Uniswap Governance Shakeup Ignites DeFi Altcoin Frenzy – Who’s Riding the Wave?

DeFi's sleeping giants wake up as Uniswap's governance overhaul sends shockwaves through the altcoin markets. Liquidity pools churn, governance tokens surge, and yield farmers scramble to reposition – all while Ethereum gas fees predictably spike.

Key moves:

- UNI holders flex new voting powers in protocol's most contentious upgrade since V3

- Second-tier DeFi tokens post double-digit gains as liquidity migrates

- Opportunistic traders front-run governance proposals (some things never change)

The real winner? MEV bots, naturally – extracting value while retail plays musical chairs with leveraged positions. As one whale put it: 'Same game, just with fancier smart contracts.'

Uniswap Rises on Governance Realignment

Uniswap’s UNI is trading around $8.50, up by 23% in 24 hours, with volume expanding across major pairs and steady spot depth.

The rise follows the introduction of the UNIfication proposal from Uniswap Labs and the Uniswap Foundation. The plan consolidates governance, activates protocol fee sharing, and introduces a structured annual growth budget that removes separate app and wallet revenue collection.

A proposal for the next chapter of![]()

UNIfication is a joint proposal from Uniswap Labs and the Uniswap Foundation that turns on protocol fees and aligns incentives across the Uniswap ecosystem

Positioning the Uniswap protocol to win as the default decentralized exchange https://t.co/ra0Y7TKpYk

![]()

The model channels a fraction of trading fees back to the protocol, funding UNI repurchases and community initiatives under governance control. It also includes a token burn designed to adjust supply dynamics.

Market data indicate that UNI has broken through resistance from October, while derivatives show growing participation aligned with spot activity. Community feedback on UNIfication will determine how sustainable this change becomes within DeFi markets.

Aerodrome Finance Extends Its Advance

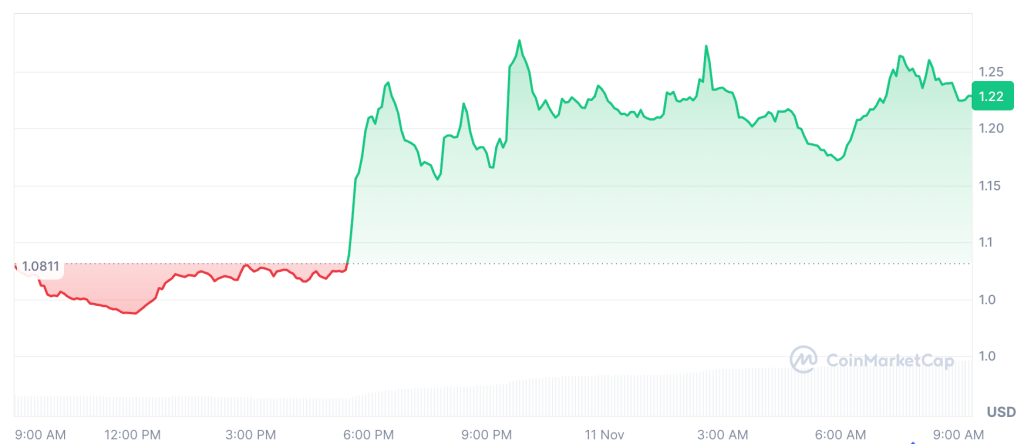

Aerodrome Finance’s AERO is now trading near $1.22, up by about 13% in 24 hours. The project has drawn renewed attention from participants following steady protocol revenue growth and recent emissions adjustments. It appears to be an improving balance between token distribution and buyback activity, factors that have lifted the token over the past week.

Liquidity conditions on major exchanges remain firm, and usage metrics show that Aerodrome continues to capture activity within its trading ecosystem. The token’s resilience this week demonstrates how consistent fee income and on-chain engagement can sustain moves even in a cautious altcoin market.

AERO Price (Source: CoinMarketCap)

SOON Maintains Stability Amid Active Flows

SOON is trading near $2.16, up by about 4% in 24 hours, with volume remaining above recent averages and liquidity steady across venues. The move follows recent listings on additional exchanges and the launch of the “10sSOON” asset creation feature connected to its Solana VIRTUAL Machine roll-up framework, both of which drew renewed attention from traders.

The project also introduced a feature allowing users to pay USDC for short-term market predictions, a step that has increased engagement and trading activity. On-chain metrics show higher validator participation and active staking, suggesting that the network’s current momentum is being supported by functional growth rather than speculation.

With stable turnover and narrowing spreads, SOON appears to be consolidating above its near-term support levels, maintaining participation across markets that favor assets with consistent throughput over one-time event-driven surges.

DeFi Sets the Tone for Altcoin Season Rotation

The latest moves across UNI, AERO, and SOON suggest that DeFi tokens with operational depth and functional governance continue to capture Flow while sentiment elsewhere is still unclear. Altcoin activity has centered on measurable progress in network design and liquidity rather than unverified speculation.

If participation in these sectors holds through the week, the current rotation could reinforce a phase in which utility, protocol adjustments, and steady trading access define which altcoins stay in focus.