Ethereum Momentum Rebounds as Bitcoin Shows Signs of Exhaustion - Here’s What’s Next

Ethereum's engine just roared back to life while Bitcoin hits the wall. The momentum shift catches traders off guard as ETH breaks pattern while BTC stumbles.

The Flip Nobody Saw Coming

Ethereum's resurgence defies expectations, charging ahead while the flagship crypto shows fatigue. Trading volumes spike as ETH positions outperform BTC holdings across major exchanges.

Technical indicators flash green for Ethereum while Bitcoin's charts signal potential correction territory. The divergence creates opportunities for savvy investors looking beyond the obvious play.

Market dynamics shift beneath the surface as institutional money rotates—because nothing says 'smart money' like chasing yesterday's winners. ETH's infrastructure upgrades finally gain traction while Bitcoin maximalists check their portfolios for the tenth time today.

This isn't just a temporary blip—it's a fundamental power shift in crypto's hierarchy. Ethereum builds while Bitcoin rests. The question isn't if the trend continues, but how far it goes before the next 'financial advisor' claims they predicted it all along.

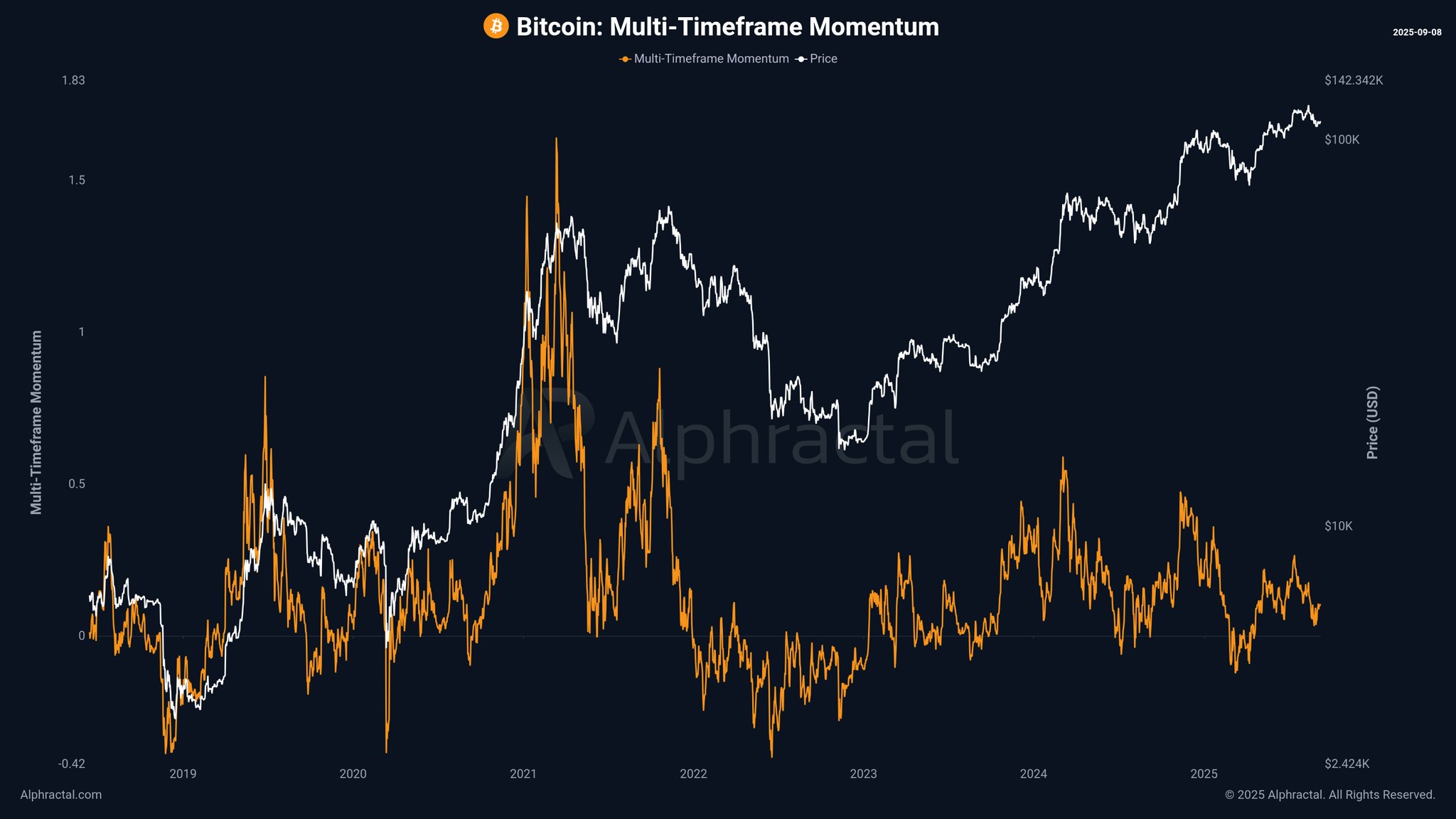

Bitcoin: High Prices, Weakening Momentum

Although Bitcoin continues to trade near record highs above $140,000, its underlying momentum has been sliding since early 2024. The MTM indicator shows that shorter-term bursts of buying are failing to align with longer-term trend strength. That mismatch implies the market’s upward drive is losing steam, even as prices remain elevated. Historically, such divergences have often preceded periods of consolidation or corrective moves.

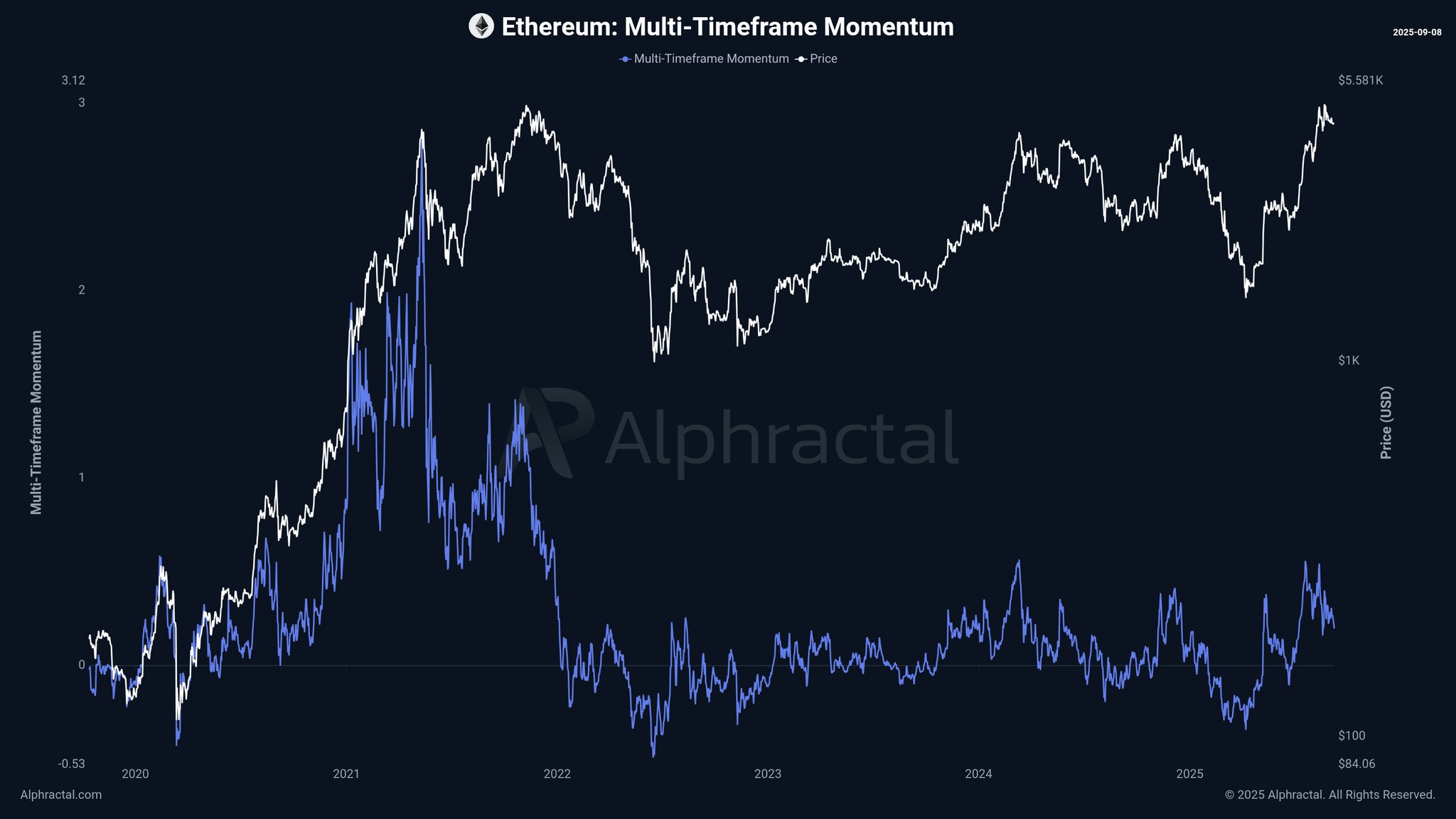

Ethereum: Quiet Comeback Gains Strength

Ethereum, in contrast, is showing a different picture. After an extended period of weak momentum, ETH has recently built up strength across multiple timeframes. The MTM readings flipped higher in recent months, pointing to growing alignment between short-term rallies and broader structural trends. With ETH trading around $5,500, this improvement could be an early signal that the asset is entering a new cycle of outperformance relative to Bitcoin.

The Bigger Picture

In Alphractal’s framework, positive MTM values indicate strong alignment across timeframes, while negative readings highlight persistent downside pressure. Right now, Ethereum is benefiting from improving synergy across horizons, while Bitcoin’s MTM trend shows fatigue.

READ MORE:

Crypto markets often MOVE in cycles, with leadership rotating between assets. The latest MTM data suggests that Bitcoin’s dominance may be waning just as Ethereum regains momentum. If the trend continues, ETH could emerge as the relative strength play heading into the final months of 2025.

![]()