US Senate Crypto Bill Advances to Markup - Democrats Sit Out in Political Standoff

Washington's crypto showdown just hit a new gear—and the silence from one side of the aisle is deafening.

The Partisan Fault Line

A landmark cryptocurrency bill is barreling toward markup in the US Senate, but it's doing so without a single Democrat backing the push. That's right—zero support from across the aisle. The move exposes a raw political divide over how to regulate the trillion-dollar digital asset ecosystem, turning what should be a technical process into a high-stakes game of legislative chicken.

What Markup Means for the Market

Markup is where bills get dissected, amended, and reshaped. It's the legislative kitchen where the sausage gets made—or in this case, where crypto's regulatory framework gets its final seasoning. Advancing without bipartisan buy-in is a gutsy, risky play. It signals the bill's sponsors are betting they can muscle it through committee on party lines, setting up a floor fight that could get messy. For traders, that means volatility. Every proposed amendment, every heated debate, will send ripples through Bitcoin, Ethereum, and the altcoin markets.

The Stakes for Innovation

Proponents argue clear rules are long overdue—that regulatory uncertainty is stifling American innovation and pushing development offshore. Critics fear a rushed, one-sided bill could create loopholes or impose unworkable burdens. The absence of Democrat input at this critical stage suggests the final product might lean heavily toward industry-friendly provisions, potentially ignoring consumer protection concerns that the other party champions. It's a classic Washington tale: a race to regulate the future, fueled by old-fashioned partisan politics.

The Bottom Line

This isn't just procedural drama—it's a power move with real consequences. A bill crafted by only one party risks being overturned or ignored by the next administration. It's the legislative equivalent of building on shaky ground, but in a town where short-term wins often trump long-term stability. After all, in finance and politics, the longest-term plan usually only extends to the next election cycle.

Legislative Path Narrows as Banking Panel Delays CLARITY Act

The Agriculture Committee’s decision to advance its Digital Commodity Intermediaries Act comes as the Senate Banking Committee postponed work on the parallel CLARITY Act until late February or March, according to sources.

The Banking panel has pivoted to housing legislation following President Trump’s push for affordability, with the president writing that he is taking “” on the housing bill, which remains a priority and “”

That delay followed Coinbase CEO Brian Armstrong’s public withdrawal of support over provisions he called “,” including restrictions on tokenized equities and stablecoin yield.

Patrick Witt, WHITE House Executive Director of the President’s Crypto Council, pushed back against Armstrong’s “no bill is better than a bad bill” stance, warning that delaying legislation risks future Democratic lawmakers writing “punitive legislation in the wake of a crisis, à la Dodd-Frank.”

“You might not love every part of the CLARITY Act, but I can guarantee you’ll hate a future Dem version even more,” Witt wrote.

Meanwhile, President TRUMP confirmed at Davos 2026 that he expects to sign crypto market structure legislation “” stating his administration is working to ensure “America remains the crypto capital of the world.“

JUST IN:![]() President Trump says he hopes to sign the crypto market structure bill (CLARITY Act) soon. pic.twitter.com/2tQQqeefwP

President Trump says he hopes to sign the crypto market structure bill (CLARITY Act) soon. pic.twitter.com/2tQQqeefwP

Democratic opposition has intensified over ethics concerns, with Senator Adam Schiff demanding controls covering the White House and Senator Ruben Gallego calling ethics guardrails “.”

Key Differences Between Competing Bills Shape Industry Response

The updated bill diverges from Banking’s CLARITY Act on several critical points, particularly regarding stablecoin yield, which has been the single biggest source of industry division.

CLARITY’s Section 404 explicitly prohibits digital asset service providers from paying interest or yield solely for holding payment stablecoins, though it permits “” rewards for transactions, loyalty programs, staking, or governance participation.

The new bill takes a fundamentally different approach by excluding “from CFTC authority entirely, deferring regulation to frameworks like the GENIUS Act rather than setting specific yield rules.

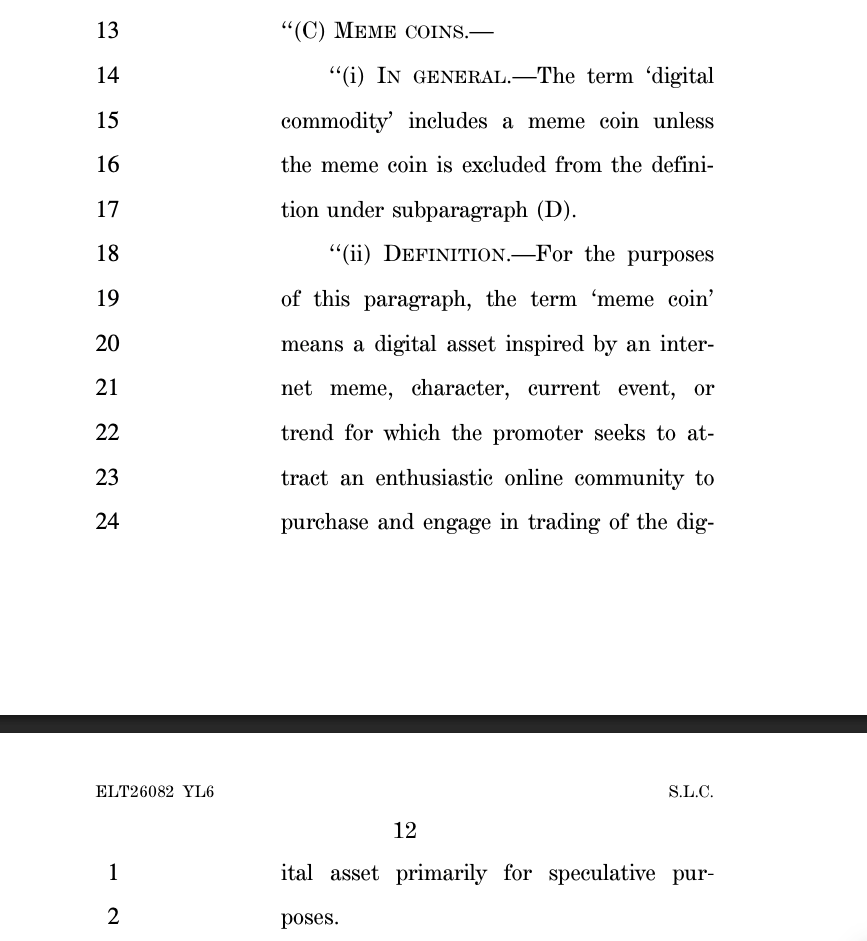

Notably, the bill also explicitly classifies meme coins as digital commodities under CFTC jurisdiction, defining them as assets “inspired by internet memes, characters, or current events, where promoters seek to attract an enthusiastic community primarily for speculative purposes.“

CLARITY instead introduces “” concepts with exemptions for tokens that were principal assets of ETFs listed as of January 1, 2026.

On developer protections, the bill establishes an Office of the Digital Commodity Retail Advocate within the CFTC, while CLARITY creates a CFTC-SEC Micro-Innovation Sandbox for small firms.

Both protect software developers from regulation, though CLARITY’s Section 604 sparked warnings from Judiciary Committee leaders Chuck Grassley and Dick Durbin that it could “materially limit prosecutors’ ability to pursue financial crime cases.“

Banking Lobby Secures Stablecoin Restrictions Amid Industry Split

The stablecoin yield debate has exposed deep rifts between crypto platforms and traditional banks.

Bank of America CEO Brian Moynihan recently warned that as much as $6 trillion in deposits (roughly 30% to 35% of US commercial bank deposits) could migrate into stablecoins, while JPMorgan CFO Jeremy Barnum called yield-bearing stablecoins “a parallel banking system that includes something that looks a lot like a deposit that pays interest, without the associated safeguards.“

Galaxy Digital also warned that Banking’s draft could grant Treasury “” surveillance powers, including authority to freeze transactions for up to 30 days without court orders.

Given this increasing friction with banks, Armstrong said Coinbase is exploring compromises with them during Davos talks, stating, “we’re going to continue to work on the market structure legislation, and meet with some of the bank CEOs to figure out how we can make this a win-win.“

![]() Coinbase CEO @brian_armstrong said he will take US crypto market structure talks to Davos, seeking a compromise with banks as legislation stalls in Washington.#Coinbase #CryptoMarketStructure https://t.co/GKvYIkcTSs

Coinbase CEO @brian_armstrong said he will take US crypto market structure talks to Davos, seeking a compromise with banks as legislation stalls in Washington.#Coinbase #CryptoMarketStructure https://t.co/GKvYIkcTSs

Despite regulatory uncertainty, Clear Street analyst Owen Lau noted that “institutional use cases continue to expand even without a favorable Clarity Act,” pointing to continued blockchain adoption by major financial institutions.