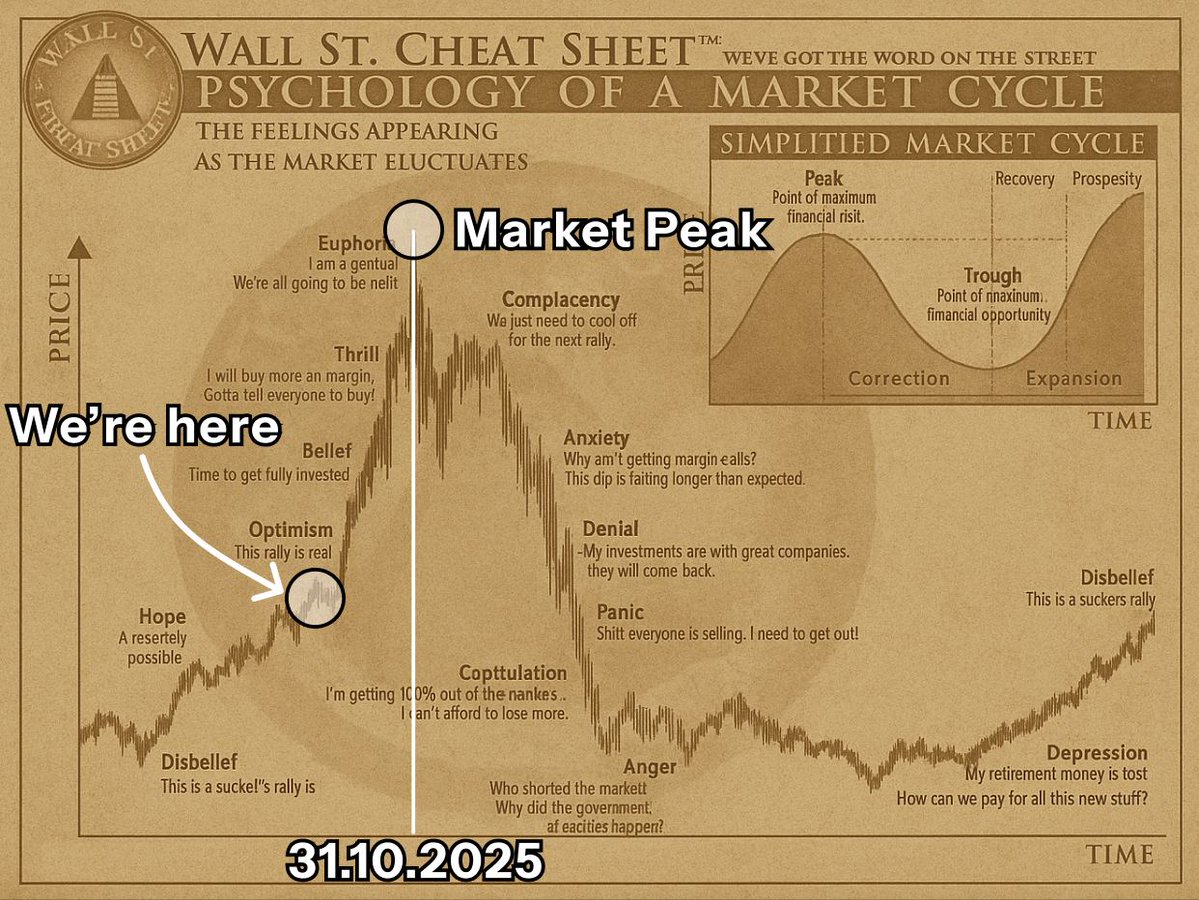

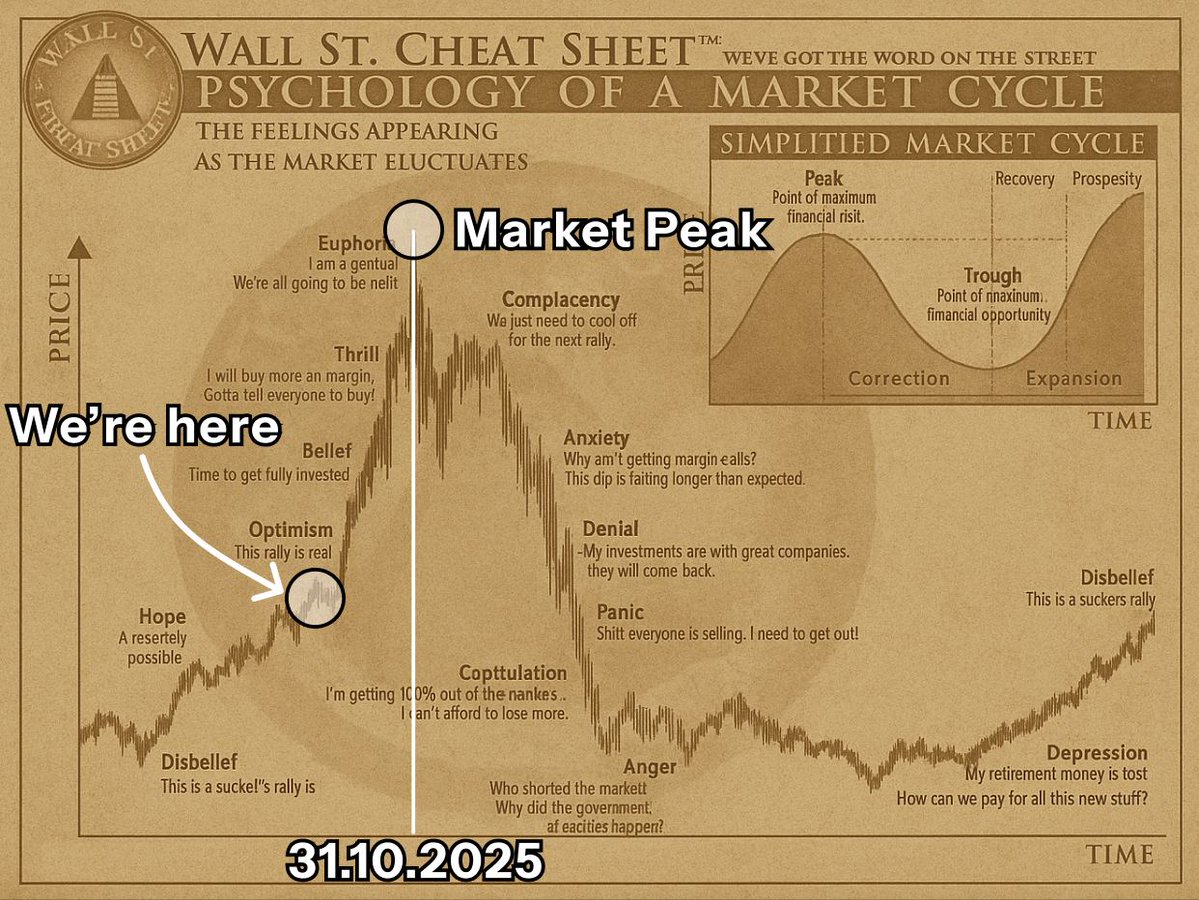

Expert Predicts Critical Crypto Market Peak Approaching in October - Don’t Miss the Rally!

Crypto markets are heating up—and one top analyst says October could deliver the mother of all rallies.

Timing the Tops

Historical cycles point toward a major inflection next month. Past bull runs have consistently peaked within narrow seasonal windows—and all signs now point to a repeat.

Institutional Fuel

BlackRock’s Bitcoin ETF inflows aren’t slowing down. Hedge funds are piling into altcoins. Even your dentist is asking about Solana.

Risks Remain

Regulatory chatter is growing louder. The SEC’s Gary Gensler still hates your gains. And let’s be real—most “fundamentals” in crypto are just vibes wrapped in a whitepaper.

One thing’s clear: whether this is the real deal or just another over-leveraged bubble, October will be a month to remember. Or regret.

Atlas emphasized that October may prove decisive. The anticipated Federal Reserve rate cut could act as a temporary liquidity injection, fueling one last parabolic surge. At the same time, he cautioned that altcoin season metrics are already approaching overheated levels, with the Altseason Index closing in on the danger zone above 65. This combination, he argued, could give traders a narrow window to take profits before the trend reverses sharply.

His strategy focuses on scaling out methodically rather than chasing every final move higher. Atlas advised trimming exposure to meme coins and illiquid tokens first, then gradually locking in gains from larger-cap plays as the rotation progresses. The ultimate step, he noted, is securing profits from Bitcoin and ethereum into stablecoins before mid-October, ahead of what he expects to be a harsh correction.

READ MORE:

Atlas warned that the biggest mistake traders make at this stage is assuming dips will keep getting bought. In past cycles, late entrants were caught holding through 50%–70% drawdowns when momentum abruptly shifted. This time, he believes the setup is no different: a euphoric ending phase followed by steep retracements.

Despite the cautionary tone, Atlas isn’t bearish yet. He still sees upside in the short term, especially for Ethereum and select altcoins, but stressed that timing is now everything. “The last 10% upside isn’t worth risking all your gains,” he concluded, underscoring October as the critical month to exit smartly.

![]()