CoinGecko CEO Breaks Silence on $500M Acquisition Rumors

Is CoinGecko getting scooped up? The crypto data giant's CEO just stepped into the spotlight to address the swirling $500 million buyout chatter.

The Rumor Mill Churns

Whispers of a half-billion-dollar deal have been ricocheting through crypto circles for weeks. Speculation pointed to everyone from traditional financial data firms to rival crypto platforms as potential suitors. The silence from CoinGecko's top brass only fueled the fire.

Straight from the Source

No more reading between the lines. The CEO cut through the noise with a direct statement, neither confirming nor denying the specific figure but addressing the acquisition narrative head-on. It's a classic move—managing market sentiment without showing your hand.

Why Everyone's Watching

A $500 million price tag isn't just a number; it's a massive valuation signal for the entire crypto infrastructure sector. It asks a brutal question: what's the going rate for trust and eyeballs in a market built on volatility? An acquisition of this scale would reshape the data landscape overnight, potentially consolidating power in fewer hands.

The Bottom Line

Whether a deal materializes or not, the episode highlights a simple truth: in crypto, your data is someone else's asset. The CEO's comments pour water on the flames for now, but in finance, where there's smoke, there's often a banker holding a lighter. The market hates uncertainty almost as much as it loves a good story—and this one has half a billion reasons to stick around.

Moelis Tapped as CoinGecko Courts Wall Street Acquisition

Insiders indicated the company has enlisted Moelis to provide advisory services for this process, although one source emphasized it’s premature to determine a precise valuation since negotiations commenced only in late 2024.

Moelis is an established Wall Street investment banking firm specializing in strategic financial guidance across mergers and acquisitions, restructuring, and capital markets for corporations, having facilitated over $5 trillion in transactions spanning various sectors.

In a post on X, Ong acknowledged receiving numerous inquiries following recent press coverage and expressed appreciation for the interest.

We’ve had a lot of questions following recent media reports, and we’re honored by the interest.@tmlee and I have been running CoinGecko for nearly 12 years, and like any growing and profitable company, we regularly evaluate strategic opportunities to strengthen our business and…

— Bobby Ong (@bobbyong) January 15, 2026He indicated that after leading CoinGecko alongside Co-founder and President TM Lee for more than ten years, “like any growing and profitable company, we regularly evaluate strategic opportunities to strengthen our business and accelerate our mission.”

This statement suggests CoinGecko is actively pursuing acquisition opportunities and positioning the deal toward traditional Wall Street institutional buyers rather than venture capital firms.

While Ong declined to address specific negotiations, he expressed enthusiasm about “possibilities that enable us to better serve users and facilitate institutional crypto adoption.“

It’s worth noting that CoinMarketCap, another crypto market data platform, was purchased by crypto exchange Binance in 2020 for an estimated $400 million.

When announcing that acquisition, Binance clarified that while both the exchange and its BNB token were featured on the platform, “CoinMarketCap and Binance remain separate entities adhering to a strict independence policy.“

More than five years later, crypto industry observers believe a $500 million valuation for CoinGecko is reasonable, given that crypto data has become increasingly valuable and Wall Street data intelligence companies command substantially higher valuations.

For instance, Bloomberg L.P., though privately held, is estimated to be worth tens of billions, recent calculations suggest over $120 billion based on a 2008 stake transaction, with current annual revenues surpassing $13 billion as of early 2025.

$8.6B in Crypto Deals: Polygon, Fireblocks Lead 2026’s M&A Explosion

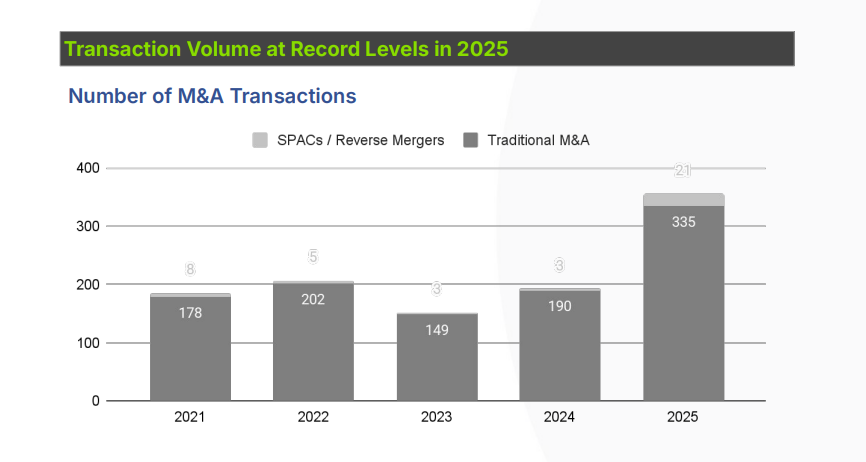

The quantity and value of mergers, acquisitions, and initial public offerings within the cryptocurrency space surged throughout 2025, with dealmaking hitting a record $8.6 billion as a more accommodating regulatory stance in the United States encouraged investors and financial institutions to re-enter the sector.

According to a report by the Financial Times, 267 crypto-related deals were completed in 2025, marking an 18% increase from 2024.

Total deal value surged nearly 300% compared with last year’s $2.17 billion.

Market participants expect momentum to carry into 2026 as regulatory clarity improves across major jurisdictions.

Already in 2026, Polygon Labs’ recently revealed plans to acquire cryptocurrency exchange Coinme and crypto wallet infrastructure provider Sequence for over $250 million.

Additionally, blockchain infrastructure firm Fireblocks announced Wednesday it acquired TRES Finance, a crypto accounting and financial reporting platform, for over $130 million to meet growing demand for “audit-ready, tax-compliant” financial documentation for blockchain-based businesses.

On January 12, Bakkt Holdings, Inc. revealed its agreement to acquire Distributed Technologies Research Ltd. (DTR), advancing its strategy to develop stablecoin settlement and programmable payment capabilities through an all-equity transaction involving shares representing 31.5% of a defined “Bakkt Share Number.”