XRP ETFs Smash All-Time Inflow Records—Wall Street Finally Waking Up to Crypto?

XRP exchange-traded funds just posted their biggest weekly inflows ever—turns out even Wall Street can't ignore the numbers.

The floodgates open

After years of skepticism, institutional money's pouring into crypto's most controversial altcoin. The irony? Banks are now chasing the asset they once dismissed as 'too volatile.'

What changed?

Regulatory clarity (mostly), plus desperation for yield in a 0% interest rate world. When traditional finance bleeds, even blockchain looks like a bandage.

One hedge fund manager quipped: 'We'll short your mom's pension fund if it means hitting our quarterly targets.' The crypto renaissance—brought to you by pure, unadulterated greed.

A Record-Breaking Week For The XRP ETFs

In the world of digital asset investments, XRP is emerging as one of the major assets that is gaining serious attention among investors and traders. Following a significant inflow of cash into exchange-traded funds linked to the leading cryptocurrency, it is once again in the limelight of crypto investment.

A crypto enthusiast known as XRP Update on the social media platform X has outlined that the altcoin is currently undergoing massive validation. While the broader market cools down, Spot XRP Exchange-Traded Funds (ETFs) record their largest weekly inflows since the products were launched.

A massive wave of capital flowing into a fund indicates that sentiment among investors, especially institutions, is undergoing a powerful shift. In addition, it suggests that major investors may be actively preparing for the altcoin’s next notable MOVE upward rather than remaining on the sidelines.

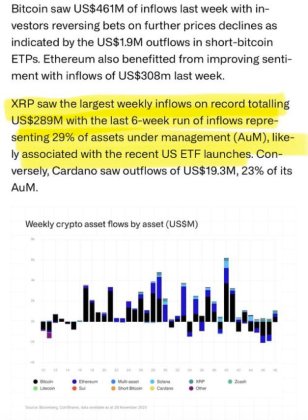

According to the data shared by the enthusiast, the funds amassed inflows valued at $289 million in a single week, marking its most successful week ever. After this week of bullish trading for the funds, they have now recorded massive inflows in 6 consecutive weeks.

These 6-week inflows currently represent nearly 30% of the total Assets Under Management (AUM), which is likely associated with the recent United States ETF launches. When ETF inflows surge, it typically implies that institutional demand is increasing again, indicating that high-net-worth investors are exploring the token.

The Fund Takes The Lead In Cryptocurrency Spot ETF

XRP has just reached a major milestone that reflects its growing position as a valuable and reliable investment strategy. Brad Garlinghouse, the Chief Executive Officer (CEO) of Ripple, announced that the token has emerged as the fastest-moving crypto Spot ETF on the market.

After more than 4 weeks of launch, the fund continues to record inflows, reaching $1 billion in AUM in the US, making it the fastest ETF. This type of growth was last seen with its ethereum counterpart, which launched late last year. With over 40 crypto ETFs introduced this year in the US alone, Garlinghouse has offered his take on what the development means, highlighting two key takeaways.

According to the Ripple CEO, demand for regulated cryptocurrency goods is pent up. Additionally, millions more people who don’t need to be experts may now use crypto thanks to Vanguard’s offering of access to regular retirement and trading accounts for Americans.

For this new generation of off-chain crypto holders, Garlinghouse noted that durability, stability, and community are all important but often overlooked factors.