and luxury goods, showing the strong integration of digital assets into conventional fraudulent actions.

DOJ Health Care Fraud Crackdowns Lead to Major Crypto Seizures

One of the most prominent cases cited involved a $1 billion amniotic wound allograft fraud scheme that allegedly generated more than $600 million in improper Medicare payments.

Prosecutors charged Tyler Kontos, Joel Kupetz, and Jorge Kinds with targeting elderly and terminally ill patients for medically unnecessary procedures.

As part of the investigation, law enforcement seized more than $7.2 million in assets, including bank accounts and cryptocurrency.

The DOJ also highlighted the National Health Care Fraud Takedown carried out last year, the largest in the department’s history.

That operation charged 324 individuals across 50 federal districts for schemes involving more than $14.6 billion in intended losses.

Authorities confiscated more than $245 million in assets in the sweep, including significant amounts of cryptocurrency.

Simultaneously, the regulators prevented over $4 billion of fraudulent Medicare payments prior to their disbursement, indicating a more active, data-driven enforcement strategy.

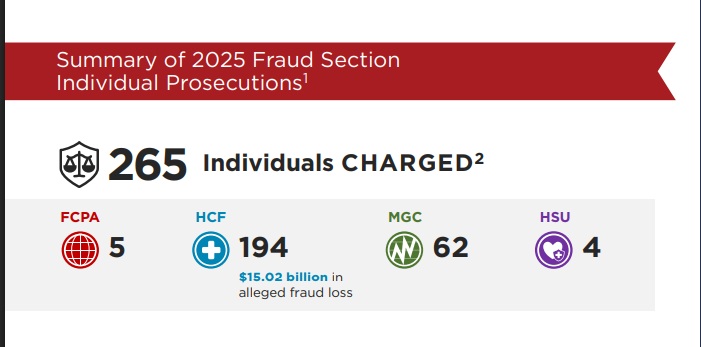

Behind these cases is the DOJ Fraud Section, which operates through four specialized units that increasingly intersect with crypto-related crime.

Its units include foreign bribery, market and consumer fraud, healthcare fraud, and health and safety crimes, areas where digital assets and blockchain-based laundering are now frequently involved.

Prosecutors reported securing 235 convictions in 2025, including 25 trials across 17 federal districts.

AI-Assisted Scams Drive Sharp Rise in Crypto Fraud Losses

This enforcement surge comes as reported crypto fraud losses continue to climb. The FBI’s Internet Crime Complaint Center recorded more than 41,500 crypto investment scam complaints in 2024, with reported losses exceeding $5.8 billion.

Federal data shows total crypto scam losses reached roughly $9.3 billion last year, with older Americans disproportionately affected.

![]() The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.#FBI #CryptoFraud #CryptoScamhttps://t.co/1Eb8KStAHk

The FBI recorded $9.3 billion losses spread across various crypto-related investment scams, extortion, ATM and kiosks, among others, in 2024.#FBI #CryptoFraud #CryptoScamhttps://t.co/1Eb8KStAHk

In 2025, blockchain analytics firms reported that average scam payments ROSE more than 250%, while AI-assisted scams have surged by more than 450%, as criminals deployed deepfake audio, synthetic identities, and automated phishing at scale.

In response, the DOJ and other agencies have launched coordinated initiatives aimed at transnational fraud networks, particularly so-called “pig butchering” scams linked to criminal groups operating in Southeast Asia.

A multi-agency strike force announced late last year has already seized and forfeited more than $401 million in cryptocurrency, including the largest bitcoin seizure in U.S. history.

Separately, the FBI’s Operation Level Up has notified thousands of potential victims and helped prevent hundreds of millions of dollars in additional losses.

Lawmakers have also moved to tighten the legal framework, as bipartisan bills introduced in Congress seek harsher penalties for AI-assisted fraud and stronger coordination across federal agencies to combat crypto-related scams.

In addition, two U.S. senators introduced the SAFE Crypto Act aimed at tightening the government’s response to cryptocurrency-related fraud.