Former Standard Chartered & UniCredit Heavyweights Launch Game-Changing Institutional Liquidity Protocol

Wall Street's old guard just got a crypto-powered rival. A team of ex-Standard Chartered and UniCredit executives is launching a new institutional liquidity protocol—aiming to slice through the traditional finance bureaucracy that moves at the speed of a fax machine.

The Institutional Plumbing Gets an Upgrade

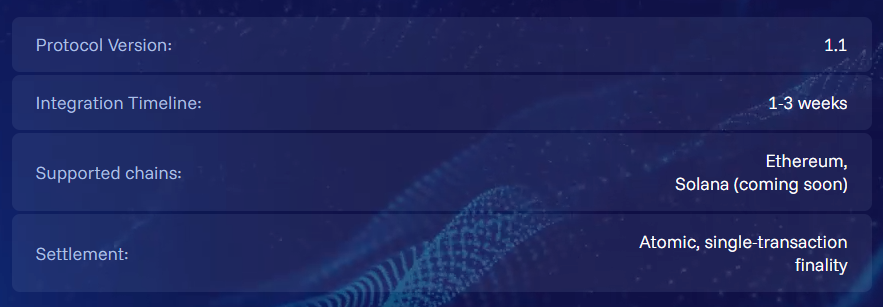

Forget the legacy systems. This protocol is built from the ground up for digital assets, offering institutions direct access to deep liquidity pools. It bypasses the usual chain of intermediaries—cutting settlement times and costs that have long padded bank profit margins.

Why TradFi Veterans Are Building on Chain

The founders aren't crypto rookies; they're finance veterans who saw the bottlenecks from the inside. They're leveraging blockchain to solve problems they lived with for years: opaque pricing, fragmented liquidity, and operational drag. It's a fix built by the people who broke it.

A Cynical Nod to the Old Ways

Let's be honest—in traditional finance, 'innovation' often means adding another fee layer. This move flips the script, using transparency and efficiency to dismantle the very rent-seeking models these executives once operated. Ironic, isn't it?

The launch signals a pivotal shift. When the architects of the old system start building the new one, it's not a trend—it's an evacuation. Watch for more institutional defectors. The walls are crumbling.

Source: Multiliquid

You may also like:

What Is Liquidity in crypto and Why Does It Matter?

Liquidity measures how easily you can buy and sell an asset without affecting its price. This is essential because liquid markets ensure efficient trading, stable prices, and low slippage.

Crypto assets can be less liquid due to factors like low supply, low adoption, or limited trading activity. This can make it more difficult to buy a particular coin.

To ensure enough liquidity, crypto exchanges rely on market makers and order books matching buyers and sellers, while decentralized...

Source: Multiliquid

You may also like:

What Is Liquidity in crypto and Why Does It Matter?

Liquidity measures how easily you can buy and sell an asset without affecting its price. This is essential because liquid markets ensure efficient trading, stable prices, and low slippage.

Crypto assets can be less liquid due to factors like low supply, low adoption, or limited trading activity. This can make it more difficult to buy a particular coin.

To ensure enough liquidity, crypto exchanges rely on market makers and order books matching buyers and sellers, while decentralized...

Making Non-Treasury Assets Structurally Liquid

Uniform Labs argues that there are hundreds of billions of dollars in stablecoins that are unable to earn yield directly.

Therefore, institutions need a compliant method to pair regulated, yield-bearing assets with the 24/7 liquidity of stablecoins.

With Multiliquid, says the team, stablecoins remain “pure payment instruments.” Yield comes from tokenised money market funds and other regulated RWAs connected via Multiliquid’s swap layer.

Moreover, the company argues, the tokenized RWA market has jumped to more than $35 billion, yet non-Treasury assets remain structurally illiquid. This includes private credit, private equity, real estate, and commodities.

“The tokenisation thesis only works if these assets are actually liquid,” said Uniform Labs CEO Will Beeson, ex-co-founder of Standard Chartered’s tokenised asset platform. Most RWAs are “just poorly wrapped versions of the same old assets,” he said.

“There’s essentially zero secondary liquidity for most tokenised assets, whether money market or private credit funds, with investors largely forced to wait for issuer-controlled redemption windows.” Multiliquid is a liquidity layer that enables “onchain capital markets [to] actually function in real time,” Beeson says.

According to Mark Garabedian, Director of Digital Assets and Tokenisation Strategy at Wellington Management, “for large asset owners, tokenisation only becomes compelling when it fits cleanly into existing liquidity and treasury workflows. Infrastructure that can reconcile regulated funds with always-on stablecoin rails is an important part of making tokenised portfolios practical at scale.”

Angelo D’Alessandro, COO of Uniform Labs and former CEO of UniCredit’s Buddybank, added that “for decades, institutional finance accepted that yield and liquidity don’t coexist. That was never a law of nature – just a limitation of the pipes.” Multiliquid, he argues, is new pipes that run finance at internet speed.

You may also like: Why Is Crypto Up Today? – December 17, 2025 The crypto market is up today, but the change at the time of the writing is so low that the market is unchanged. The cryptocurrency market capitalisation increased by just 0.1%. It now stands at $3.03 trillion. Also, 75 of the top 100 coins have gone up over the past 24 hours. At the same time, the total crypto trading volume is at $108 billion. Crypto Winners & Losers At the time of writing, four of the top 10 coins per market capitalization have seen their prices decrease and four...