Crypto Rally Stalls as Geopolitical Tensions Resurface: Laser Digital Warns of Shifting Focus

Crypto's recent surge hits a wall. The market's upward momentum is fading fast as investors pivot their attention back to the global chessboard of geopolitical risk, according to analysis from Laser Digital.

The Risk-On Trade Takes a Backseat

For weeks, digital assets rode a wave of bullish sentiment. Now, that wave is crashing against the hard rocks of international uncertainty. The narrative is flipping from pure speculation to sober risk assessment. It's a classic flight-to-safety play, just with a 21st-century portfolio.

Laser Digital's analysts point to a clear pattern: crypto rallies thrive on macroeconomic narratives like inflation and monetary policy. But when tanks start rolling or diplomatic cables burn, the calculus changes. Suddenly, volatility isn't just an opportunity—it's a threat. Capital gets cautious, and the 'number go up' machine sputters.

Not a Crash, But a Reality Check

This isn't a signal to abandon ship. It's a reminder that crypto isn't traded in a vacuum. The same algorithms scanning Fed statements are also parsing headlines from conflict zones. The market is maturing, connecting its fate to the same real-world forces that buffet traditional finance. A sobering thought for those who believed decentralization meant detachment.

The takeaway? The crypto market is growing up, learning that sometimes the most important chart isn't a price graph, but a map. And as one Laser Digital source dryly noted—sometimes the safest hedge isn't a stablecoin, but an old-fashioned bunker. Just don't expect that asset class to get a token any time soon.

Tariff Headlines Trigger Risk-Off Move

Over the weekend renewed geopolitical tension weighed heavily on broader risk markets after former U.S. President Donald TRUMP proposed new tariff measures targeting European Union and NATO countries.

While crypto assets appeared insulated from the news sentiment deteriorated sharply once U.S. equity futures opened weaker during early Asian trading hours.

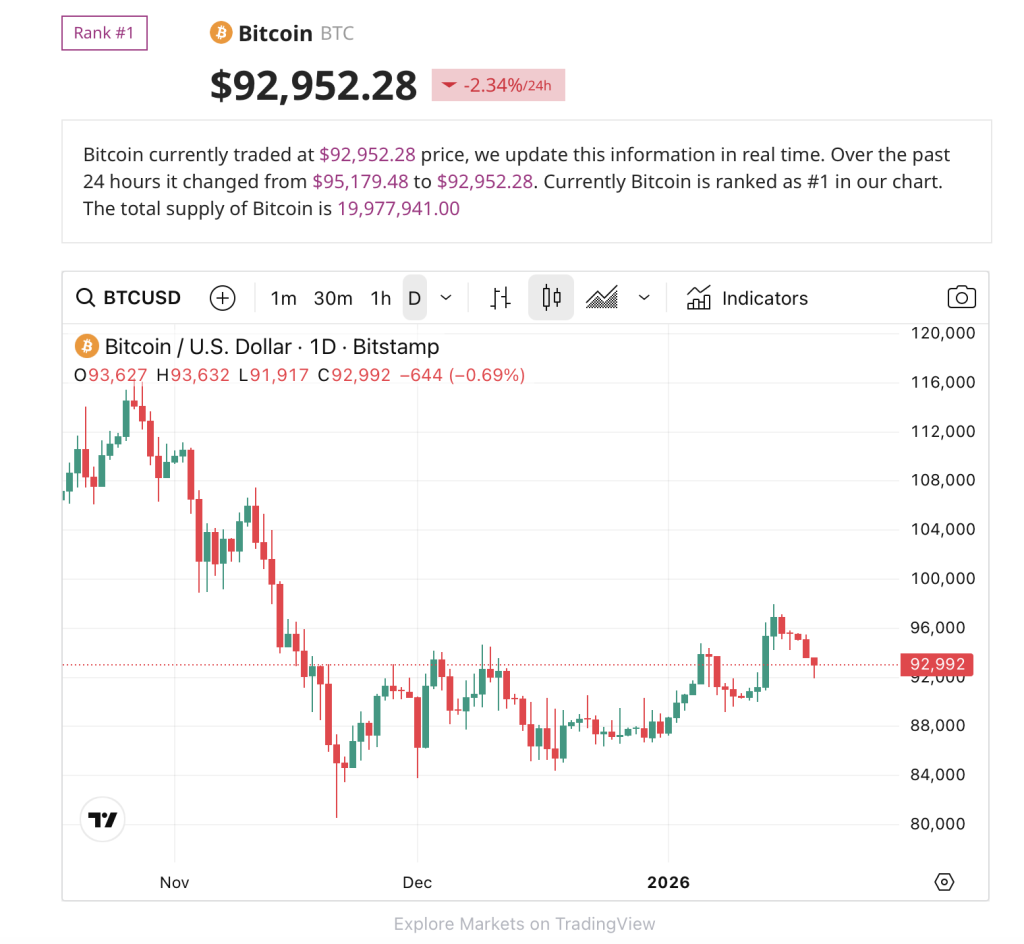

This shift triggered aggressive selling across digital assets. Bitcoin fell to approximately $92,500, while ethereum dropped to around $3,200, effectively erasing the majority of gains recorded during the prior week.

The move highlights crypto’s continued sensitivity to global macro and geopolitical developments, particularly during periods of heightened uncertainty.

On Monday Bitcoin’s price action is showing near-term consolidation after a sharp pullback, with BTC trading around $93,000following a rejection from the mid-$90,000s.

Near-Term Outlook Hinges on Macro Developments

Looking ahead near-term price action is expected to remain highly reactive to how U.S.–EU trade tensions evolve. Any escalation could pressure risk assets while signs of de-escalation may provide room for stabilization. Geopolitical risks in the Middle East remain elevated with tensions increasing over the weekend and contributing to a more cautious market backdrop.

From a macro perspective, markets face a busy week. Key events include the World Economic Forum in Davos, upcoming U.S. GDP and PCE inflation data and a Bank of Japan policy meeting.

Although there are no scheduled Federal Reserve speeches due to the blackout period, markets may still see policy-related developments. U.S. Treasury Secretary Scott Bessent has indicated that a Fed chair announcement could occur closer to the Davos Forum, adding another potential catalyst for volatility.

Caution Returns After Breakout Attempt

While last week’s breakout above $95,000 marked a technical milestone for Bitcoin the subsequent pullback shows the fragile nature of sentiment at elevated price levels.

With macro and geopolitical risks back in focus, traders are likely to remain cautious in the NEAR term, watching for clarity on tariffs, central bank direction and broader risk appetite before committing to the next directional move.