Visa Launches Stablecoins Advisory as Market Tops $300B — Are Banks Finally Catching Up?

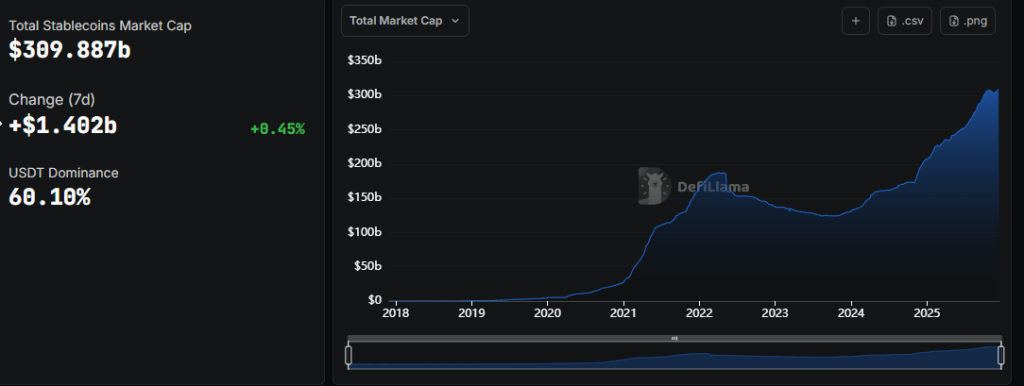

Visa just dropped a stablecoin advisory service. The timing's no accident—the market just smashed past $300 billion.

Why This Matters Now

Traditional finance is scrambling. For years, banks treated stablecoins like a fringe experiment. Now, with a market cap that rivals some national economies, the narrative's flipped. Visa's move isn't just a service launch; it's a signal flare to the entire banking sector.

The Institutional Stampede

Watch the dominoes fall. One major player legitimizes the space, and the rest follow—not out of innovation, but fear of missing out. It's the same old herd mentality, just with a blockchain wrapper. They're not building the future; they're buying a ticket to it.

The Real Question

Is this genuine adoption or just regulatory arbitrage? Banks love efficiency, but they love compliant revenue streams more. Stablecoins offer both—a rare trifecta of speed, transparency, and, increasingly, a framework that keeps regulators at bay. It's less a revolution and more a very profitable loophole.

The Bottom Line

The $300 billion threshold wasn't just a number; it was a point of no return. The infrastructure battle is over. The fight for the financial soul of the network has begun. And as usual, the big money shows up late to the party, tries to buy the venue, and calls it a strategy.

Visa Works With Early Clients on Stablecoin Strategies

Carl Rutstein, global head of Visa Consulting and Analytics, said the practice is designed to meet growing client demand rather than push adoption indiscriminately.

He said Visa is working with dozens of early clients, including Navy Federal Credit Union, VyStar Credit Union, and Pathward, and expects the number to expand into the hundreds.

The advisory work spans strategy development, technical architecture, operational readiness, and implementation support, with some clients ultimately deciding whether stablecoins align with actual customer needs.

Stablecoins are cryptocurrencies designed to maintain a fixed value, typically pegged to the U.S. dollar through reserves.

Once largely confined to crypto trading, they are increasingly being used for payments, cross-border transfers, and business-to-business settlement, particularly in regions with currency volatility or limited access to traditional banking rails.

According to DefiLlama data, the global stablecoin market capitalization now stands at $309.85 billion. Tether’s USDT remains dominant with a 60.10% market share and a market cap of $186.23 billion, followed by Circle’s USDC at $78.31 billion.

Other stablecoins, including Ethena’s USDe, Sky Dollar, Dai, and PayPal USD, make up smaller but growing portions of the market, collectively reflecting broader issuer diversity.

Visa Pushes Stablecoins Deeper Into Global Payments

Visa’s latest move follows a series of stablecoin initiatives by the company over the past several years. In 2023, Visa piloted USDC settlement on blockchain networks and now supports more than 130 stablecoin-linked card programs across 40 countries.

Visa recently began testing a system that allows businesses to fund cross-border payments using stablecoins instead of pre-depositing cash into local accounts.

![]() Credit card giant @Visa has begun testing stablecoin-powered cross-border payments, marking a major step in digital tokens gaining acceptance among global finance players.#Visa #Stablecoins https://t.co/bJwqFJe5tc

Credit card giant @Visa has begun testing stablecoin-powered cross-border payments, marking a major step in digital tokens gaining acceptance among global finance players.#Visa #Stablecoins https://t.co/bJwqFJe5tc

Visa has said the program will expand in 2026 and targets banks, remittance firms, and financial institutions that currently rely on costly correspondent banking networks.

The push has been reinforced by regulatory clarity in the United States following President Donald Trump’s signing of the GENIUS Act in July, which established formal rules for stablecoin issuance.

Since then, several financial and payments firms have accelerated their stablecoin strategies.

PayPal and Mastercard have expanded their digital dollar capabilities, while institutions such as Citigroup, JPMorgan, and Standard Chartered continue to explore tokenized settlement and on-chain liquidity tools.

Stablecoin Adoption Spreads Globally as Banks and Card Networks Step In

Visa’s advisory launch also arrives as stablecoin adoption spreads beyond the U.S. In Africa, Visa has partnered with Yellow Card Financial to support stablecoin payments across 20 countries, while Circle has worked with Onafriq to connect stablecoins to hundreds of wallets and bank accounts.

@visa and @yellowcard_app have partnered to expand stablecoin-powered payments across Africa.#stablecoin #Visahttps://t.co/nB85xKKAXa

— Cryptonews.com (@cryptonews) June 19, 2025Mastercard recently partnered with chainlink to let cardholders make on-chain crypto purchases. Meanwhile, Sony Bank plans to launch a regulated dollar-pegged stablecoin for payments within its digital entertainment ecosystem.

![]() @chainlink announces historic @Mastercard partnership enabling 3 billion+ cardholders to buy cryptocurrency onchain through seamless fiat-to-crypto conversion eliminating complex barriers.#Chainlink #Mastercard #Cryptohttps://t.co/SSrILSQ5Tf

@chainlink announces historic @Mastercard partnership enabling 3 billion+ cardholders to buy cryptocurrency onchain through seamless fiat-to-crypto conversion eliminating complex barriers.#Chainlink #Mastercard #Cryptohttps://t.co/SSrILSQ5Tf

Institutions such as Goldman Sachs, Wells Fargo, McKinsey, Anchorage Digital, and GFT Technologies already offer advisory, research, or infrastructure services tied to stablecoins.

Visa executives have consistently framed stablecoins not as a threat to existing payment systems, but as an extension of them.

Speaking earlier this year, Visa’s head of crypto, Cuy Sheffield said the future of payments WOULD combine traditional rails with on-chain settlement, rather than replacing one with the other.