WLFI Faces Backlash: How 9 ’Team Wallets’ Swung a 59% Vote on the USD1 Growth Proposal

Decentralization or delegation? A governance vote sparks controversy as concentrated holdings tip the scales.

The Wallet Whispers

Nine addresses—flagged as team-linked—cast enough voting power to push a key proposal past the finish line. The measure, focused on expanding USD1's utility and integrations, needed a simple majority. It got 59%.

Community forums lit up. Critics slammed the move as a 'soft rug'—governance theatre where the outcome feels pre-ordained. Supporters fired back, arguing the team's substantial token holdings naturally translate to significant voting weight. They called it alignment, not manipulation.

The Liquidity Lifeline

The approved proposal unlocks fresh capital for strategic liquidity pools. The goal? Deepen USD1's market presence and cement its role as a stablecoin workhorse within the WLFI ecosystem. More pools mean less slippage, smoother swaps, and ideally, a tighter peg.

But the process leaves a sour taste for some. When a handful of wallets control the narrative, it begs the question: who's really steering the ship? It's the age-old crypto paradox—efficiency versus egalitarian ideals. Sometimes, decentralization looks a lot like a boardroom vote where one share equals one token. A cynical take? In finance, concentrated power rarely disperses without a fight—or a fat exit.

The vote passed. The roadmap advances. But the debate over true decentralized governance? That's far from settled.

Source: WLFI

Source: WLFI

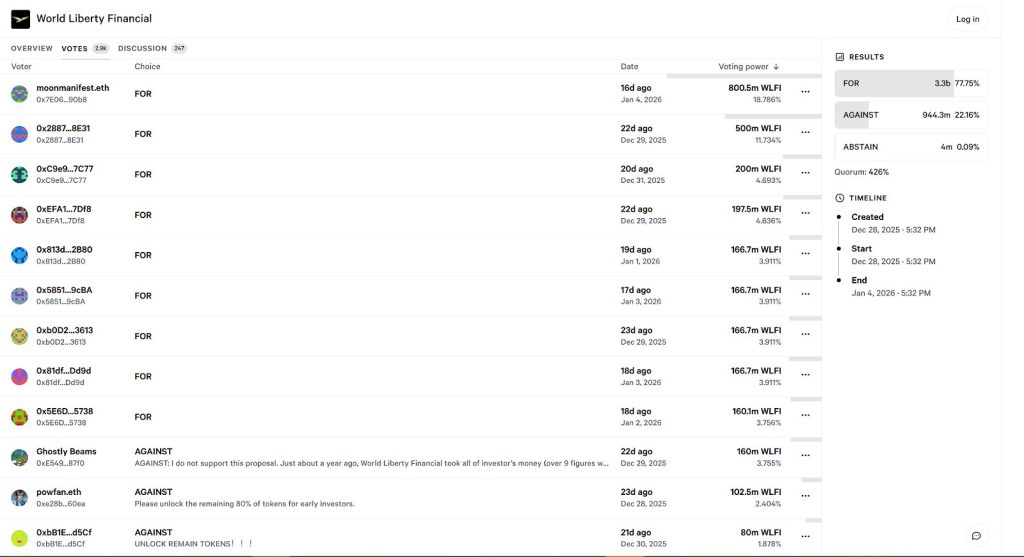

On-chain voting data reviewed by market participants shows that the top nine wallets backing the proposal accounted for roughly 59% of the total voting power.

The single largest wallet alone represented 18.786% of votes cast in the snapshot.

WLFI Vote Passes 78%, but Access Dispute Overshadows Outcome

Analysis shared by pseudonymous trader and researcher DeFi^2 showed that several of these addresses are flagged by on-chain mapping tools as team-linked or strategic partner wallets, effectively allowing a narrow group of insiders to determine the outcome.

Haven’t seen anyone else talk about this yet, so I wanted to bring up an alarming governance vote by World Liberty Fi this month that appears to be the start of a slow extraction of value from WLFI holders by the team:

What you see above appears to be a rigged vote, where the… pic.twitter.com/CGsj7vVUUk

The proposal itself authorized World Liberty Financial to deploy less than 5% of its unlocked WLFI treasury holdings to support the adoption of USD1, the project’s dollar-backed stablecoin.

The vote, created on December 28 and closed on January 4, attracted 2,931 participants and passed comfortably, with 3.3 billion votes, or 77.75%, in favor.

Votes against totaled 944.3 million, while abstentions were negligible. The quorum level reached 426%, far exceeding the threshold required for validity.

The backlash has centered less on the mechanics of the proposal and more on who was able to participate.

Many WLFI holders remain locked out of their tokens following the project’s token generation event and cannot vote on governance matters until unlock conditions are changed.

Several community members pointed out that while these holders are unable to influence decisions, team and partner wallets appear to have had full voting access.

DeFi^2 described the episode as an “alarming governance vote,” arguing that a measure unrelated to token unlocks was pushed through despite repeated calls from holders to address access restrictions first.

Tokenholders opposing the proposal have also questioned its economic logic.

WLFI holders are not entitled to protocol revenue, according to the project’s own documentation, which allocates 75% of revenue to the TRUMP family and 25% to the Witkoff family.

WLFI Holders Voice Frustration Over Incentives and Locked Supply

Against that backdrop, critics argue that using WLFI tokens to incentivize USD1 growth increases dilution without offering a direct upside to tokenholders.

One tokenholder who voted against the proposal said the project had previously deployed more than nine figures of investor capital to accumulate assets such as Bitcoin, Ether, and Chainlink, yet WLFI holders saw no tangible benefit from those holdings.

Tensions increased further after on-chain data showed a transfer of 500 million WLFI tokens to Jump Trading shortly after the vote concluded, while early investor allocations remain locked.

Just In: World Liberty Finance ( @worldlibertyfi ) sent 500M $WLFI worth $83.12M to #Jump Trading.

Data – @Nansen_ai pic.twitter.com/1IoOz3nrR1

Community members have described the situation as asymmetric, with emissions rising and liquidity becoming available to select counterparties while long-term holders wait for unlocks.

Calls to release the remaining 80% of tokens for early investors have grown louder across social channels.

The governance dispute is unfolding as World Liberty Financial accelerates its broader expansion.

On January 8, the group disclosed that World Liberty Trust had filed a de novo application for a U.S. national banking charter with the Office of the Comptroller of the Currency.

![]() World Liberty Financial filed for a US national banking charter, seeking OCC oversight to bring its dollar-backed stablecoin USD1 fully inside the regulatory perimeter. @worldlibertyfi#WLFI #OCC https://t.co/kDgbVB1c25

World Liberty Financial filed for a US national banking charter, seeking OCC oversight to bring its dollar-backed stablecoin USD1 fully inside the regulatory perimeter. @worldlibertyfi#WLFI #OCC https://t.co/kDgbVB1c25

If approved, the charter WOULD allow the trust to issue and safeguard USD1 directly within the U.S. banking system.

Days later, on January 12, World Liberty Financial announced the launch of World Liberty Markets, a lending and borrowing platform built around USD1 and WLFI.