Bitcoin Price Prediction: $1.55 Billion Flooded In Last Week – Are Investors Preparing for a Global Meltdown?

Digital gold just got a $1.55 billion vote of confidence. In a single week, that tidal wave of capital surged into Bitcoin—not a trickle, not a stream, but a flood. The question on every trader's screen isn't just about price targets; it's about motive. Is this smart money positioning for a moon shot, or are they building a lifeboat?

The Bull Case: Front-Running the Halving

Forget the timid retail investor. This move reeks of institutional calculus. The next Bitcoin halving looms on the horizon, a programmed scarcity event that has historically acted like a rocket booster for prices. That $1.55 billion inflow looks less like a gamble and more like a strategic deployment—sophisticated capital positioning itself before the supply shock hits. They're not betting on hype; they're betting on code.

The Bear Trap: Hedging Against Everything Else

But let's flip the script. What if the smart money isn't all that optimistic? Traditional markets look… fragile. Geopolitical tensions, debt ceilings, the usual circus of fiscal mismanagement. Bitcoin, for all its volatility, has cemented its role as a non-sovereign hedge. That billion-dollar influx could be a simple, cynical trade: a hedge against a potential meltdown in everything else. It's the ultimate 'break glass in case of emergency' asset—and some whales might think they see smoke.

The Data Doesn't Lie, But It Whispers

The raw numbers are clear: $1.55 billion entered the Bitcoin ecosystem. The narrative behind those numbers is everything. This isn't FOMO-driven retail mania; this is capital with a purpose. It moves markets, shifts sentiment, and sets the stage for the next major volatility spike.

Prediction: Volatility is the Only Guarantee

So, where does the price go from here? Predicting a specific number is a fool's errand—best left to charlatans on financial television. The only solid prediction is turbulence. That massive inflow creates a new layer of support, but it also represents potential fuel for a sell-off if macro conditions sour. The stage is set for a battle between halving-driven euphoria and recession-proof hedging. One thing's certain: the boring days are over. Buckle up.

$1.55B Bitcoin Inflows Signal Defensive Positioning

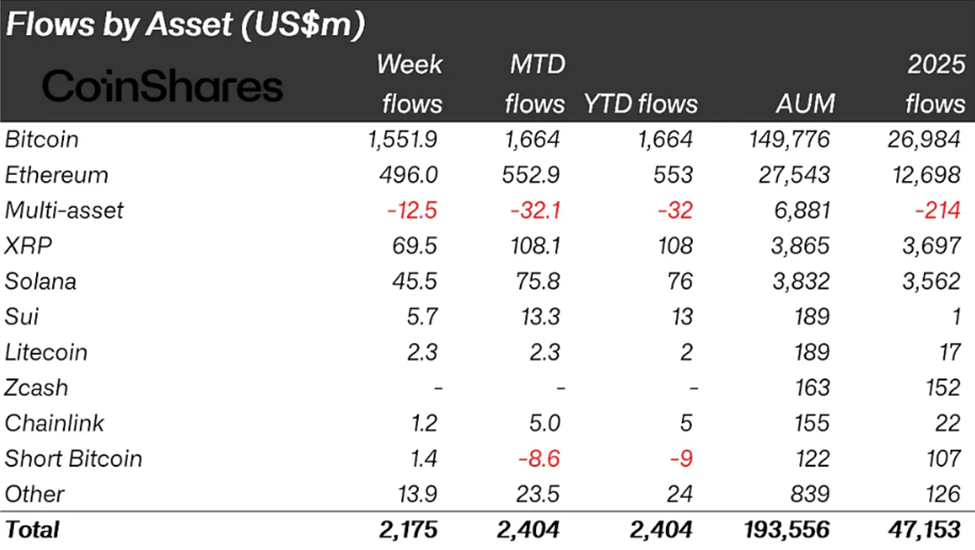

Bitcoin is back in focus after $1.55 billion flowed into BTC investment products in a single week, according to the latest data from CoinShares. The scale of inflows is notable not just for its size, but for its timing. Capital moved aggressively into bitcoin as geopolitical tensions, tariff threats, and policy uncertainty intensified, suggesting investors are positioning defensively rather than chasing momentum.

Total crypto fund inflows reached $2.17 billion, the strongest weekly intake since October 2025. Bitcoin alone accounted for more than 70% of that demand, reinforcing its role as the market’s preferred hedge when macro risks rise. Historically, inflows of this magnitude tend to appear when investors expect volatility elsewhere, not when risk appetite is peaking.

Why Macro Stress Is Driving BTC Demand

The recent inflow surge reflects mounting macro pressure rather than speculative enthusiasm. Trade tensions involving NATO allies, renewed tariff threats, and growing debate over US policy credibility have unsettled risk assets. While equities and bonds struggled to find direction, BTC drew steady inflows early in the week before momentum slowed into Friday.

Trump is raising tariffs on 8 NATO allies because they rightly support Denmark's sovereignty in Greenland.

Destroying our closest alliances to take Greenland — which Denmark lets us use freely already — is insane. Congress must say NO.

That late pullback is telling. Investment products recorded $378 million in single-day outflows near week’s end, underscoring fragile sentiment. Still, the week closed firmly positive, suggesting larger allocators were willing to sit through volatility to keep exposure intact.

Key forces behind the rotation include:

- Rising geopolitical risk tied to trade and diplomacy

- Delayed expectations for near-term Fed policy shifts

- Growing use of BTC as a portfolio hedge

- Reduced confidence in traditional safe havens

This Flow profile points to capital repositioning under stress, not momentum chasing. BTC is increasingly treated as a hedge against political risk rather than a short-term trade.

Bitcoin Price Prediction: What Price Levels Matter Next for BTC

From a market perspective, Bitcoin price prediction has turned bearish. BTC is trading near $91,000, after failing to hold recent highs just below $98,000. The pullback aligns with the late-week sentiment reversal, but hasn’t invalidated the broader structure.

Two scenarios are now in play:

- Downside risk increases if Bitcoin fails to hold the $90,000–$88,000 zone, where prior demand and psychological support converge

- Upside recovery requires a reclaim of $94,000, which would reopen the path toward $96,800–$98,000

What’s important is that heavy inflows didn’t arrive at local bottoms. They arrived after a strong rally, reinforcing the view that institutions are buying exposure, not chasing short-term price moves.

Bitcoin Price Prediction: Hedge First, Speculate Later

Bitcoin’s latest inflow surge doesn’t guarantee an immediate breakout. Instead, it points to strategic positioning ahead of potential global stress. When $1.55 billion moves into a single asset in one week, it reflects preparation, not panic.

If macro conditions worsen, BTC is likely to remain the first digital asset investors turn to. If conditions stabilize, those same inflows could provide the base for another attempt toward $98,000. Either way, the message from fund flows is clear: Bitcoin is being treated less like a trade and more like insurance.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $30.8 million, with tokens priced at just $0.013605 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale