MetaMask’s Game-Changer: ’Transaction Shield’ Subscription Now Backed by $10K Loss Guarantee

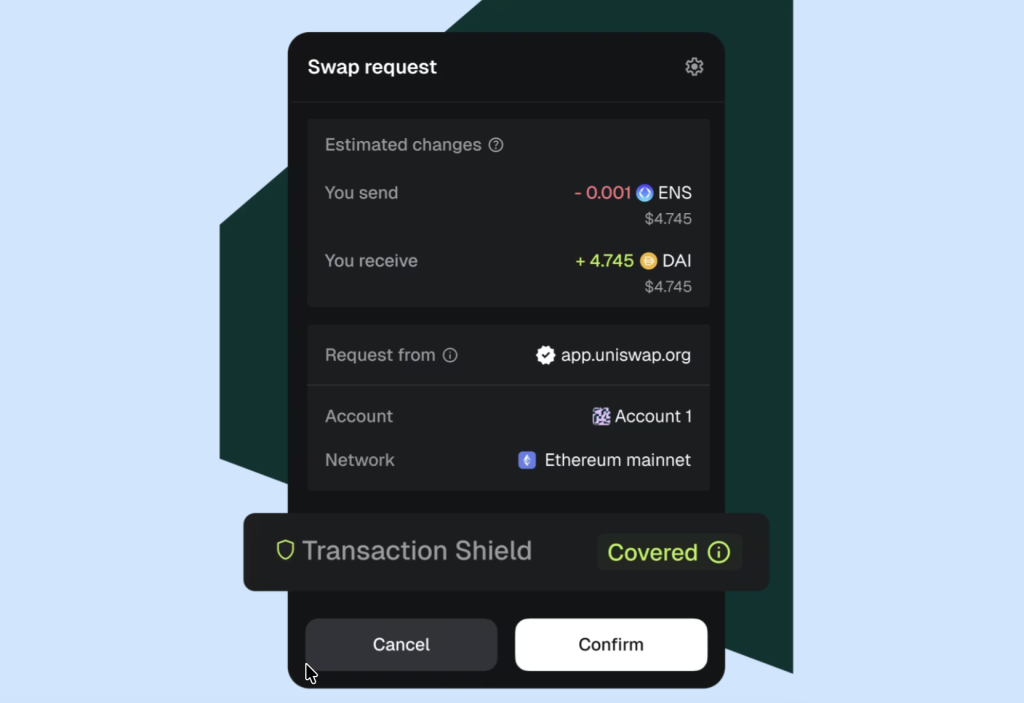

Your next crypto transaction just got an insurance policy. MetaMask—the wallet used by millions—is rolling out a paid safety net that promises to cover user losses up to $10,000. It's a bold move in an ecosystem where 'your keys, your coins' has often meant 'your mistake, your problem.'

What's in the Shield?

For a monthly fee, the Transaction Shield subscription aims to tackle one of decentralized finance's biggest headaches: irreversible errors. Send funds to a wrong address? Get tricked by a sophisticated scam? The feature is designed to step in. It's not just a promise—it's a financial guarantee, putting a concrete number on user protection for the first time.

Why This Changes the Game

This shifts the entire risk paradigm. Until now, navigating crypto required a blend of technical skill and constant vigilance. A single misstep could wipe out a portfolio with zero recourse. By offering a loss guarantee, MetaMask isn't just adding a feature—it's selling peace of mind. It's a calculated bet that reducing user anxiety will fuel mainstream adoption faster than any bull market rally.

The Fine Print and The Frontier

Naturally, questions remain. What exactly qualifies for a claim? How swift is the reimbursement process? The devil, as they say in traditional finance—where they invented fees for everything and then sold insurance against their own mistakes—will be in the details. Yet, the mere existence of this product signals a maturation. Crypto is moving beyond the wild west, building guardrails as it goes.

MetaMask's $10K guarantee is more than a safety feature. It's a direct challenge to the industry: if you want people to trust decentralized systems, you sometimes have to centralize the trust. The gamble is that the cost of covering mistakes will be far less than the value gained by bringing in the next 100 million users.

Source: MetaMask

Source: MetaMask

The Fine Print – What Is Not Covered by the MetaMask Transaction Shield?

The coverage is specific. It applies to assets lost during the interaction itself—such as a drainer contract masking as a mint. It doescover:

- Compromised Keys: If a user loses their seed phrase or falls for a phishing site that steals credentials, the payout is zero.

- Protocol Hacks: If Aave or Uniswap get exploited after the deposit, MetaMask is not liable.

- Market Volatility: Slippage and price crashes are on the user.

Coverage is capped at $10,000 monthly across 100 eligible transactions. Claims must be filed within 21 days, with payouts settled in mUSD within roughly 15 business days.

Market Context

The service supports major EVM chains including Ethereum, Arbitrum, Polygon, BNB Chain, and Base. It is currently available only on the browser extension, with mobile support pending.

This MOVE signals a pivot for wallet providers from passive tools to active, paid guardians. By monetizing security, MetaMask creates a recurring revenue stream while addressing the primary barrier to entry for retail capital: fear of the “Sign” button.