AI Models Signal Bitcoin Stability—But Brace for September Storm

Bitcoin holds steady as AI forecasting tools project near-term calm—but traders eye September's historical volatility with sharpened focus.

Patterns Don't Lie

Machine learning algorithms digest years of market data, spotting trends human analysts often miss. They currently flag stability in Bitcoin's immediate future, pointing to consolidated trading ranges and reduced sell-off pressure.

The September Shadow

Then comes the seasonal risk. September repeatedly wallops crypto returns—a trend so reliable you’d almost think the markets read a calendar. AI models acknowledge this pattern, warning of potential downward pressure as autumn approaches.

No crystal ball guarantees outcomes, but when algorithms and history agree, smart money pays attention. Maybe just don’t bet your entire portfolio on a hedge fund’s algorithmic horoscope.

Neutral Trend, Mild Downside

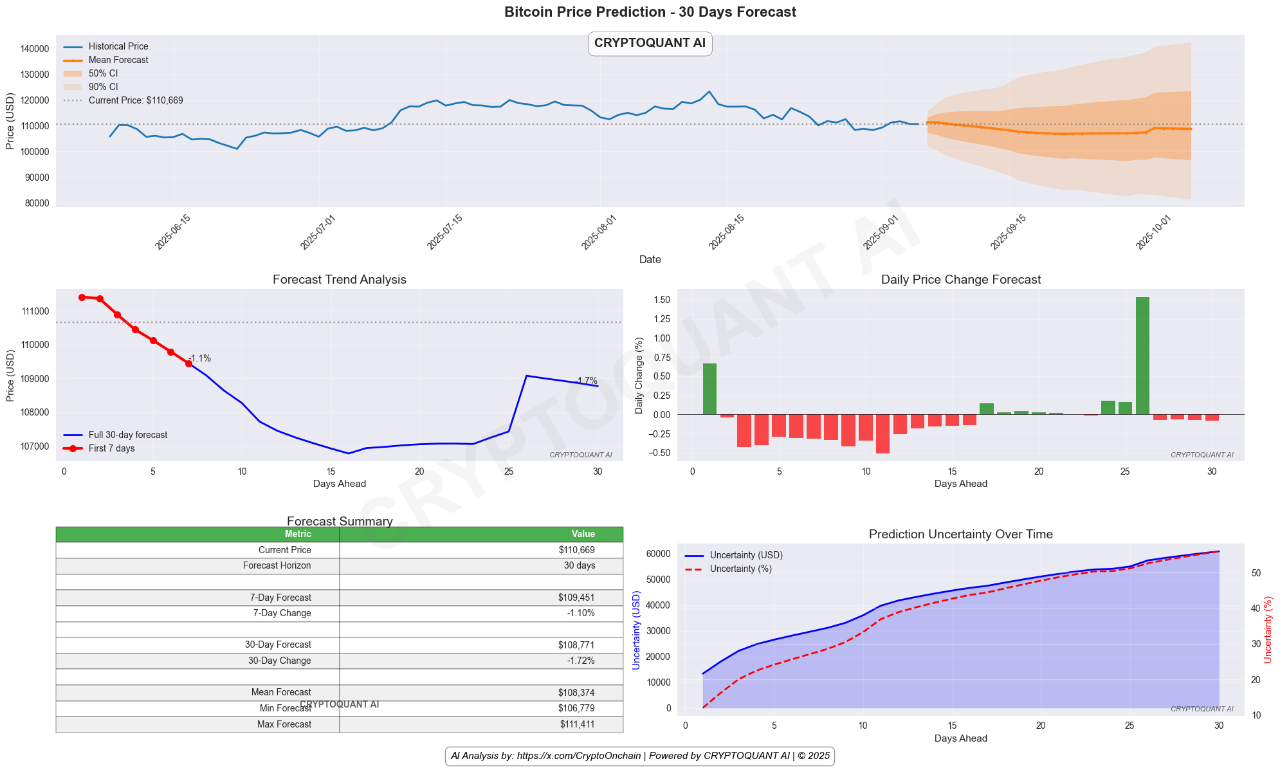

According to the, Bitcoin’s current price around $111,000 is expected to see only modest shifts in the coming weeks. The 7-day forecast projects a slight decline of 1.1% to $109,451, while the 30-day forecast anticipates a 1.72% dip to $108,771. Both the WaveNet and Temporal Fusion Transformer (TFT) AI models point to a largely neutral trajectory, with bitcoin trading in a $108,000–$120,000 range through most of September.

Uncertainty Surges in Late September

Where the models differ is in their outlook on volatility. The TFT model shows confidence intervals widening sharply, with uncertainty surpassing 50% by the end of the forecast window. This suggests that while the base case remains steady, the probability of a sudden breakout – up or down – increases significantly heading into the last week of the month.

READ MORE:

Scenarios for Traders

The combined models outline two primary scenarios:

- Base case: Bitcoin holds its neutral channel for most of September.

- High-risk scenario: A market catalyst, such as news or sentiment swings, sparks an explosive move outside the current range.

The analysis concludes that while Bitcoin faces mild selling pressure in the short term, late September could prove pivotal. Traders should brace for a potential spike in volatility as uncertainty builds across models.

![]()