Fed Rate Cuts Imminent: Crypto Trader Unveils 10 Must-Watch Altcoins Set to Explode

As the Federal Reserve signals potential rate cuts, crypto markets brace for impact—and one trader's altcoin picks could define the next cycle.

Portfolio pivots ahead

Monetary policy shifts send ripples through risk assets. Traders now rebalance portfolios, eyeing altcoins that historically outperform during liquidity injections.

The watchlist revealed

Ten altcoins make the cut—each selected for robust fundamentals, ecosystem growth, and liquidity profiles poised to capitalize on incoming capital flows.

Timing the tide

Market veterans note altcoin rallies often lag initial Fed moves by weeks. This time? They’re betting the smart money front-runs the paperwork—because on Wall Street, even ‘forward guidance’ arrives late.

Fed Policy as a Catalyst

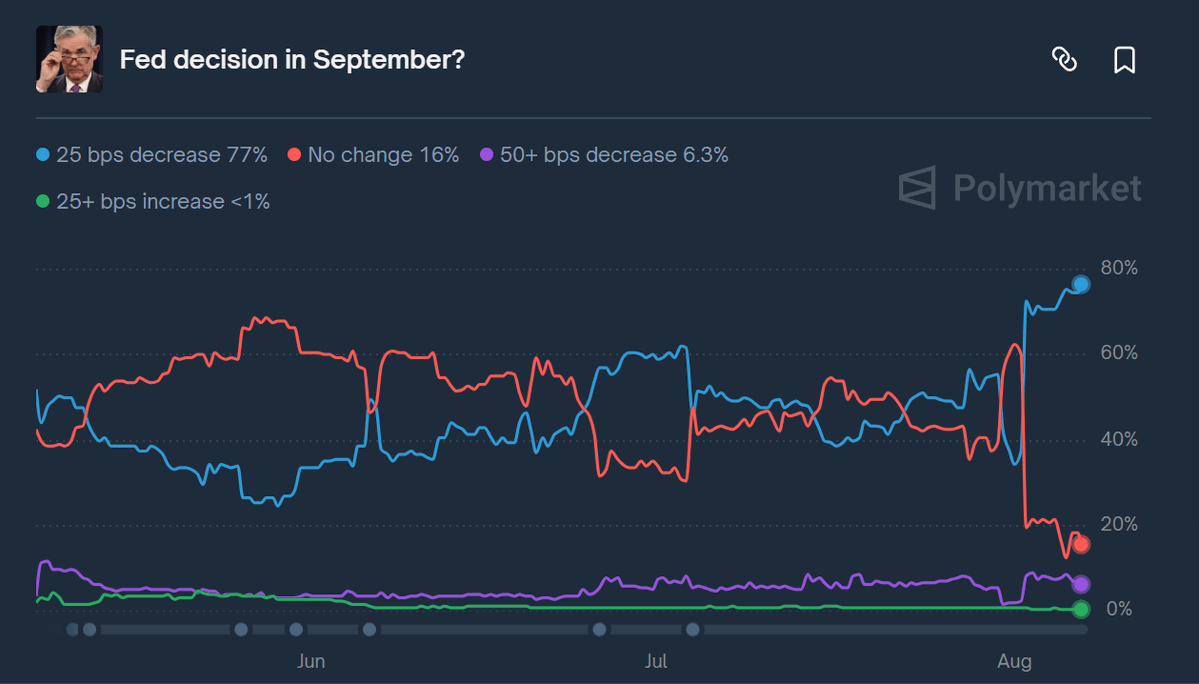

The trader pointed to September’s anticipated Federal Reserve rate cut as the spark that could ignite risk markets. Policy meetings are intensifying, chairs are holding back-to-back discussions, and with market odds of a cut hovering around 80%, Fencer views the decision as “inevitable.” Should rates fall, he expects capital to rush back into high-risk assets like crypto at full speed.

Altseason Around the Corner

While many investors are waiting for an altcoin season, Fencer believes the key drivers are already in place. Trade deal fears, he said, are largely resolved, with only lingering concerns around China. Once those uncertainties clear, capital could FLOW heavily into altcoins.

He suggests that properly timed bets could turn even small investments into exponential gains, claiming that “$100 could become $25,000 with the right picks.”

READ MORE:

Ten Tokens to Watch

After scanning thousands of projects, Fencer highlighted ten altcoins he believes have the strongest potential for outsized returns:

- Pendle ($PENDLE) – Yield management and trading platform (Market Cap: $670M).

- Ethena ($ENA) – Synthetic dollar protocol on Ethereum (MC: $4.4B).

- FartCoin ($FARTCOIN) – A memecoin on Solana with nearly $1B cap.

- Aerodrome ($AERO) – AMM serving as Base chain’s liquidity hub (MC: $660M).

- Ondo Finance ($ONDO) – Tokenized U.S. assets bridging TradFi and DeFi (MC: $2.9B).

- Morpho ($MORPHO) – Lending and borrowing protocol (MC: $600M).

- Worldcoin ($WLD) – Global currency initiative with $1.7B cap.

- Useless Coin ($USELESS) – Niche alt with $280M cap.

- Jupiter ($JUP) – DEX aggregator with plans for its own chain (MC: $1.4B).

- Kamino Finance ($KMNO) – Solana-based auto-compounding platform (MC: $150M).

The Bigger Picture

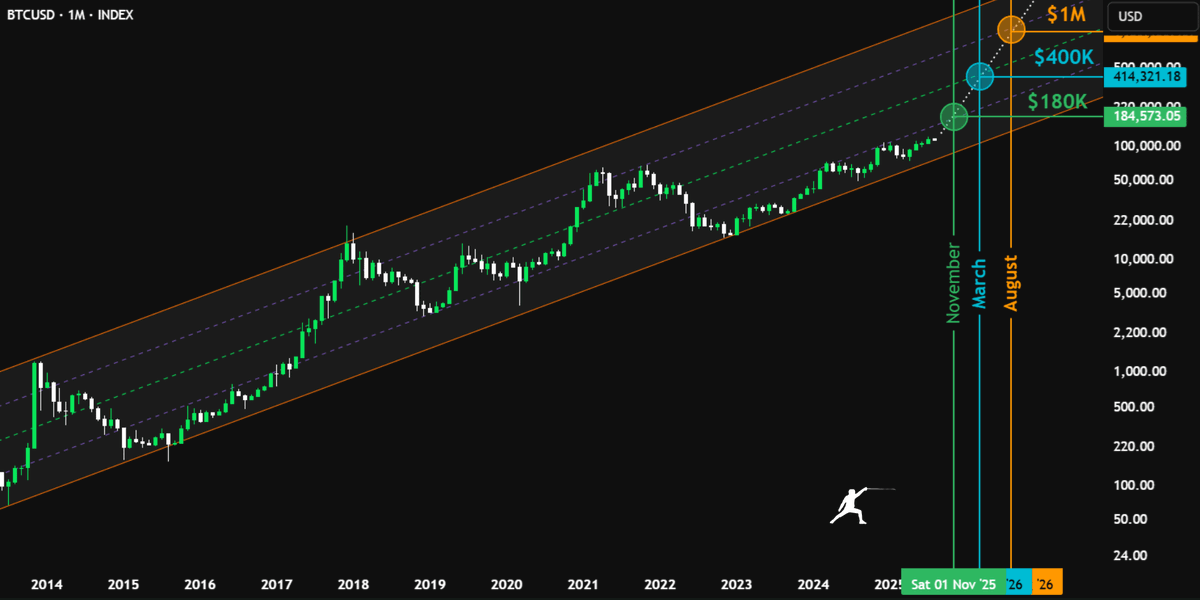

Fencer’s outlook is clear: the next parabolic run could be short, sharp, and violent. With Bitcoin’s chart suggesting possible targets as high as $180K–$400K, he sees this as the final window before markets inevitably cool.

For traders willing to take the risk, he says, “the time to position is now.”

![]()