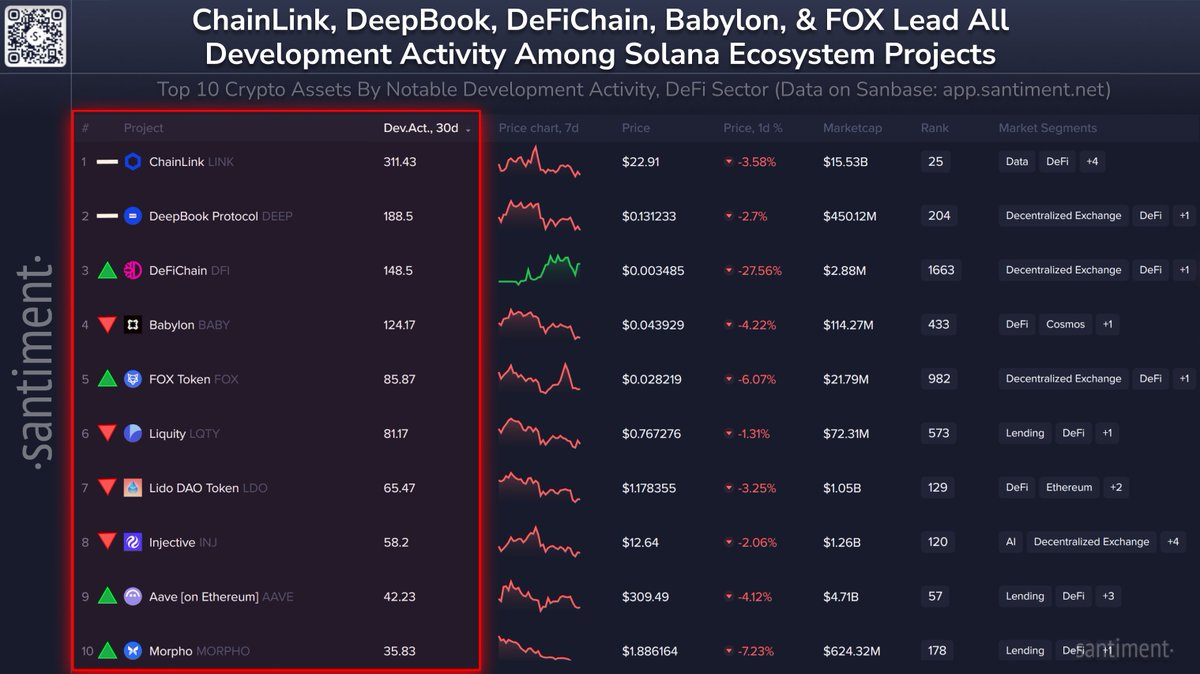

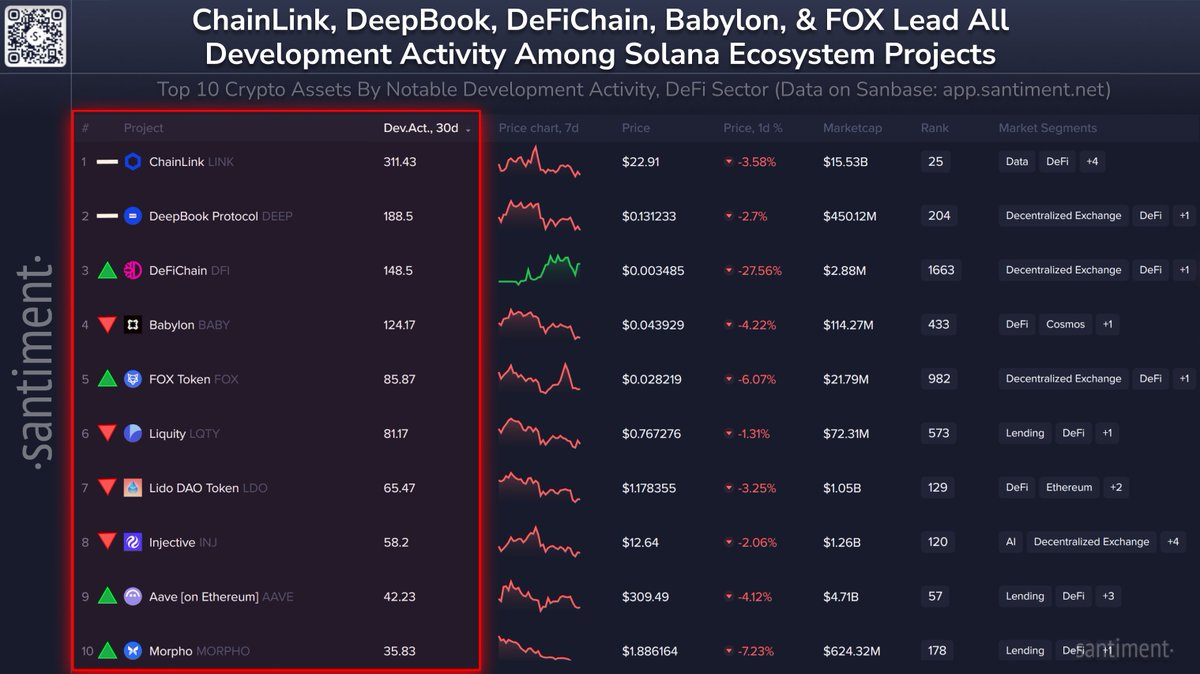

Chainlink and DeepBook Dominate September’s DeFi Development Race - Here’s Why It Matters

Two protocols just lapped the entire DeFi field in development activity—while traditional finance keeps reinventing the same spreadsheet.

The Development Dominance

Chainlink's oracle network and DeepBook's trading infrastructure pulled away from the pack, showcasing what actual blockchain innovation looks like beyond speculative trading. Their GitHub commits and protocol upgrades tell the real story—unlike the usual 'vaporware' projects that dominate headlines.

Why Builders Build

Real utility attracts real developers. While meme coins flash and crash, these platforms quietly assemble the plumbing that makes decentralized finance actually work. No hype, no hollow partnerships—just code that solves genuine market problems.

The Institutional Irony

Wall Street spends millions trying to blockchain-enable legacy systems while these open-source projects out-innovate them with fraction of the budget. Maybe next quarter they'll discover what 'decentralized' actually means.

Bottom line: Development activity doesn't always predict price moves, but it never lies about where the real value is being built.

Chainlink cements its lead

Santiment’s ranking shows Chainlink with more than 311 tracked development events, far ahead of the pack. The oracle provider continues to expand its Cross-Chain Interoperability Protocol (CCIP), which has become a cornerstone of blockchain connectivity. While LINK’s price has dipped -3.58% over the week, the heavy coding activity signals that fundamentals remain strong.

Rising momentum for emerging projects

In second place, DeepBook logged 188.5 dev events, reinforcing its reputation as one of the most active decentralized exchange projects. Meanwhile, DeFiChain ranked third with 148.5 events, even as its token lost over 27% in the past 30 days. Other names rounding out the top five include Babylon (BABY) and FOX (FOX), both of which saw developer activity outpacing more established players.

Stalwarts remain active

Further down the list, leading DeFi protocols such as Lido (LDO), Injective (INJ), and Aave (AAVE) remain fixtures in the rankings, alongside Liquity (LQTY) and Morpho (MORPHO). Despite market-wide corrections of 3%–7%, these projects continue to attract consistent developer engagement.

READ MORE:

Why it matters

Santiment emphasizes that development activity is a strong forward-looking indicator, often preceding price recoveries and long-term adoption. While many DeFi tokens are under pressure, the sustained GitHub commits reflect ongoing confidence in project roadmaps.

As the sector heads into September, this ranking underscores how developer persistence can act as a stabilizing force, even in turbulent markets. For investors, it offers a window into which teams are building through volatility – potentially setting the stage for future growth when market sentiment turns bullish again.

![]()