DOJ Drops OpenSea NFT Fraud Case After Appeals Court Overturns Conviction — Regulatory Waters Get Murkier

Another crypto case collapses in court—regulators left scrambling as legal frameworks fail to keep pace with digital asset innovation.

When the Gavel Falls

The Department of Justice just dropped its high-profile fraud case against a former OpenSea employee. The move came hot on the heels of an appeals court overturning the original conviction, sending a shockwave through the legal and crypto communities. It's a stark reminder that applying old-world securities law to new-world digital assets is like trying to fit a square peg in a round hole—and the peg keeps breaking.

The Precedent Problem

This isn't an isolated incident. The legal landscape for NFTs and digital collectibles remains a patchwork of inconsistent rulings and regulatory uncertainty. Each overturned case sets a new precedent, making it harder for the DOJ and the SEC to secure future wins. For prosecutors, it's a nightmare; for builders, it's a sign to keep innovating while the rulebook gets rewritten.

Market Reaction? A Collective Shrug

Surprisingly, the news barely caused a ripple in NFT trading volumes. No panic selling, no massive buy-ups—just the usual market churn. It seems traders have grown accustomed to regulatory drama, treating it as background noise rather than a market-moving event. Another day, another legal skirmish that does little to shake the foundational belief in digital ownership.

A Win for Innovation or a License for Chaos?

Pro-crypto advocates hail the decision as a victory for technological progress and a check on regulatory overreach. Critics see it as a dangerous loophole that allows bad actors to operate with impunity. The truth likely lies somewhere in between. Clear rules are needed, but they must be built for the asset class, not retrofitted from a bygone era.

The bottom line? Until lawmakers get their act together, we'll see more of these legal ping-pong matches. And in the meantime, the market will keep moving—volatility, innovation, and all. Just another reminder that in crypto, the only constant is change, and the only thing thicker than a blockchain ledger is the irony of traditional finance trying to regulate it.

Appeals Court Ruling Undermines Prosecution’s Foundation

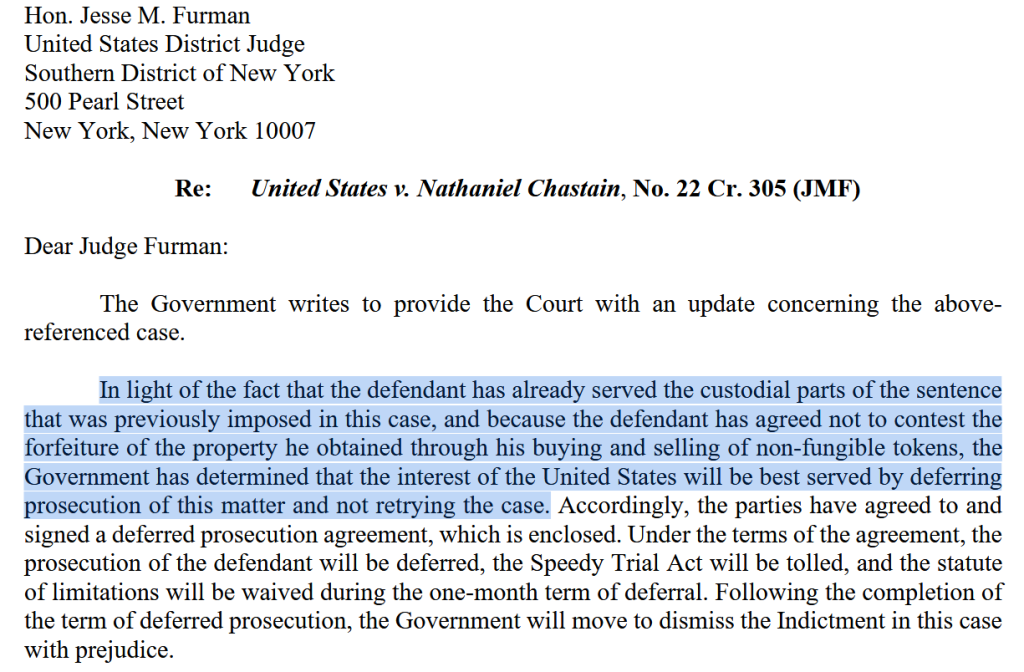

Manhattan US Attorney Jay Clayton, a former SEC chair, told the federal court that prosecutors would not retry the case given Chastain had already served three months in prison and agreed not to contest forfeiture of 15.98 ETH worth $47,330.

“The interest of the United States will be best served by deferring prosecution of this matter and not retrying the case,” Clayton wrote in the court filing.

The collapse stems from a July 2024 appeals court decision that found the trial jury received flawed instructions.

The 2nd US Circuit Court of Appeals ruled 2-1 that jurors were improperly told they could convict Chastain based solely on unethical behavior rather than actual theft of property with commercial value.

Judge Steven Menashi wrote last year August that the lower court erred by allowing conviction even if the information Chastain used lacked tangible value to OpenSea.

The appeals panel sharply criticized jury instructions that permitted conviction based on violations of “broad notions of honesty and fair play,” warning such standards could criminalize nearly any deceptive act.

The court found the featured NFT data was not monetized by OpenSea and was not treated internally as a valuable asset, making it too “” to qualify as property under federal wire fraud statutes.

Original Conviction Built on Novel Legal Theory

Chastain was convicted in May 2023 after prosecutors accused him of exploiting his role to buy dozens of NFTs shortly before they appeared on OpenSea’s homepage between June and September 2021.

After tokens were featured and prices increased, he sold them at two- to five-times profit using anonymous wallets. The government alleged he made over $57,000 through the scheme.

US Attorney Damian Williams had described the case as a warning to digital asset markets when announcing charges. “NFTs might be new, but this type of criminal scheme is not,” Williams said.

“As alleged, Nathaniel Chastain betrayed OpenSea by using its confidential business information to make money for himself.“

The conviction came after a week-long trial, with prosecutors charging wire fraud rather than securities fraud since NFTs have not been legally classified as securities.

More than 300 defense attorneys had filed letters supporting dismissal, arguing that treating confidential business information as property would “criminalize a broad swath of conduct.“

Broader Regulatory Retreat Under Trump Administration

The dropped prosecution aligns with a broader shift in federal crypto enforcement under the TRUMP administration.

As reported by Cryptonews earlier today, a Cornerstone Research report found the SEC initiated just 13 crypto-related actions in 2025, down 60% from 33 in 2024 and the lowest level since 2017.

The agency has dismissed multiple high-profile cases including those against Coinbase, Kraken, Consensys, and Cumberland DRW.

The SEC also closed its investigation into OpenSea in February 2025 after issuing a Wells notice in August 2024 that alleged the platform functioned as an unregistered securities marketplace.

![]() The SEC has officially ended its investigation into NFT marketplace @OpenSea, according to the company’s founder, @dfinzer.#SEC #OpenSeahttps://t.co/OtOT6c3WMd

The SEC has officially ended its investigation into NFT marketplace @OpenSea, according to the company’s founder, @dfinzer.#SEC #OpenSeahttps://t.co/OtOT6c3WMd

At that time, OpenSea founder Devin Finzer called the closure “a win for everyone who is creating and building in our space.“

For now, Chastain will not face supervision by US Pretrial Services and can seek return of the $50,000 fine and special assessment paid following his conviction.

Notably, the global NFT market cap currently stands at $2.56 billion, down 6.72% in the last 24 hours with total sales volume reaching $3.68 million, according to CoinGecko data.

The figure represents an 84.78% decline from the market’s peak of $16.82 billion in April 2022, when digital collectibles were among the hottest assets in crypto and the Chastain case was first unfolding.