ETH Gas Airdrop Confirmed for Jan 21: Binance $GWEI Listing, TGE, and Mainnet Launch

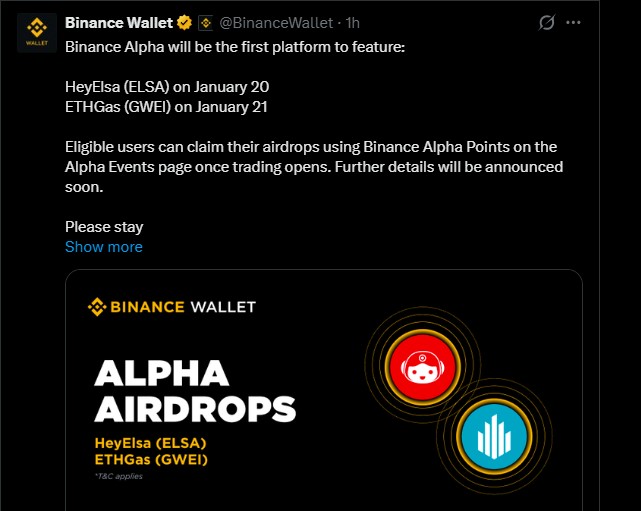

Gas fees just got interesting. The long-rumored ETH Gas airdrop is locked in for January 21, 2026, bringing with it a trifecta of market-moving events: a Binance listing for the $GWEI token, its Token Generation Event (TGE), and the official mainnet launch.

The Triple-Threat Catalyst

This isn't a quiet rollout. The coordinated launch of the airdrop, exchange listing, and core network activation is a deliberate play for maximum visibility and liquidity from day one. It signals a project moving out of stealth mode with its foot firmly on the accelerator.

Why $GWEI Matters

The token is positioned as a direct utility play on Ethereum's infamous network congestion. The mechanics suggest a model where holding $GWEI could influence or offset transaction costs—a proposition that hits every ETH user where they feel it most: their wallet.

A Calculated Market Entry

Timing the TGE and Binance listing alongside the airdrop floods the market with initial supply while immediately providing a major venue for trading. It's a strategy that bypasses the slow burn of a tiered exchange rollout, aiming for instant price discovery and volume.

The mainnet going live concurrently means the token isn't just a speculative voucher; it's meant to be used from the jump. This pushes the narrative beyond mere airdrop farming into functional ecosystem building.

The Fine Print on the 'Free' Money

While the airdrop confirmation will send community channels into a frenzy, the real test comes after the claim window opens. Tokenomics, vesting schedules for the team and treasury, and the actual mainnet adoption will separate a flash in the pan from a lasting protocol. After all, in crypto, the most expensive stuff is often the 'free' stuff—just ask anyone who's paid a four-figure gas fee to claim a $50 token. The market's about to see if this gas solution has real fuel or is just another source of hot air.

Eligible users will be able to claim rewards using Binance Alpha Points on the Alpha Events page once trading opens. This confirms that the launch is moving from preparation into active distribution.

ETH Gas Airdrop Schedule: Binance $GWEI Listing Confirmed

The ETHGas Foundation has revealed the full role of $GWEI. It is the governance token of the project’s ecosystem, created to guide how ethereum blockspace is priced and used in real time.

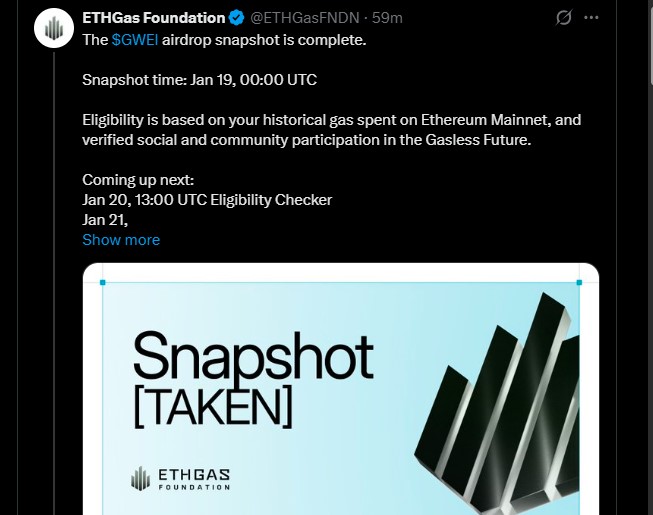

After the ETHGas listing on Binance announcement went live, the project shared that the snapshot was completed on January 19 at 00:00 UTC. Eligibility is based on historical fee spent on Ethereum Mainnet and verified community participation in the Gasless Future movement.

Users had to prove their “proof of pain” through fee ID and take part in social actions such as sharing Gas ID on X or engaging in Open fee Initiative campaigns.

The upcoming schedule is now fixed:

-

January 20, 13:00 UTC: Eligibility Checker

-

January 21, 13:00 UTC: ETHGas listing date and airdrop

This approach makes the ETH Gas airdrop unique because it rewards real $ETH users, not just wallet activity.

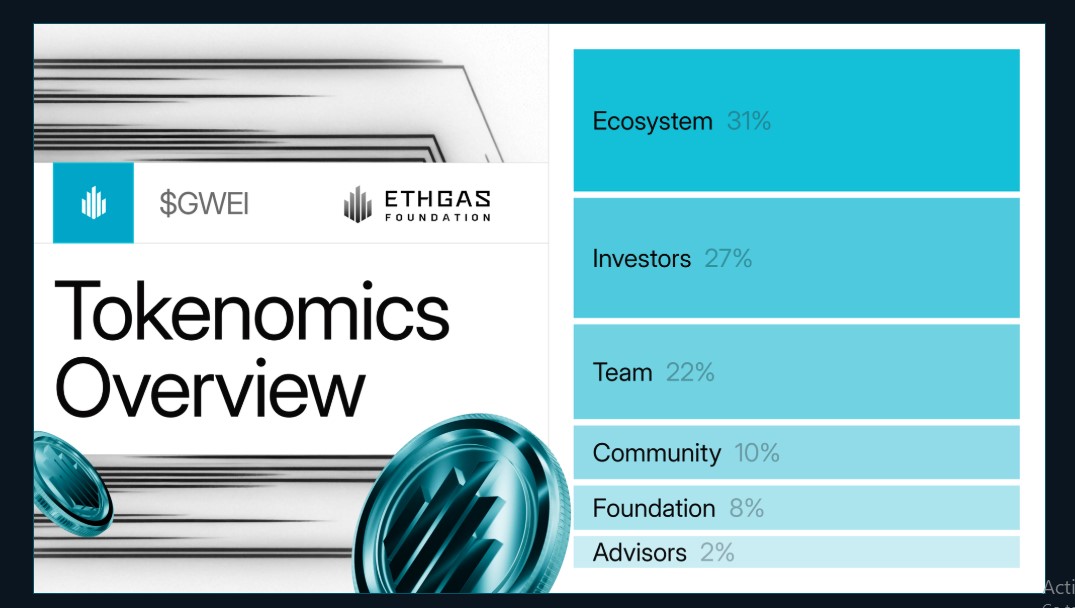

GWEI Tokenomics Shows a Sustainable 10-Year Model

The official team has designed a 10-year distribution model that focuses on balance and stability. GWEI tokenomics is divided as follows: It will be deployed as an ERC-20 token on Ethereum Mainnet with a fixed total supply of 10 billion.

-

Ecosystem: 31%

-

Investors: 27%

-

Team: 22%

-

Community: 10%

-

Foundation: 8%

-

Advisors: 2%

"Most of the tokens are being used to grow the project and make sure it succeeds in the long run. A big chunk is also set aside for the team and the community, which helps keep things fair and ensures the project is built the right way. As per crypto experts $GWEI price prediction on launch day is expected to trade NEAR $0.002 to $0.005 range.

This setup is why the ETH Gas airdrop listing isn't just a one-time giveaway—it’s actually a key part of a much bigger plan to keep the project growing for a long time."

$12 Million Funding Strengthens Market Confidence

The project recently raised a $12 million seed round led by Polychain. In addition, it has received $800 million in commitments from major Ethereum builders.

This funding is focused on building Ethereum’s blockspace futures market and strengthening asset’s marketplace infrastructure. It gives solid backing to its long-term roadmap.

Conclusion

The ETH Gas airdrop connects Ethereum users with true protocol control. From Binance GWEI listing to strong funding and clear tokenomics, it shows long-term vision. The project is built for governance, not hype. It turns gas usage history into real decision-making power for Ethereum’s future.