Bitcoin Price Alert: September & October JOLTS Data Drops Today — Will Job Openings Shift Fed Rate Decision?

Markets brace for impact as dual JOLTS reports hit the wire—September and October data landing in a single session. This double-dose of labor market intel could rewrite the Fed's December playbook.

The Domino Effect on Digital Gold

Cooling job openings signal economic softening—exactly the kind of macro shift that sends institutional cash flooding into Bitcoin. Every hint of dovish Fed sentiment fuels the crypto rally. Watch treasury yields—they move inverse to crypto's risk appetite.

Why Traders Are Glued to Screens

Two months of data means double the volatility. A significant miss could trigger immediate Fed pivot speculation, lighting a fire under Bitcoin's price. Remember—crypto markets price narratives faster than traditional finance can draft a meeting memo.

The Cynical Take

Wall Street will overanalyze every decimal point while Bitcoin does what it always does—ignore the noise and follow liquidity. The Fed's rate decision matters less than the trillions sitting on sidelines waiting for any excuse to move.

Bottom line: Today's numbers don't just describe the economy—they'll help determine which asset class owns the next cycle. Smart money's already positioning.

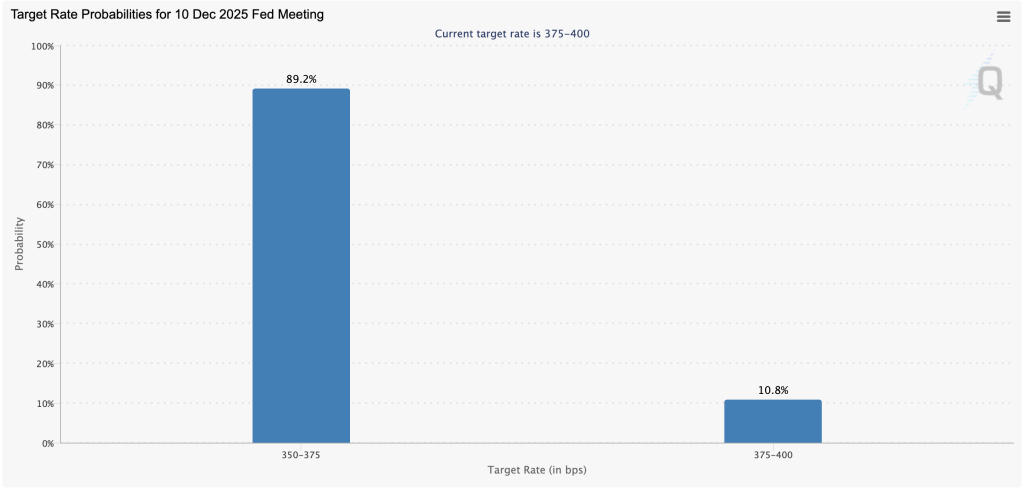

Source: CME FedWatch Tool

Source: CME FedWatch Tool

Job openings are a critical leading indicator for the Fed because they signal labor demand before it shows up in hiring or unemployment data.

After last Thursday’s shockingly strong jobless claims print (191K vs 219K expected—lowest since 2022), Fed Chair Powell faces conflicting signals. Robust initial claims suggest no labor market distress, but if JOLTS openings have declined sharply over September and October, it WOULD support the case for preemptive easing.

The Fed has already ended quantitative tightening as of December 1, and September PCE data showed Core inflation improving to 2.8% from 2.9%, creating a.

Markets are essentially getting two months of data in one release, which could produce volatility if the trend shows clear acceleration or deceleration.

Bitcoin needs to hold support at $90,000-$92,000 heading into tomorrow’s 2:00 PM ET Fed decision and Powell’s 2:30 PM press conference. Resistance remains at $90,000, and the descending trendline that’s capped rallies since mid-November.

If JOLTS data shows job openings collapsing, it strengthens the rate cut case and could provide the catalyst Bitcoin needs to break above $98K.

Conversely, if openings remain elevated, it reinforces the “” scenario where the economy stays strong, and the Fed pauses easing, potentially sending bitcoin back toward the $88,000-$90,000 support zone that marked November’s low.