Ethereum Whales Gobble Up $241M - Is This the Reversal Signal You’ve Been Waiting For?

Massive money moves as Ethereum whales accumulate staggering amounts while retail investors panic-sell.

The $241 Million Question

When whales start feeding, markets tend to notice. Ethereum's largest holders just deployed $241 million in fresh capital - a move that typically precedes major price movements. These aren't your average crypto tourists dipping toes in the water; these are institutional-grade players making calculated bets.

Timing the Tides

While retail traders chase memecoins and get wrecked by leverage, smart money positions itself for the next leg up. The accumulation pattern mirrors previous cycle bottoms where patient capital outperformed emotional trading. Funny how the 'dumb money' always seems to sell right before the smart money buys.

Reversal or False Dawn?

Market structure suggests we're either witnessing the beginning of a major trend change or the most expensive whale miscalculation since that hedge fund manager who thought he could time Bitcoin. Either way, $241 million doesn't lie - someone's betting big on an Ethereum comeback. Because nothing says 'financial revolution' like watching billionaires get richer while you refresh your portfolio every five minutes.

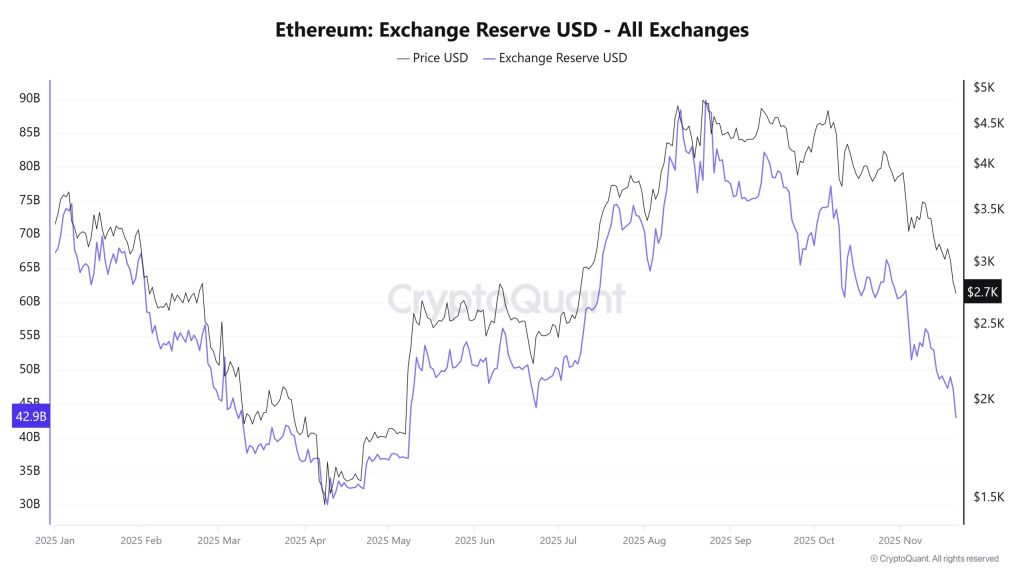

Exchange Supply Falls to a 55-Month Low

This accumulation coincides with a meaningful drop in ETH available on exchanges. CryptoQuant data shows exchange reserves falling to 15.6 million ETH, the lowest level in more than four years. Fewer coins on exchanges often translate into thinner sell-side liquidity and a reduced ability for the market to absorb additional downward pressure.

When supply tightens at the same time large entities buy aggressively, it often suggests an early accumulation phase rather than a continuation of the downtrend.

Key signals supporting the tightening supply narrative:

- Exchange reserves now sit at a 55-month low

- Whale inflows concentrated at multi-month price lows

- Institutional accumulation rising despite market weakness

Ethereum (ETH/USD) Technical Outlook: ETH Tests Final Support Zone

Ethereum price prediction has broken below its long-held trendline from March and is now trading inside a broad descending wedge, a structure that often forms during late-stage selloffs. Candles are printing long lower wicks, showing sellers failing to push price cleanly below the $2,630 support area.

The RSI at 27 marks one of the most oversold readings of 2025, signaling exhaustion.

If buyers defend $2,630, a rebound toward $2,900–$3,060 becomes likely, followed by a retest of the wedge’s upper boundary near $3,214. A daily close above the 20-day EMA WOULD confirm a momentum shift.

Ethereum Trade Setup and Reversal Potential

A straightforward setup for new traders is to wait for a bullish reversal candle, a hammer, engulfing pattern, or long-wick doji, within the $2,630 demand zone. A confirmation close above $2,780 strengthens the case for targets at $3,060, $3,214 and $3,653.

If sentiment stabilizes and ethereum reclaims mid-trend resistance, the broader structure still supports a medium-term path back toward $4,242 into 2026.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $28 million, with tokens priced at just $0.013295 before the next increase.

As bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale