Michael Saylor’s Billion-Dollar Bitcoin Bet: 22,305 BTC for $2.13B in Latest Strategic Move

Another massive chunk of digital gold just vanished from the market—scooped up by the most relentless corporate buyer in crypto history.

The Accumulation Playbook

Forget dipping a toe—this is a full-scale strategic deployment. The latest purchase adds over twenty-two thousand Bitcoin to the treasury, executed with the precision of a military operation. No hesitation, no dollar-cost averaging theatrics—just a clean, colossal transfer of value from fiat to the blockchain.

Why This Isn't Just Another Buy

It reinforces a thesis that's becoming gospel in certain boardrooms: Bitcoin isn't a speculative asset; it's the primary treasury reserve asset for the digital age. While traditional finance plays with bonds yielding negative real returns, this strategy bypasses the middlemen entirely—opting for a bearer instrument with a verifiable, immutable monetary policy.

The Market Calculus

The numbers speak for themselves. Twenty-two thousand coins. Over two billion dollars. This isn't sentiment; it's a capital allocation decision with more conviction than most hedge funds show in a decade. It's a bet on network security over counterparty risk, on open-source code over central bank promises.

A Quiet Jab at the Old Guard

Let's be cynical for a second. In a world where CFOs optimize for quarterly earnings and manage legacy systems, this move looks borderline reckless. But that's the point—it's a rejection of the old playbook. It's capital voting for a system that doesn't require permission, bailouts, or financial advisors taking a clip on the ticket.

The final take? While Wall Street debates P/E ratios, one billionaire's strategy keeps cutting through the noise—converting the dollars of a fading system into the hardest money the world has ever known. The balance sheet transformation is underway, and everyone else is just watching.

ATM Program Funds Latest Bitcoin Acquisition

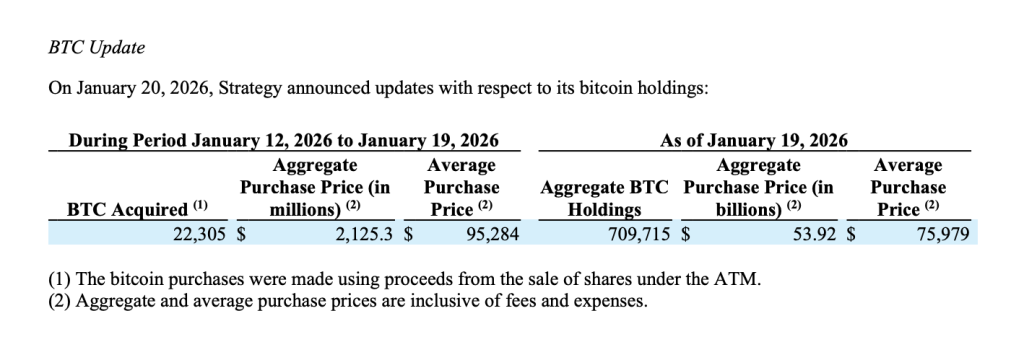

According to the filing, Strategy raised approximately $2.125 billion in net proceeds during the period through a combination of equity and preferred stock issuance. The majority of capital was generated through sales of STRC variable-rate preferred shares and MSTR Class A common stock.

Notably, Strategy sold 2.95 million STRC shares for $294.3 million in net proceeds and issued 10.4 million MSTR shares, generating $1.83 billion. Smaller amounts were raised through STRK preferred stock sales, while no issuance occurred under STRF or STRD during the period.

The company confirmed that proceeds from the ATM program were used directly to fund bitcoin purchases, reinforcing its long-standing capital markets-to-bitcoin conversion strategy.

Bitcoin Holdings Continue to Scale

With the latest acquisition, Strategy’s bitcoin holdings have grown by more than 22,000 BTC in a single week, cementing its position as the largest corporate holder of bitcoin globally.

At current levels, the company’s aggregate holdings represent over 3% of bitcoin’s total circulating supply. While the average purchase price of recent acquisitions sits above Strategy’s historical cost basis, management has repeatedly emphasized long-term accumulation over short-term price sensitivity.

The disclosure shows that while the latest tranche was acquired NEAR recent market highs, Strategy’s blended acquisition price remains materially lower due to earlier purchases made at discounted levels.

Capital Markets Strategy Remains Intact

Strategy’s continued use of preferred stock issuance and equity sales reflects a deliberate effort to diversify funding sources while minimizing operational cash Flow dependence.

The firm still has more than $8.4 billion of MSTR stock and billions in preferred securities available for future issuance under its ATM programs.

Despite heightened volatility in crypto markets and ongoing regulatory uncertainty, Strategy has maintained its bitcoin-centric capital allocation framework, positioning BTC as its primary treasury reserve asset.

Long-Term Conviction Unchanged

The latest purchase shows Strategy’s unwavering conviction in bitcoin as a long-duration store of value and monetary asset. By systematically converting capital raised in traditional markets into bitcoin exposure, the company continues to operate as a Leveraged proxy for institutional bitcoin adoption.

As of January 19, Strategy’s balance sheet reflects not just scale but persistence — a defining feature of its approach as bitcoin enters a more institutionally driven phase of market maturity.