Coinbase Disrupts UK Banking with 3.75% Yield Savings Account – Beats Traditional Banks at Their Own Game

Crypto giant flips the script on stale savings products

Coinbase just dropped a financial grenade in the UK market—a savings account that actually pays you. While high street banks offer insulting 0.5% returns, the crypto exchange delivers a juicy 3.75% APY. No 'new customer bonuses' that vanish after three months—just straightforward yield.

The fintech playbook in action

This isn't your grandma's savings account. Funds get swept into USD Coin (USDC), earning yield through decentralized finance protocols. The twist? Coinbase handles all the crypto complexity behind the scenes—customers just see pounds and interest deposits.

Regulators won't like this one bit

The FCA's been cracking down on crypto firms, but Coinbase found a loophole: FSCS protection doesn't apply, but neither do traditional banking's 35-page terms and conditions. A bold move as UK banks face their biggest deposit exodus since 2008.

Closing thought: Maybe those 'stablecoin skeptics' should explain why their 'safe' bank accounts pay 7.5x less. Just saying.

Coinbase’s 3.75% Rate Competes With Traditional Banks

The average easy-access savings rate in the UK currently hovers around 4.2%–4.5% AER, according to data from MoneySavingExpert and Money.co.uk.

While Coinbase’s 3.75% rate sits slightly below top-tier offers, it exceeds many standard flexible accounts. Major high-street banks, such as HSBC and NatWest, still pay between 1.15% and 3.5% on similar deposits.

According to Keith Grose, CEO of Coinbase UK: “Our aim is building the UK’s number 1 financial app.”

This means the goal is to be Revolut, not Binance.

Just as it’s Coinbase vs Robinhood in the US, it could be Coinbase vs Revolut in Europe.

1/ COIN vs HOOD:

– @Coinbase is a bet on crypto volumes + institutional infra.

– @Robinhood is a bet on the fintech super-app with broader, steadier growth.

Both are converging, but the paths (and risks) differ. pic.twitter.com/Nj7jqnW8Vr

![]()

“Barclays, NatWest, and HSBC can all match or beat 3.75%, but none let you MOVE GBP to BTC in the same app,” said Simon Taylor, a London-based fintech analyst.

“It’s not just about the rate, it’s about capturing users who want seamless access between their GBP savings and crypto portfolios,” Taylor added.

He sees Coinbase becoming a SAFE haven for Brits to bank and challenged UK banks to catch up.

The Bank Disintermediation Threat

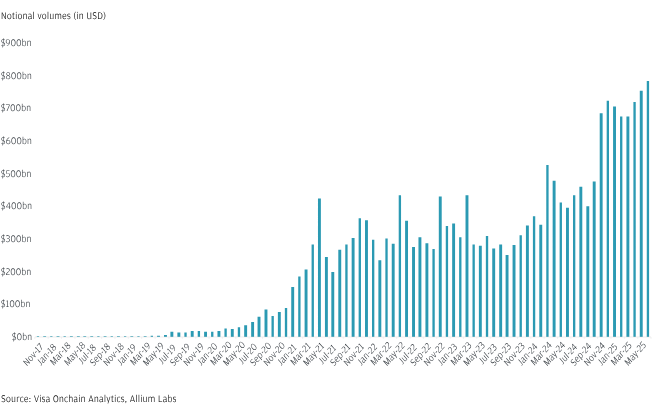

The launch comes amid growing concern that crypto-linked products could drain deposits from traditional banking.

Standard Chartered recently warned that over $1 trillion could FLOW out of emerging-market banks into stablecoins by 2028.

The Bank of England has repeatedly warned that digital money adoption could trigger ““, where households shift deposits into digital alternatives, threatening financial stability and credit availability.

Citigroup’s Ronit Ghose drew parallels to the late 1970s when money market funds skyrocketed from $4 billion to $235 billion in seven years, draining bank deposits.

In 1971, the US ran out of money and defaulted on its debts. Now, they didn’t say it that way. But by moving away from the Gold standard, money as we understood it ended.

I expected the stock market to plunge, but it went on to rise nearly 25%. That surprised me. But when I… pic.twitter.com/jlaR9ZVF8a

However, Coinbase’s Faryar Shirzad countered that the “stablecoins will destroy bank lending” narrative ignores reality.

According to him, “Most stablecoin demand comes from outside the US, expanding dollar dominance globally, not competing with your local bank.”

UK £20,000 Stablecoin Cap vs Coinbase £85,000 Savings Limit

Coinbase’s savings launch comes just days after the Bank of England proposed a £20,000 cap on stablecoin holdings for individuals.

Yet Coinbase allows deposits up to £85,000 with FSCS protection.

This effectively allows the crypto exchange to offer a higher balance ceiling than permitted under the new stablecoin limits, potentially luring Brits to opt for its savings option.

Tom Duff Gordon, Coinbase’s vice-president of international policy, told the Financial Times that “imposing caps on stablecoins is bad for UK savers, bad for the City and bad for sterling.“

![]() UK’s central bank wants to cap how much stablecoin people can hold, but crypto groups are fighting back, warning the move could choke innovation and leave Britain trailing rivals.#bankofengland #stablecoins https://t.co/lSNMQrEp7z

UK’s central bank wants to cap how much stablecoin people can hold, but crypto groups are fighting back, warning the move could choke innovation and leave Britain trailing rivals.#bankofengland #stablecoins https://t.co/lSNMQrEp7z

Simon Jennings of the UK Cryptoasset Business Council added that “limits simply don’t work in practice” because issuers cannot monitor token holders in real time.