Ethereum Price Prediction: ETH Holds Critical Support as Network Transactions Shatter Records – The Coil Tightens Before the Explosion

Ethereum isn't just holding the line—it's building a launchpad. While price action clings to a crucial technical level, the real story unfolds beneath the surface: the network just processed more transactions than ever in its history. That's not mere activity; it's a fundamental pressure cooker.

The On-Chain Engine Roars

Forget the sleepy charts for a second. All-time high transaction volume screams one thing: utility. Real, gas-burning, contract-executing demand. This isn't speculative froth; it's the digital economy's backbone firing on all cylinders. DeFi, NFTs, layer-2 settlements—they're all gulping blockspace. Price might be coiling, but the network is exploding.

The Technical Squeeze Play

Every trader's eye is locked on that key support. Hold it, and the massive transactional energy underneath has a solid floor from which to spring. Break it, and... well, let's just say the 'fundamentals are strong' crowd would need a new talking point. This is the classic technician-versus-on-chain-analyst showdown. One measures lines on a screen, the other measures economic throughput. Place your bets.

The Looming Catalyst

Markets hate uncertainty, but they love pent-up energy. Ethereum is brewing both. Record usage during a period of price consolidation creates a potent asymmetry. It's the market equivalent of a coiled spring—the tighter the compression, the more violent the eventual release. When this much fundamental fuel meets a technical breakout, the move isn't a ripple; it's a tidal wave.

So, is ETH coiling to explode? The ledger doesn't lie. While Wall Street debates P/E ratios over three-martini lunches, Ethereum's ledger is logging an economic revolution, one transaction at a time. The fuse is lit. The only question is your proximity to the blast zone.

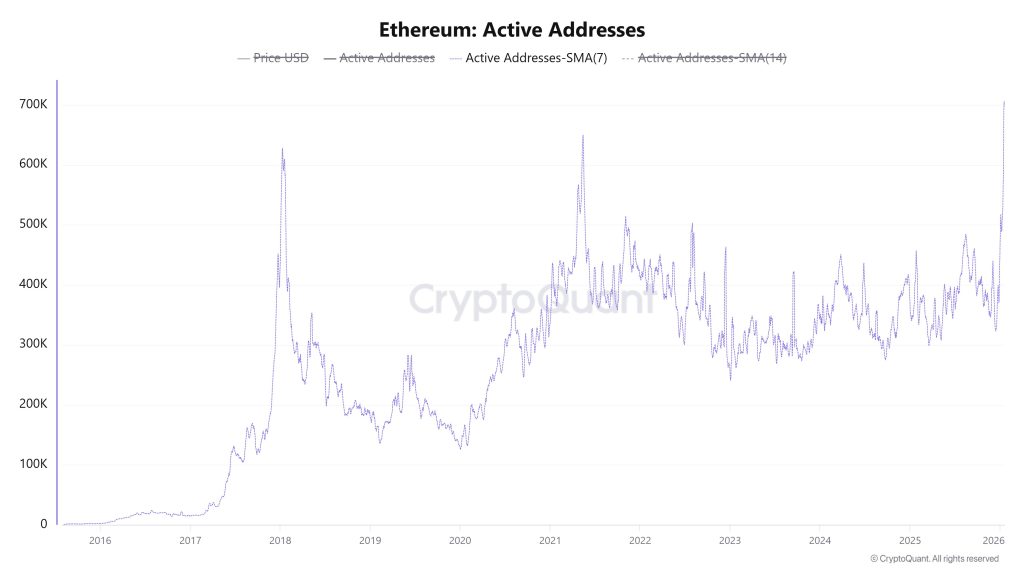

Ethereum active addresses 7-day SMA. Source: CryptoQuant.

Ethereum active addresses 7-day SMA. Source: CryptoQuant.

Despite this on-chain strength, market participation remains selective. Whales are the only cohort accumulating, with wallets holding 10,000–100,000 ETH adding roughly 190,000 ETH over the past week.

Retail behavior tells a different story. Wallets in the 1,000–10,000 and 100–1,000 ETH brackets have continued to reduce exposure, likely reacting to macro uncertainty with geopolitical tensions between the U.S. and NATO over Greenland.

While metrics show a disconnect between fundamentals and market behavior, technicians show bullish momentum quietly building beneath the surface for the altcoin.

Ethereum Price Prediction: Key Line Could Trigger Explosive Move

Since ethereum carved out a local bottom in November, a clear sequence of higher lows has established a decisive support trendline, compressing price against upper resistance.

This forms a 2-month symmetrical triangle, now nearing its apex – making the next retest of support its potential last before a breakout or breakdown.

That structure has formed a two-month symmetrical triangle now approaching its apex, making the next support retest its potential last before pressure releases in a breakout or breakdown.

Momentum indicators continue to favor the bullish case. While the RSI has slipped below the neutral 50 level, its own rising trendline suggests a bounce may be imminent.

The recent MACD death cross could also prove short-lived, reflecting consolidation rather than a broader trend reversal.

The key breakout threshold stands in a divisive zone around $3,350. If flipped into support, a MOVE toward all-time highs comes into focus, with a.

Traders should remain cautious NEAR $4,250, which stands as strong interim resistance to the move.

Maxi Doge: Another Play Quietly Building Momentum

When capital rotates from bitcoin into altcoins, momentum almost always circles back to one thing: Doge.

History makes the pattern clear. Dogecoin started the trend, Shiba Inu ran with it in 2021, followed by Floki, Bonk, Dogwifhat, and Neiro. Every bull cycle eventually crowns a new Doge meme-inspired frontrunner.

This time around, Maxi Doge ($MAXI) is tapping into those early Dogecoin vibes with a community built around sharing early alpha, trading ideas, and competitive engagement.

Participation is at its core. Weeklyandcompetitions reward top performers with leaderboard recognition, incentives, and bragging rights.

The HYPE is already showing in the numbers. The $MAXI presale has raised over $4.5 million, while early backers are earning up tothrough staking rewards.

For those who missed the DOGE wave before, Maxi Doge could be the next chance to catch a meme coin before it enters the mainstream.

Visit the Official Maxi Doge Website Here