Bitcoin Skyrockets Following Surprise JOLTS Report: Crypto Analysts Reveal What’s Next

Bitcoin just ripped higher. An unexpected twist in the JOLTS jobs data sent shockwaves through traditional markets—and straight into digital asset portfolios.

The Catalyst No One Saw Coming

Forget the usual inflation chatter. This rally ignited on a different fuse. The latest Job Openings and Labor Turnover Survey (JOLTS) printed a number that caught Wall Street flat-footed. The immediate reaction? A classic flight from conventional uncertainty into crypto's decentralized promise. It's the kind of pivot that makes old-school portfolio managers sweat into their silk ties.

Decoding the Market's Instant Reaction

Analysts point to a simple, powerful narrative: shaky macroeconomic data weakens the case for aggressive traditional policy, making hard-capped, non-sovereign assets look suddenly more attractive. Liquidity didn't just move—it vaulted. The buying pressure wasn't a trickle; it was a flash flood into Bitcoin and major altcoins, showcasing crypto's evolving role as a leading indicator, not just a follower.

Expert Lens on the Path Ahead

The consensus from trading desks isn't about a one-day wonder. They're watching for sustained momentum, eyeing whether this marks a genuine regime shift in capital allocation. Key resistance levels are now in play, with the entire market watching to see if this is the spark for the next leg up. After all, in crypto, sentiment can turn on a dime—or a data point.

So, while traditional finance scrambles to revise its models, the crypto market has already placed its bet. It's a stark reminder: sometimes the best economic indicator isn't a bond yield, but a blockchain's hash rate. The 'smart money' might still be debating the print, but the digital money has already voted.

Summarize the content using AI

ChatGPT

Grok

In an unexpected turn of events today, Bitcoin (BTC) $90,610 exceeded $93,000 despite poor JOLTS data. The movements in cryptocurrencies are inherently driven by their own dynamics, which we witnessed once again today. While Trump’s forthcoming economic statements might seem to have spurred this increase, the primary factor remains the increased buying of Bitcoin by individuals. Let’s delve into the assessments of well-known figures in the crypto world today.

$90,610 exceeded $93,000 despite poor JOLTS data. The movements in cryptocurrencies are inherently driven by their own dynamics, which we witnessed once again today. While Trump’s forthcoming economic statements might seem to have spurred this increase, the primary factor remains the increased buying of Bitcoin by individuals. Let’s delve into the assessments of well-known figures in the crypto world today.

The Crypto Oracle’s Latest Prediction

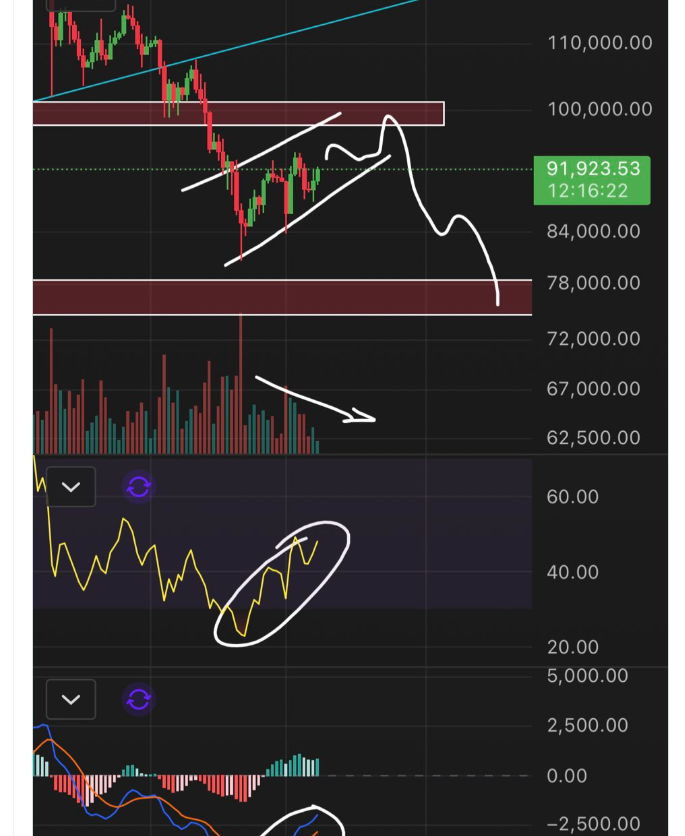

It was recently announced that the BLS would release the December inflation report on January 13. BTC is currently above $93,500, but what is needed are convincing closures above $94,000. With about 24 hours left for the Fed’s interest rate decision, the crypto oracle, Roman Trading, highlighted the bear flag formation seen on the daily chart.

The analyst, who expects a temporary rise before the downward trend continues due to the MACD and RSI being in oversold territory, asserts that the volume drop accompanying the price increase confirms this. Previously, it was stated that after creating a lower peak that could extend to $104,000, the movement WOULD head below $80,000.

If such an increase occurs, it would be surprising for significant buyers to enter the game and counter those who are prepared to sell at the peak.

Three Analysts’ Bitcoin Predictions

Let’s quickly see what other analysts have to say. Jelle mentioned anticipating a swift MOVE to $100,000 before the uptrend accelerates. When Jelle wrote that the range of $91,000 to $93,000 was still targeted, BTC had not yet exceeded that area, but he was proven right. For now, BTC needs to make closures above $94,000 and prove to investors that this is not another selling opportunity. However, many investors still expect the same scenario to unfold: “prices returning to their previous state with sales over $93,000,” and yes, that is what they are anticipating.

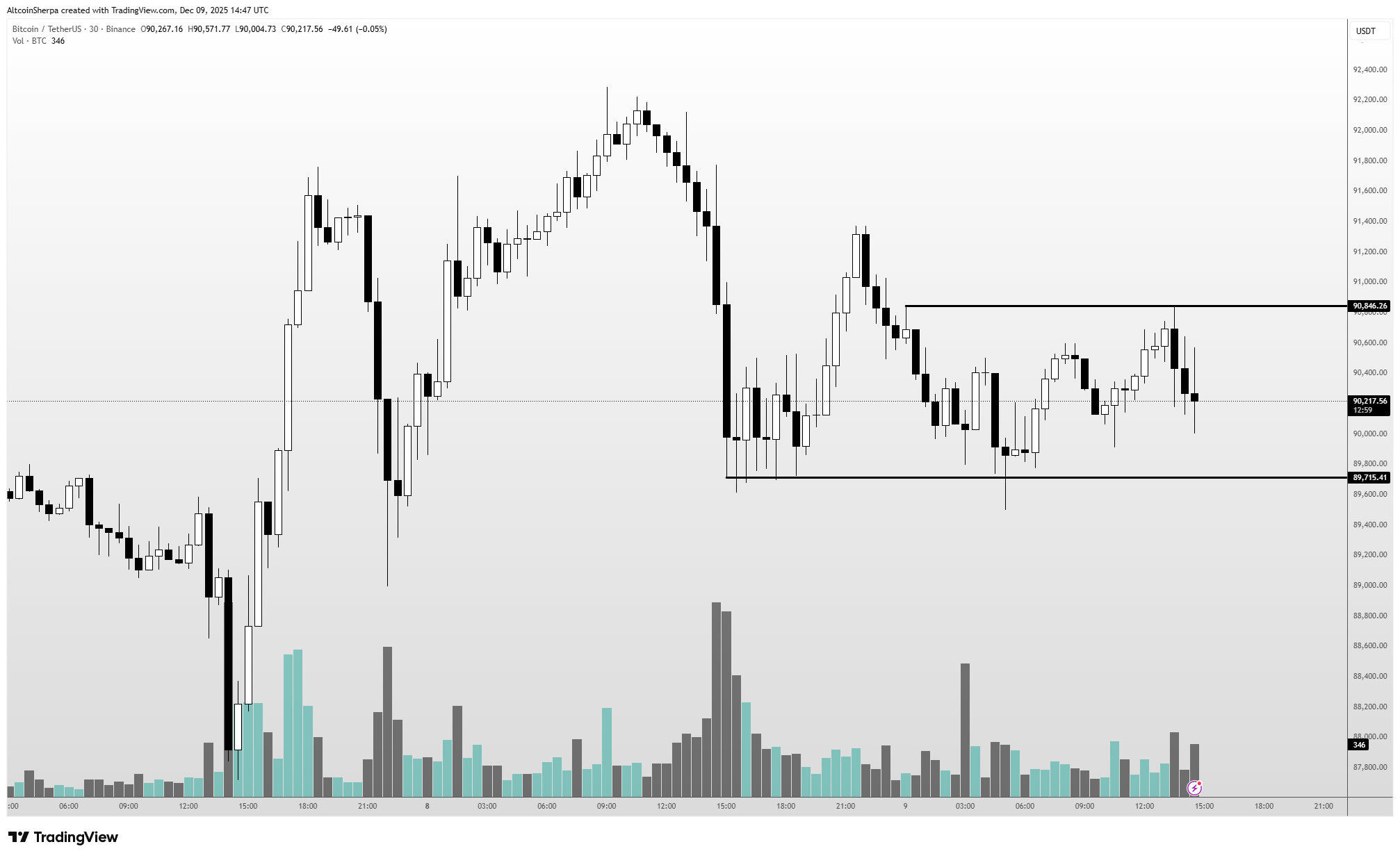

An analyst using the alias Sherpa pointed out that the highly volatile chart does not reflect a trending environment. Sherpa expects the narrow range movements to end, with the next big move predicted to reach $95,000.

Michael Poppe, on the other hand, says our primary focus should be on Bitcoin’s status against gold.

“Considering the parabolic trajectory of gold, this condition raises the cap of Bitcoin’s potential price without overvaluation.

The current valuation of BTC/USD in terms of Gold is at the 300-Moving Average level. Is this significant? It might be. Am I searching for confirmation bias data? Honestly, yes. Anyway, my interpretation of this chart revolves around these:

– Markets typically bottom around the 300-SMA level of BTC/USD against gold. This indicates that the current correction should be at a low level (considering production cost isn’t too far off).

– The current value is ’21’. The highest recent value is ’40’. This means even if gold stays at these price levels and Bitcoin rises to $150,000 or even $175,000, we might not still reach a new peak.

Therefore, I believe this cycle isn’t over yet.”

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.