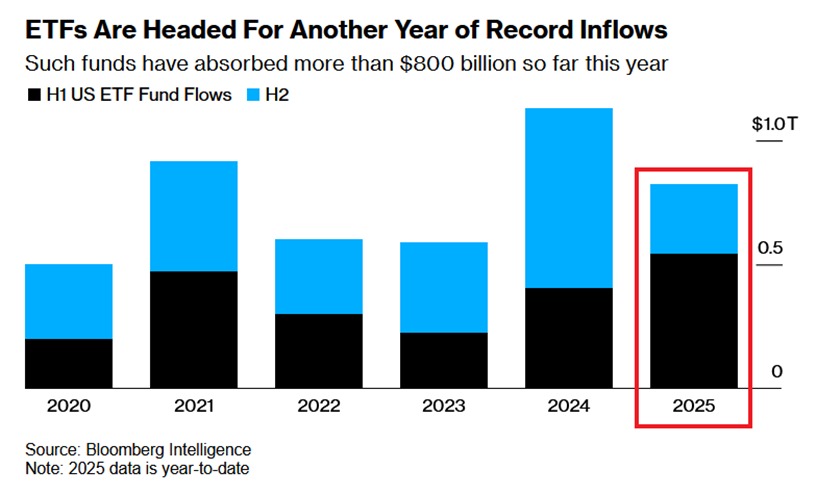

US ETFs Shatter Records: $1 Trillion Inflows Projected for 2025

Wall Street's ETF machine hits unprecedented velocity as institutional money floods into exchange-traded products.

The $1 Trillion Milestone

Projections show US-listed ETFs absorbing a staggering $1 trillion in net new assets this year—smashing all previous inflow records. Pension funds, wealth managers, and even retail investors pile into diversified baskets while avoiding single-stock risk.

Behind the Surge

Lower fee structures continue draining assets from traditional mutual funds. ETF issuers roll out increasingly niche products targeting everything from AI infrastructure to climate transition metals. The wrapper's tax efficiency and intraday liquidity keep attracting capital that once favored active management.

Regulatory Green Lights

Recent SEC approvals for previously excluded asset classes—including certain digital assets and private equity exposures—further expand the addressable market. Critics note the irony of regulators embracing complexity while simultaneously pushing 'simplified' disclosure frameworks.

As always, Wall Street found a way to package, fee-ify, and sell diversification—proving once again that financial innovation means inventing new products to solve problems created by previous ones.

Equity Funds Lead the Charge

The majority of capital is being funneled into equity ETFs, which have attracted $475 billion so far. This reflects investors’ sustained appetite for stocks, even against a backdrop of interest rate uncertainty and shifting economic conditions.

The first half of 2025 alone saw $543 billion in inflows, the strongest H1 performance ever recorded. Last month added further momentum, with over $120 billion in new allocations, heavily concentrated in both equity and bond ETFs.

Investors Can’t Get Enough Risk Assets

The surge underscores how ETFs have become the vehicle of choice for institutions and retail investors alike. Their combination of low fees, liquidity, and broad market exposure has made them indispensable tools for capturing upside in a market still dominated by equity enthusiasm.

Analysts note that the trend mirrors last year’s record-breaking flows but with an even faster pace, suggesting 2025 could mark back-to-back trillion-dollar inflow years.

READ MORE:

Outlook for the Rest of the Year

If current momentum continues, ETF inflows could eclipse all prior benchmarks, reinforcing the narrative that investors are doubling down on stock exposure rather than retreating. While bond funds are gaining ground, the data shows equity ETFs remain the clear favorite.

With investors still hungry for stocks, ETF growth looks set to redefine what “record inflows” means in back-to-back years.

![]()