Institutional Floodgates Open: 35 Major Firms Go All-In on Ethereum Onchain

The suits are finally getting their hands dirty. Forget dipping toes—thirty-five heavyweight institutions just plunged headfirst into Ethereum's decentralized waters, signaling a seismic shift from cautious exploration to full-scale operational deployment.

Wall Street's Onchain Awakening

This isn't about speculative treasury buys anymore. We're talking core infrastructure—settlement layers, asset tokenization engines, and automated compliance rails being built directly onchain. The move cuts out legacy intermediaries that have skimmed fees for decades, proving blockchain's utility extends far beyond digital gold narratives.

The Compliance Conundrum Gets Solved

Regulatory hurdles that once paralyzed institutional movement are being bypassed through private execution environments and programmable compliance. Smart contracts now handle what used to require floors of lawyers—a not-so-subtle middle finger to the old guard's gatekeeping business model. (Take that, traditional custody providers charging 30 basis points for glorified spreadsheet management.)

Network Effects Hit Escape Velocity

Each new institutional participant doesn't just add volume—it strengthens the network's legitimacy and attracts the next wave. The domino effect turns skeptics into participants, creating a gravitational pull that makes staying offchain the riskier strategic bet. Liquidity begets liquidity, and Ethereum's flywheel is spinning at ATH velocity.

The real story isn't the thirty-five firms moving today—it's the hundreds now forced to explain to shareholders why they're still using systems built when dial-up internet was cutting-edge tech.

Think of this shift like the early days of the internet: Ethereum is moving from being a "speculative digital asset" to the essential plumbing that keeps the global economy running.

This isn't just about hype; it's about real money moving in a big way. Take BitMine Immersion, for example. Led by Tom Lee, the company recently staked a staggering 1.77 million ETH a hoard worth over $5.66 billion. In one single, bold move, they locked up 86,848 tokens, effectively taking them off the market.

For BitMine, this isn't just a "buy and hold" strategy. It’s a genius MOVE to generate a steady paycheck (native yield) to pay down corporate debt and fund their upcoming MAVAN operations. When a player this big locks up billions of dollars, it sends a loud message to the rest of the world: Ethereum is a safe, productive place to park capital.

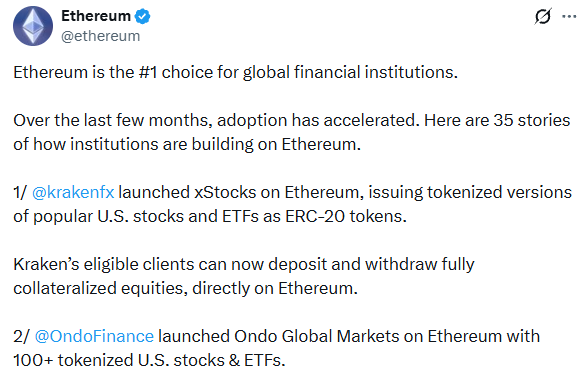

35 Giants Building the "Onchain" Future

From the high-stakes meetings at Davos to the trading floors of Wall Street, the evidence of Ethereum institutional adoption is everywhere you look. Here’s a quick breakdown of the four big pillars changing the game:

: Google didn't just show up; they brought the future. Their new "Agent Payments Protocol" (AP2) lets AI bots pay each other automatically using stablecoins on Ethereum. Plus, Google Search is now using Polymarket (a crypto prediction market) as a trusted source of truth for its results.

: JPMorgan has officially moved its digital deposit product (JPMD) over to the Base network (an Ethereum "Layer 2"). Meanwhile, Fidelity and BlackRock are doubling down. BlackRock is even pushing for a "Staked ETH ETF" so regular investors can earn the same rewards the big guys do.

: SWIFT, the network that moves money between 11,500 banks worldwide, is currently building a bridge to ETH. They want to make sure global payments can happen 24/7, in real time, without the old-school delays.

: Stripe now lets businesses handle subscriptions in USDC (digital dollars), and Mastercard is making it easier for people to use their own digital wallets safely through their "Crypto Credential" program.

The Great Supply Crunch: Why ETH is Vanishing from Exchanges

All this ETH institutional adoption has created a bit of a problem: there simply isn't enough Ether to go around. As companies like BitMine, SharpLink, and ETHZilla snatch up every available token and lock them away in staking or long-term vaults, according to CryptoQuant, the amount of ETH left on exchanges has hit a record low of just 16.3 million.

Imagine a popular toy at Christmas everyone wants it, but the shelves are nearly empty. That’s the "supply vacuum" we’re seeing now. For anyone watching the markets, this suggests that ETH is shifting from a simple currency into the world’s most valuable "productive asset."

The Bottom Line

Ethereum has become the "gold standard" for governments and big business. Whether it’s Sony building a new gaming world on an Ethereum-linked network or Africa’s M-Pesa helping 60 million people move money faster, the trend is clear. The world is moving onchain, and they’ve chosen Ethereum to be the foundation.